Last week, the coveted Bitcoin Conference, hosted in the city of Miami, took place. A congregation of some of the greatest and most influential minds within the Bitcoin community, with Jack Dorsey (CEO of Block), Saifedean Ammous (author of The Bitcoin Standard), and Michael Saylor (CEO of Microstrategy) some of the key speakers at this year’s event. The Bitcoin Conference is a key event in the yearly calendar for those interested in the developments within the space and the amalgamation of ideas to further expand the utility, usage, and awareness of the network. A year on from the infamous 2021 conference, we can reflect on the progress made since then and offer some insight into how the space may develop going forward.

Last Year's Headlines

Arguably the biggest announcement from the 2021 conference was the collaboration between the CEO of Strike, Jack Mallers, and El Salvador’s President, Nayib Bukele. In an emotional speech, Mallers announced they were working with the El Salvador government to develop a digital financial infrastructure to onboard Salvadorians onto the Bitcoin monetary network. Bukele’s commitment to adopt Bitcoin as legal tender represented a historic milestone, with El Salvador being the first nation state to recognise Bitcoin as legal currency. This announcement grabbed headlines globally and excited many Bitcoiners to speculate it could set the blueprint for other countries to follow suit.

Within the first 45 days of officially passing Bitcoin as legal tender, the Chivo wallet (a government-launched crypto wallet) onboarded approximately 4 million users, demonstrating rather impressively the speed at which onboarding can be accomplished, considering a population size of around 6.5 million. With previous estimates suggesting that over 70% of El Salvador’s population was unbanked, this represents significant strides in modernising the financial systems and products available to El Salvador’s citizens.

To further indicate his commitment to Bitcoin, Bukele also announced his plans to issue a Bitcoin-backed bond ($1 billion USD raise), with half of the proceeds to be spent on acquiring more Bitcoin and the remaining half to be used to develop a "Bitcoin City" that will focus on Bitcoin mining using local geothermal energy sources, mainly the Conchagua volcano. This bond allows investors to gain exposure to a 6.5% yield and a Bitcoin dividend. How market participants react and whether or not they allocate to this financial product should offer a good idea of how these financial actions are perceived and pave the way for other countries to follow suit. The bond was scheduled to be issued between March 15th and March 20th, but it has been delayed by El Salvador’s finance minister, Alejandro Zelaya, due to volatile market conditions linked in part to the ongoing conflict in Ukraine.

Bitcoin Game Theory

Proponents of Bitcoin’s game theory claimed this initial nation state adoption was an inevitability and would, spur further nation state adoption rapidly due to the incentive to remain financially and liberally competitive with other jurisdictions. Amongst the hype and speculation, it was also predicted by many last year that Spot Bitcoin ETF’s (exchange traded funds) were almost a given. However, a year on, legal tender adoption from other nations has yet to occur and no Spot ETF’s have come to market. Instead, we have seen adoption come in the form of other financial products, such as Canada’s Purpose Bitcoin ETF, Bitcoin ETPs in Europe (exchange traded product), and Bitcoin Futures in the US. These financial vehicles provide exposure to Bitcoin, however, they do not provide self-custody of the Bitcoin to which an investor is exposed, which is arguably one of the major unique selling points of owning Bitcoin.

The International Monetary Fund (IMF) just this year urged El Salvador to remove Bitcoin as a form of legal tender, highlighting, in their opinion, risks to financial stability, integrity, and consumer protection. With the IMF consisting of 190 countries, this statement from them, has a significant bearing on the actions of member nations when it comes to their hesitancy towards potential adoption of Bitcoin. Over the past year, we have witnessed repeated attacks upon Bitcoin being a viable technological solution from central bankers such as Christine Lagarde (ECB) and Andrew Bailey (Bank of England). This in turn, generated uncertainty and doubt as these institutions and individuals hold significant powers and valued opinions. Conversely, investors should also consider the credibility of these statements as, inevitably, El Salvador’s move, if successful, may remove their reliance on such institutions in the future. The IMF uses the traditional monetary system of a fiat standard in the form of the most commonly dollar-denominated loans to aid distressed economies. The IMF’s ability to do so is therefore diminished as nations potentially move away from this monetary standard. Essentially, it can be seen that the transformation to a Bitcoin monetary standard would lead the IMF into greater irrelevancy over time as they would no longer have sufficient financial tools to pursue their endeavours.

Bitcoin Adoption

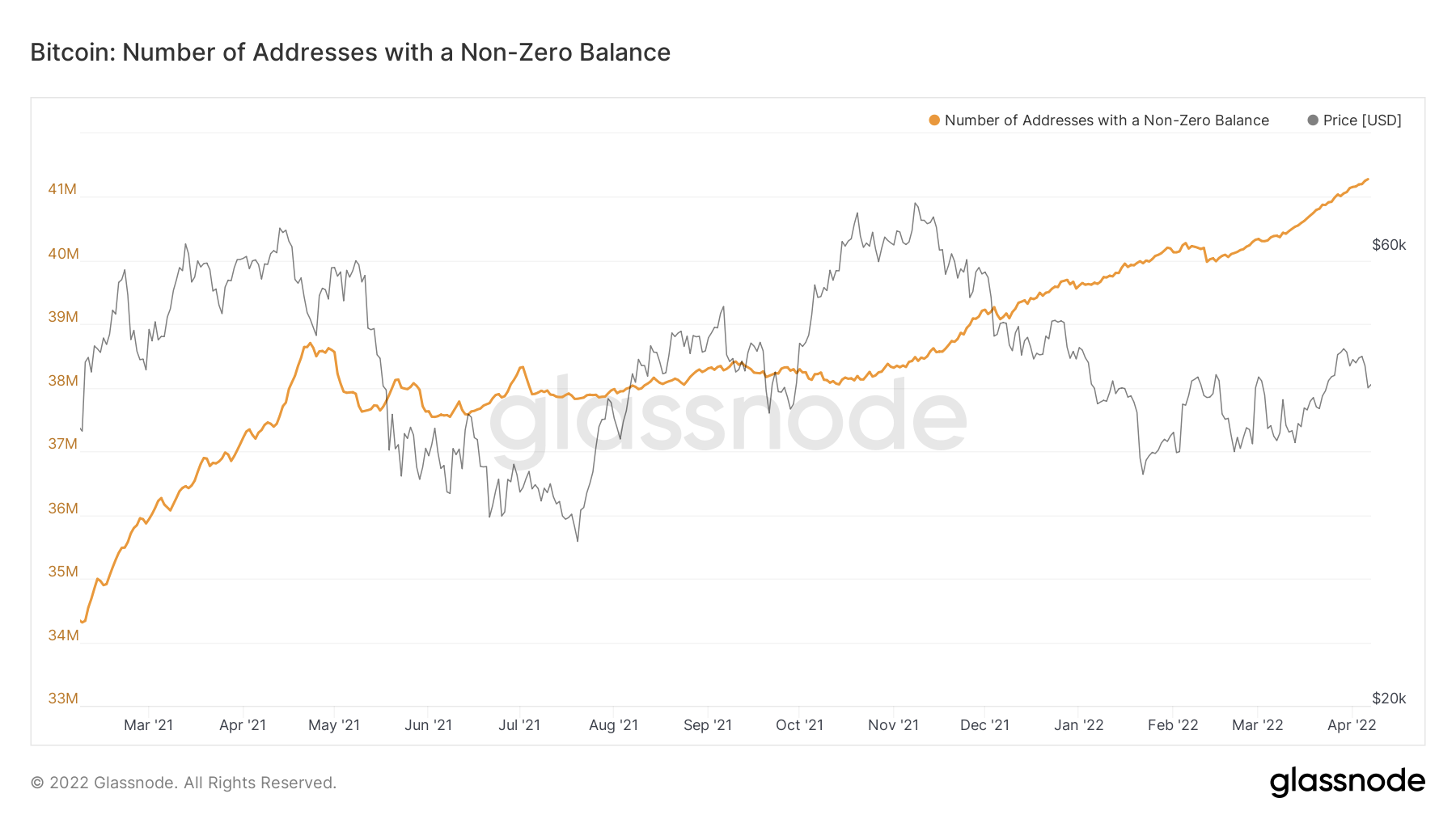

Amongst all this uncertainty on a macroeconomic and nation-state level, when reviewing the past year, Bitcoin accumulators overall seem unfazed. From analysing metrics collected from Glassnode, there has been a consistent uptick in the balances of the majority of wallet sizes (e.g., 0.01-0.1, 0.1-1 Bitcoin balances, etc). During this most recent downtrend period, beginning at the start of the year, accumulation has increased in pace. This continual accumulation can be attributed to the nature of increasing mistrust between nations and hence their fiat currencies, the dollar’s reserve currency status being increasingly tested (Russia’s demand to be paid in Roubles, increased trade between major powers such as India, China, and Pakistan in their respective currencies), inflationary pressures that have not been seen in over 40 years in some regions of the world and the rapid digitisation of financial services.

****The past year has led to very interesting developments in the various spheres that Bitcoin inhabits, albeit not necessarily in the manner that many assumed. However, progress has been made. This year should signal further progress in the adoption of the network both on an individual and nation state level if the current trends to date continue. Bitcoin has now seated itself as a serious player on the world stage, inciting strong reactions from both sides of the debate, and there will be many keen eyes on how it develops and the level of acceptance in the coming period.

Recommended reading: The Game Theory of Cryptocurrency

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)