The Global Picture

The Bitcoin mining industry has witnessed a number of exciting advancements over the last year. Changes in mining demographics and infrastructural development within nations, institutional entry into the space, plus hardware production are all factors to consider. These innovations and advancements have impacted emerging areas, resulting in a completely new competitive playing field for the Bitcoin network.

The biggest Bitcoin mining story in 2021 would arguably be from June, when the Chinese government took additional steps to curtail Bitcoin-related activities.

Read more: China's ban forces some bitcoin miners to flee overseas

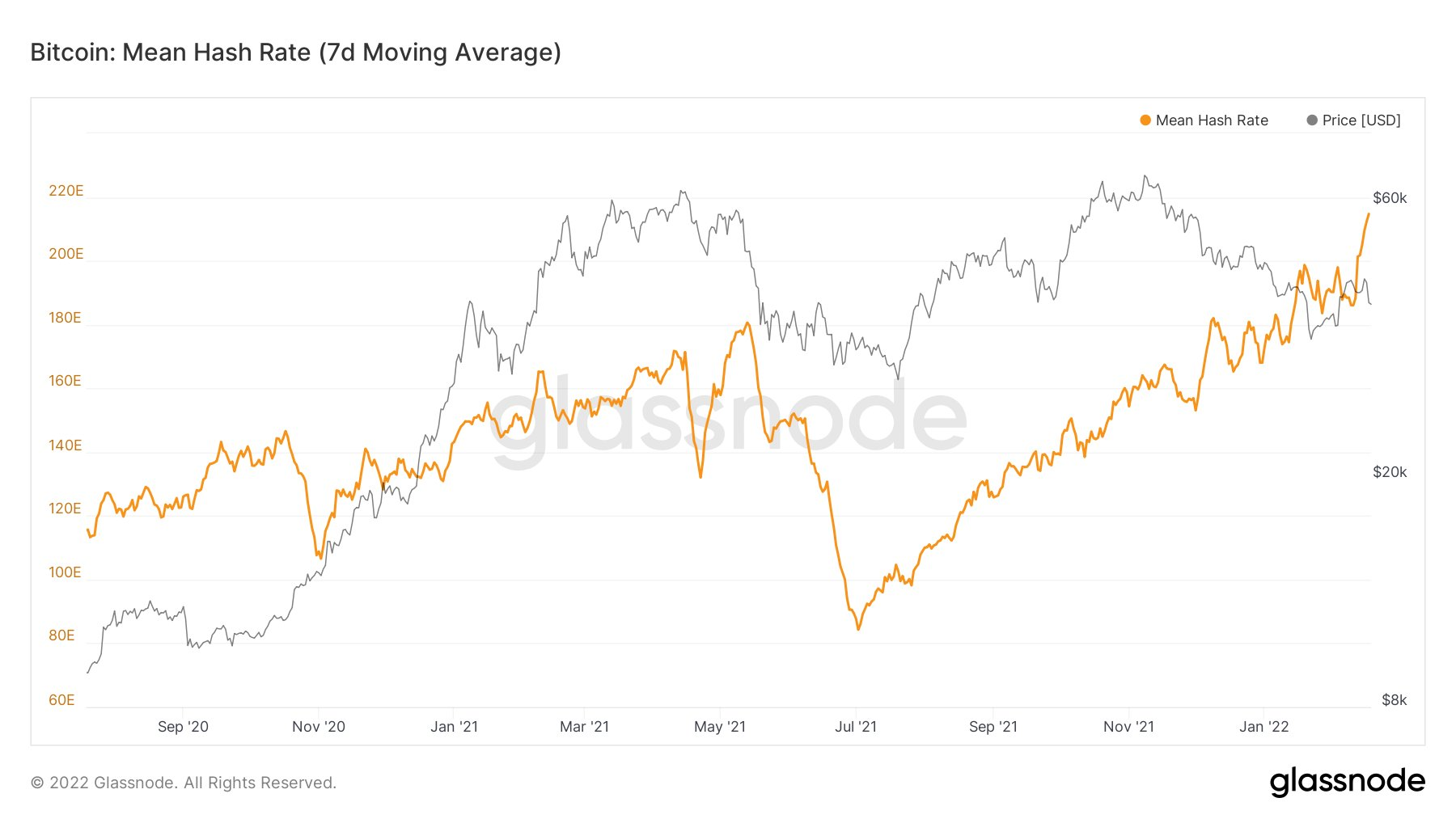

The Chinese government began by prohibiting banks from facilitating transactions between exchanges, and then imposed a blanket ban on Bitcoin mining within the country. As shown in the graph below, this resulted in a 38% decrease in the network's hash rate.

Furthermore, the difficulty adjustment was reduced by about 20% as a result of this. The difficulty adjustment is a mechanism of the bitcoin network that adjusts how much computational power is required to successfully mine a block, being adjusted every 2016 blocks (average block is mined in 10 minutes).

This was the highest single drop in difficulty, demonstrating the magnitude of the ban. Despite this, the network remained sturdy and recovered over the next few months. This is a testament to the network's robustness and decentralisation, as some of these miners relocated to other countries such as Kazakhstan or the United States.

Going into 2022, the network has continued to expand and its hash rate has climbed, indicating that investment in mining operations has reached all-time highs.

Due to the overall increased energy requirements, this strengthens the network, making it more immune to a 51% attack (possible when a single entity controls more than half of the total hash power). The hash rate bottomed in 2021 at roughly 80 EH/s and has since soared to around 200 EH/s (for perspective, EH/s stands for exahashes per second, with 1 EH equalling one quintillion hashes). As a result of the network's increased computational security, as well as the dispersion of miners and decreased Chinese domination of the hash rate, it may become a more appealing investment prospect for some.

US Infrastructure Developments

Following China's mining exodus, the United States emerged as the most significant entrant into the mining ecosystem, with businesses such as Bitfarms, Riot Blockchain, and Hut 8 Mining beginning to publicly list on stock exchanges such as Nasdaq. This increases transparency into the operations of these US corporations, their balance sheets, and the size of their mining operations.

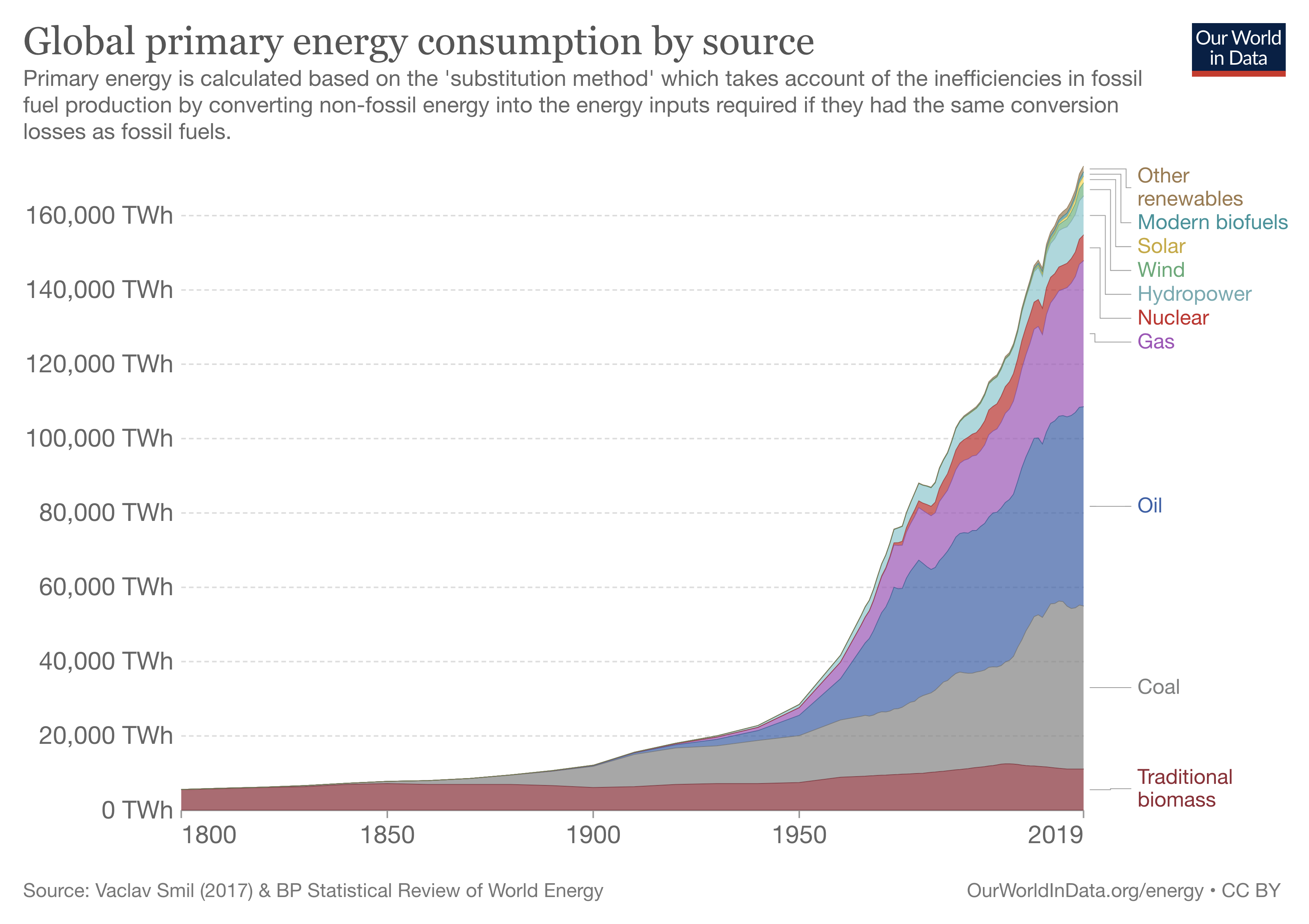

According to filings, these miners are projected to increase their power capacity by around 5.2 gigawatts by the end of 2022. To put this in context, 1 gigawatt is equal to 1 billion watts, with the ordinary household bulb merely requiring 60-100 watts to demonstrate the magnitude of such processes. ISW Holdings, which is collaborating with BitMain to build a 200MW mining facility, provides a great insight into the costs of such an enterprise. The investment for the setup and energising of miners is roughly $62 million, averaging out to $300,000 per megawatt added. If we extend this data to determine the entire mining investment in North America, it could be valued as high as $1.5 billion. Overall, the network consumes approximately 200 TWh of electricity per year, whereas global energy use is approximately 160,000 TWh, demonstrating that Bitcoin is only a minor part of total energy consumption (0.125%).

The state of Texas, which has been at the forefront of these infrastructural developments, accounts for roughly half of the 5.2GW capacity being installed. Because of its deregulated energy market and pro-Bitcoin mining legislative stances, Texas has an advantage over many other states. This has provided new entrants into the area with viable energy sources to capitalise on, as well as making such processes as frictionless as feasible for new entrants.

Texas's energy mix also highlights some of the greener energy sources that can be used to mine Bitcoin. With renewables accounting for a sizeable share of the grid (22.5% wind and solar), the emergence of mining operations assures that these sources have a consistent energy purchaser as well as the economic incentive to innovate in order to boost miner profitability. Bitcoin mining infrastructure benefits local companies by encouraging increased energy output and capacity, which can be extremely advantageous to a location's power reliability in the event of a power outage/shortage. Texas suffered power outages as recently as 2021, demonstrating the need for such changes to preserve the grid's reliability for its users. Bitcoin mining is also highly flexible in its operations, allowing for demand to be satisfied elsewhere on the grid if necessary by turning off miners if required.

Mining Hardware

Chinese hardware manufacturers are the most dominating in the field, with key firms such as Bitmain, MicroBT, and Canaan. These firms have contracts to deliver 1 million ASIC miners to the bulk of North American operations by 2022. However, since the outbreak of the pandemic, supply chains have been plagued by a slew of challenges, notably rising transportation costs and chip shortages. Of course, due to these supply chain concerns, it is possible that these contracts will not be met on time. Another thing to examine is the operational practicality of using these miners, as power capacity limits may occur. SEC filings show which corporations are potentially entering the field particularly aggressively, as well as how substantial some of these contracts are, despite the fact that Bitcoin mining on a global scale is still in its infancy. Core Scientific, Marathon, Cipher, Riot, and Terawulf are just a few of the companies with significant miner pre-order contracts. Marathon and Core Scientific both have pre-order contracts ranging from 100,000 to 150,000 units.

The most popular mining equipment of choice is currently Bitmain's AntMiner S19 Series, with roughly 60% of contractual orders placed for this hardware. The second most popular miner is the WhatsMiner, with a 20% market share, demonstrating BitMain's current dominance over its competitors. The current market pricing for an AntMiner S19 Series is roughly $11,000, with a profit margin of about $4,500 (assuming 24/7 operating time and using approximated electricity price estimates).

The reliance on Chinese-made hardware may fade in the future, lessening the centralisation of this component of Bitcoin's ecosystem. As demand for miners grows and it becomes more viable (assuming prices continue to rise), mining solution suppliers will try to capitalise on this demand, resulting in increasing competition for mining hardware solutions. This has already been proved, with Intel announcing earlier this year that they would enter the space with a mining solution that is touted as being half the price of the AntMiner S19 while being 15% more efficient in terms of energy required for the same hashing power (uses less power for the same hash output).

Diversification of the hardware manufacturing business helps to alleviate the over-reliance on Chinese-made items, which is a net benefit for the Bitcoin ecosystem's broader decentralisation. As more research and development is done in this industry, this expansion will create new jobs in manufacturing, as well as an enhanced monetary incentive for engineering, labour, and computing-based roles worldwide.

These are only a few of the facets that comprise the Bitcoin mining ecosystem, albeit some of the more essential ones, but they provide valuable insight into how rich the ecosystem is and how it might continue to expand in the future. 2022 is shaping up to be a year of significant growth and maturation for this aspect of the network, which will hopefully solidify the need for Bitcoin on the global stage.

Recommended reading: Caleb & Brown Powers Crypto Holdings with Verified Renewables

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)