What is the Bitcoin Market Cycle?

The bitcoin market cycle refers to the recurring pattern of price behaviour in the bitcoin market, characterised by alternating periods of appreciation and depreciation. This cycle is a result of market sentiment, which impacts buying and selling activity. Bitcoin sentiment is influenced by a variety of factors, including regulatory changes, technological developments, and the broader economy and traditional finance (TradFi) markets.

Historically, bitcoin has followed a four-year cycle tied to Bitcoin halving events, which happen approximately every four years. A halving event marks a 50% cut in the bitcoin reward miners receive for mining new blocks and verifying transactions. In effect, the bitcoin supply continues to increase, but at a slower rate, upholding the network’s deflationary principles. The knock-on effect has led to steep price increases, driven by speculation and a decrease in the supply of new bitcoin entering circulation. The last halving occurred on April 19, 2024, when the block reward decreased from 6.25 to 3.125 bitcoins. The next halving is expected in April 2028.

What are the Bitcoin Market Cycle Phases?

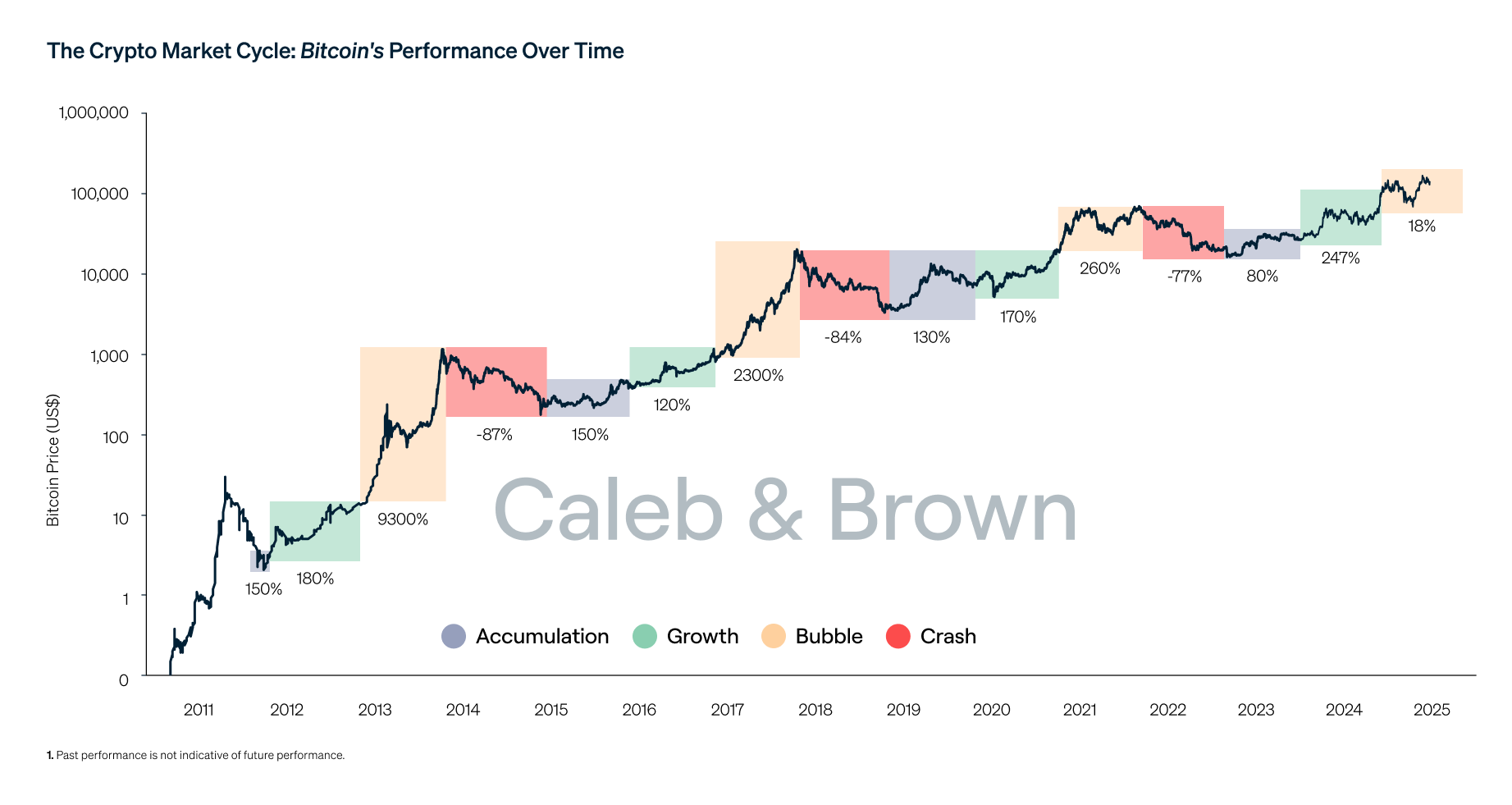

The chart below illustrates the cyclical nature of bitcoin’s price and its historical trends.

Phase 1 – Accumulation

The accumulation phase of the bitcoin market cycle occurs when prices are (relatively) low, but small signs of growth appear. During this phase, forward-thinking buyers will accumulate cheaper bitcoin as it represents the point of maximal upside.

Typically, there is bearish sentiment in the market, so volume is low and prices fluctuate in a tight range near the bottom.

Phase 2 – Growth

In bitcoin’s growth phase, price continues moving towards the all-time high. Halving events in the past have occurred here, coinciding with shrinking exchange reserves as buyers absorb supply in anticipation of capturing rising prices and new all-time highs.

Phase 3 – Bubble

In the bubble phase of the bitcoin market cycle, the price eclipses the previous all-time high and begins to move exponentially to the upside. These higher prices typically exceed the previous highs by a significant amount. The bitcoin bubble phase is extremely volatile, characterised by rapid price increases followed by significant corrections.

Sell volume builds as a portion of investors lock in healthy profits, while many market participants continue to buy, believing the bull market has more room to run. As a result, price volatility is low given that buy and sell volumes begin to balance against a backdrop of overconfidence. At this point, the Fear & Greed Index typically flashes Extreme Greed.

Phase 4 – Crash

Following the euphoria of the bubble phase, the market will experience a major correction to the downside. Previous bear market periods have resulted in approximately 80% drawdowns from the top and negative price action for approximately a year. The most recent example saw the price tumble by almost 78% from an all-time high of US$69,000 in November 2021 to US$15,476 in November 2022.

Understanding Sentiment through Historical Bitcoin Cycle Patterns

Aside from trading volume and indicators, such as the Fear and Greed Index, there are other indicators that can help traders and investors understand bitcoin’s market sentiment.

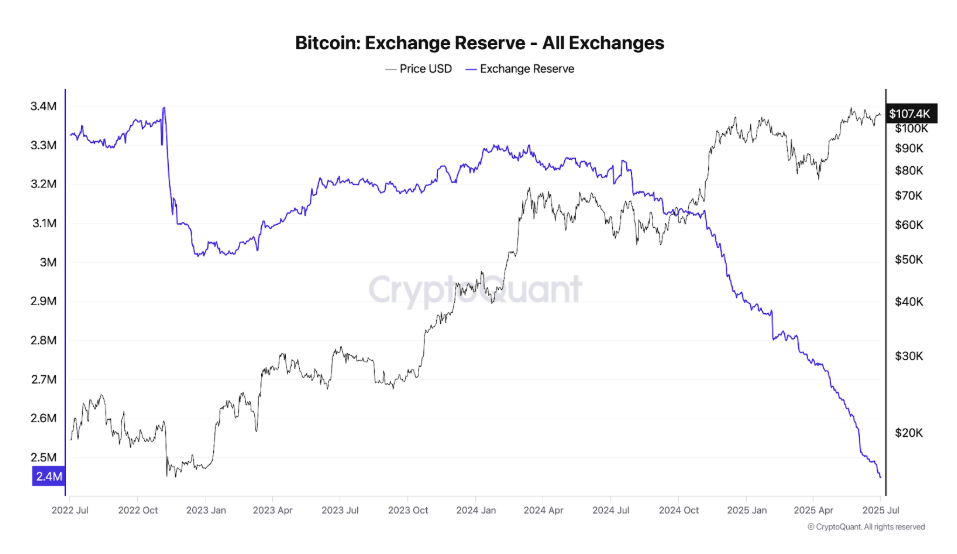

Getting an Indication of Price through Bitcoin Exchange Reserves

Before bitcoin reaches new highs, the amount of bitcoin held in central exchange wallets is typically low, indicating that investors may be holding their BTC and waiting for higher prices. This HODLing reduces available supply (even further in a high-demand period) and, as seen below, this can result in sharp price increases.

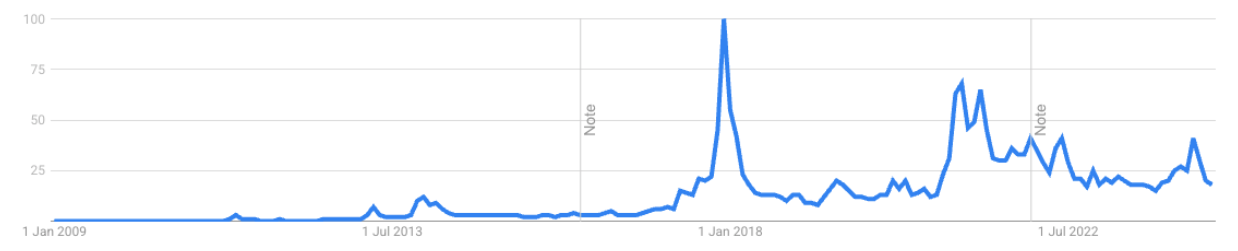

Identifying Market Cycle Phase with New Interest in Bitcoin

Peak interest in bitcoin, as measured by Google search activity, was reached in December 2017, coinciding with the bull market’s run-up to an all-time high. Since then, Google Trends shows that the search volume for 'bitcoin' hasn’t reached the same levels as the 2017 bull run, despite delivering multiple all-time highs since.

Similarly, Google search volume for ‘crypto’ peaked during the 2021 bull run. Attention is now focused on the entire ecosystem, which has evolved dramatically since earlier bull runs. Further, as crypto becomes better understood through mainstream channels, those new to cryptocurrency may be getting basic information through news articles or social media, as more information is presented to the public.

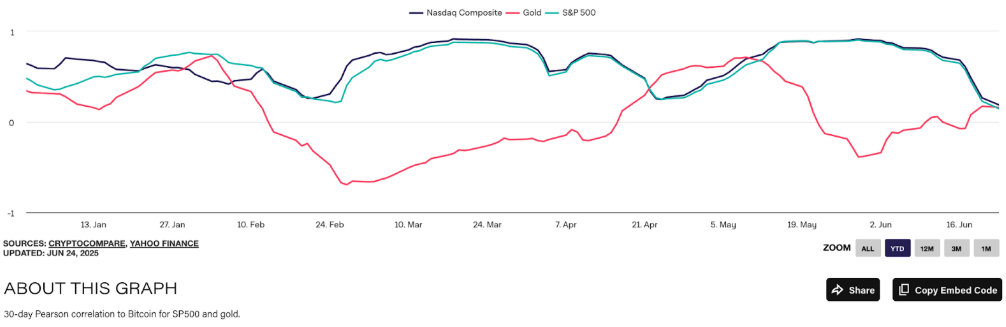

Macro & Bitcoin Correlation

The relationship between Bitcoin and the S&P 500, referred to as a correlation, shifts based on broader market sentiment. Throughout 2025, a pattern has emerged in which bitcoin’s price is highly correlated with risk assets, such as those held in the S&P 500 and Nasdaq Composite (Nasdaq), when risk-off sentiment prevails. For example, in April 2025, following the announcement of President Trump’s tariffs, the correlation between bitcoin and the S&P 500 and Nasdaq reached 0.73 and 0.76, respectively. As geopolitical uncertainty in the Middle East persisted throughout May and June 2025, bitcoin’s correlation with both the S&P 500 and the Nasdaq hovered around 0.90.

It's important to recognise that correlations can change over time, and the relationship between bitcoin’s price movements and other asset classes can be influenced by various factors, including macroeconomic events, geopolitical uncertainty, and regulatory developments.

Mainstream Adoption of Bitcoin

Several recent developments have seen adoption in the growth of bitcoin as both a store of value and legal tender. These developments are outlined below.

Public Companies Buying Bitcoin

Mainstream adoption of bitcoin has been on a steep curve. In January 2018, the value of BTC trading on Binance surpassed $11 billion – a fraction of the bitcoin traded on the platform in March 2024, when the exchange saw over $1trillion worth of volume across all assets. Over this period, bitcoin has proven itself to a growing community of retail and, crucially, institutional investors, including public companies, which held over 1.5% supply as of May as of June 2025. The largest publicly traded holder of bitcoin is Microstrategy, which currently holds 576,230 BTC, purchased at an average price of $66,384 per bitcoin. Famously, Tesla also holds a stack of over 11,500 BTC on its balance sheet.

Bitcoin Exchange-Traded Funds

Bitcoin’s mainstream adoption has grown following the successful launch of over ten Bitcoin Spot ETFs. For those seeking exposure to bitcoin through traditional finance institutions and wealth management firms, bitcoin ETFs offer an option that may be more accessible to those less familiar with crypto technology. However, for crypto natives and those interested in the privacy that crypto offers, buying bitcoin through a broker or exchange and transferring these holdings to a cold wallet is the optimal approach. This approach is what gave rise to the saying, “not your keys, not your coins,” in the crypto community.

Regulatory Developments

Governments worldwide have increased their regulatory efforts to establish a clear framework for the cryptocurrency sector. In June 2021, El Salvador became the first country in the world to adopt bitcoin as legal tender. The country's legislature approved a law that requires businesses to accept bitcoin as a form of payment for goods and services, and also established a BTC reserve through purchasing bitcoin using the country’s funds. El Salvador’s BTC reserve currently stands at 6,089 BTC, with an average purchase price of US$43,357.

Crypto regulation was a key policy area for President Trump in the 2024 presidential election, and several regulatory developments have occurred since his inauguration in January 2025. In early 2025, President Trump made an executive order to create two new government-managed funds for digital assets: a Strategic Bitcoin Reserve (SBR) and a U.S. digital assets stockpile. At this stage, these digital asset reserves will be capitalised with crypto assets seized in criminal forfeiture. Bills to establish other digital asset reserves, where the Federal Government may use public funds to acquire bitcoin and other digital assets, are currently before Congress in varying stages of progress.

Three U.S. states have enacted laws to establish a Strategic Bitcoin Reserve (SBR) using public funds: Arizona, New Hampshire and Texas. There are currently 19 SBR bills live across eight states, while nineteen states voted against SBR bills.

Other key pieces of legislation expected to provide regulatory clarity to the crypto sector, which could potentially drive upward price momentum, are the GENIUS Act (the U.S. Senate’s stablecoin bill) and the Digital Asset Market Clarity, or CLARITY Act. Stay up-to-date on the latest developments in crypto regulation and the current market with our Weekly Rollup.

Bitcoin as Legal Tender

Beyond investors, several large companies accept bitcoin as payment, including PayPal, Microsoft, Shopify, and Chipotle, among others. This trend is expected to continue growing as crypto adoption becomes increasingly mainstream.

Recommended reading: Crypto Portfolio Basics: The Key to a Well-Balanced Portfolio

Invest in Bitcoin with Caleb & Brown

You don’t have to be an expert on bitcoin's market cycle to invest in the original and largest cryptocurrency.

Caleb & Brown is the world's leading crypto brokerage for beginner and advanced investors alike, with bitcoin and thousands of other crypto assets readily available for your portfolio.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto. Not to mention key features such as:

- No joining or signup costs

- 300+ crypto assets available to buy, sell, and swap

- 24/7 customer support

If you're ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)