What is Volatility?

Comparing Crypto Volatility to Traditional Markets

Factors Affecting Crypto Volatility

Closing Thoughts

It's no secret that crypto markets are highly volatile. Significant price swings, which would be considered major events in traditional financial markets, are a common occurrence in the crypto market. But is this crypto volatility a feature, a bug, or the growing pains any financial market must go through, just as the U.S. equity market did in its infancy?

While most investors accept that crypto asset prices can fluctuate, few understand the underlying reasons behind this volatility. This article explains why cryptocurrency is so volatile, enabling investors to better understand the risks and opportunities that volatility presents. Keep reading below to learn more.

What is Volatility?

Volatility in financial markets refers to the degree to which the price of an asset fluctuates over a specified period. High volatility is characterised by larger and more frequent price movements, whereas low volatility is characterised by the opposite.

Generally, the more volatile and unpredictable an asset is, the riskier it's considered to be as an investment. This brings with it the potential for greater returns or greater losses over shorter time periods compared to less volatile assets.

Comparing Crypto Volatility to Traditional Markets

As a relatively new asset class, crypto continues to be highly volatile and, therefore, riskier than traditional asset classes. Stocks, for example, display a wide range of volatility, from the relative stability of large-cap stocks (like Google, Apple, and Berkshire Hathaway) to the often erratic penny and small-cap stocks. Bonds are an even lower risk, as they typically exhibit less dramatic price movement, especially in the case of higher-grade bonds, such as U.S. Treasuries.

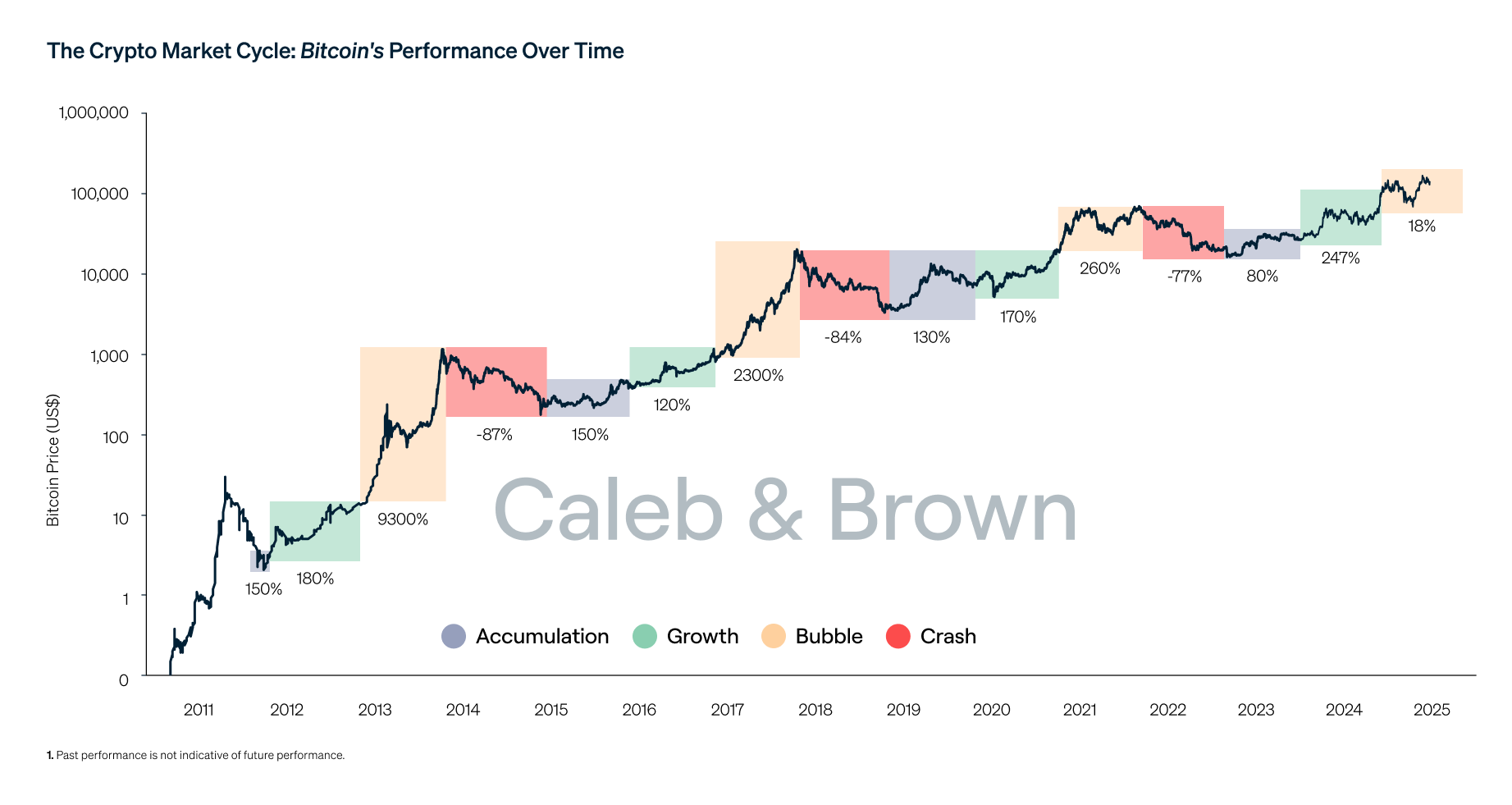

In contrast, crypto assets often experience large gains followed by steep drops. Using Bitcoin (BTC) as an example, you can see that BTC has witnessed over eight corrections over 50% in its 17 years of existence. However, bitcoin has managed to recover from each correction over the course of a full cycle to make new all-time highs, including its most recent all-time high of US$123,000 in July 2025.

Many of the reasons for price volatility in traditional finance (TradFi) markets are also reflected in the crypto market. Speculation and black swan events, such as COVID-19, drive price swings in both crypto and TradFi. However, the effects of these events are often exaggerated in crypto due to the unique features that characterise the relatively nascent nature of digital assets.

Factors Affecting Crypto Volatility

Several factors impact volatility in crypto markets. These factors are outlined below.

Price Discovery

All new financial markets take time to settle and be accepted in order to reach mass adoption. The same holds true for crypto. The asset class, the market, and its investors and speculators are still finding their footing during this early and high-growth phase.

Bitcoin has only been around for 17 years. While this is longer than most crypto assets, BTC still reaches a new price discovery phase in each market cycle. This means that prices will continue to fluctuate as new participants enter the market, attempting to establish a consensus on what one bitcoin is worth.

While crypto is now mainstream, following unprecedented adoption rates that are faster than other innovative technologies (like the Internet), the asset class is still considered an outlier compared to traditional assets like stocks or commodities. Growing acceptance and maturity of the market go hand in hand. Until investors gain more certainty in crypto's long-term future utility and regulatory standing, price discovery will continue to be a major driver of crypto volatility.

Immature Markets

Rapid upside comes with growing pains. Many of the financial products and instruments within the cryptocurrency ecosystem are still in development. Compared to assets like equities, crypto can be more difficult for sophisticated investors to gain exposure to (which is why it's retail-heavy), though this applies more to smaller or new tokens. The introduction of bitcoin and other altcoin ETFs has seen significant flows into products offered by the world’s largest wealth management and financial institutions. BlackRock’s Bitcoin ETF, for example, grew to US$70 billion in inflows faster than any other ETF on the market, including those that offer exposure to TradFi assets, such as tracking the S&P 500.

While larger-cap cryptocurrencies have high liquidity and the depth to accommodate large trades, smaller cryptocurrencies can struggle with liquidity, especially if they aren’t traded on well-known centralised exchanges.

A few major stock exchanges, such as the New York Stock Exchange (NYSE), facilitate the majority of trading in traditional markets. In contrast, crypto liquidity is fragmented across many different exchanges and trading channels. Therefore, it can be difficult for large players to enter or leave the market at 'size', without affecting prices and moving the market.

Supply and Demand Dynamics

The difference between supply and demand plays a significant role in the volatility and price movements of any asset. However, it is particularly nuanced in the crypto space due to the unique supply dynamics of many different digital assets.

The limited supply of certain assets often creates conditions where sudden increased demand can put even greater upward pressure on prices, increasing volatility. The most prominent example of a fixed supply schedule digital asset is bitcoin, which has a supply cap of 21 million coins.

This pressure can be compounded further when large holders, often referred to as whales, buy or sell significant quantities of a particular asset, potentially sending its price soaring or tumbling. The cryptocurrency markets are not yet efficient enough to absorb these supply and demand shocks without a significant price impact. Due to limited liquidity, smaller market cap assets are particularly susceptible to the movement caused by whales' trades and are often more volatile and risky as a result.

Sentiment

Crypto markets are heavily influenced by investor sentiment. The immaturity of the overall crypto market means that positive or negative views can spread like a contagion. This is due to the psychology of the crypto investor, who is typically an individual who may be more impressionable and susceptible to acting on short-term price fluctuations compared to more seasoned TradFi and crypto investors.

A notable example of this is when Tesla purchased Bitcoin in January 2021, prompting the market to react with exuberance and over-optimism, which led to a surge in BTC buying and a subsequent price rally to an all-time high of around US$69,000 in the months that followed.

The fear of missing out (FOMO) factor is particularly prominent with speculative assets, as investors often hear stories of prices rising during a bull market and people taking profits, prompting them to enter the market and encourage their friends and family to follow. This can create a positive reflexive feedback loop with high (but unsustainable) demand for an asset, causing significant price movements.

Lack of Regulation

Regulation is an important factor in market volatility. The crypto market is not comprehensively or clearly regulated by any government bodies, unlike traditional financial markets. The unique digital and decentralised characteristics of cryptocurrencies present major challenges for regulators globally. The need for regulation to protect consumers and legitimise the industry has long been called for by prominent figures within the industry. President Trump’s administration is the first to have included cryptocurrency regulation as part of a presidential election policy platform. Since his inauguration in January 2025, several crypto bills have been introduced to Congress.

Regulatory agencies, such as the U.S. Securities and Exchange Commission (SEC) and the U.S. Department of Justice, have operated with a “regulation by prosecution” approach under previous administrations. This has led to some cryptocurrencies being subject to increased volatility when an investigation into a particular asset is announced. For example, following the SEC's 2020 announcement of its case against Ripple, $16 billion, or 63%, was wiped off XRP's market cap during the trading period that followed. Meanwhile, the broader crypto market remained relatively steady.

24/7 Trading

Crypto markets don't sleep.

Unlike traditional markets that trade between set hours, Monday-Friday, such as the NYSE, the crypto market doesn't close. Coupled with the lack of regulation, this means there are no circuit breakers like in traditional markets.

Circuit breakers are interventions by exchanges to dampen volatility caused by panic selling or destructive events, internal or external to the stock market. With no training wheels or guard rails in place, crypto's free market dynamics are susceptible to high volatility.

Closing Thoughts

The crypto market is becoming increasingly sophisticated, and institutions are becoming more involved in transacting in crypto or structuring investment products to provide both retail and sophisticated investors with crypto exposure via TradFi channels. However, digital assets are still a relatively new asset class, which can subject cryptocurrencies to higher volatility than more established assets. It’s important to note that crypto’s volatility is a feature, not a bug, during its high-growth phase. The rapid fluctuations in price present both challenges and opportunities for traders and investors alike.

As time passes, the factors that drive volatility in the cryptocurrency market will subside. We are already witnessing the introduction of different players into the market, along with increased institutional participation and regulatory oversight, which will reduce volatility in the future as the broader crypto market matures.

Make Your First Crypto Investment

There are thousands of crypto projects in the market, each with unique and varying use cases. At Caleb & Brown, we take an objective and factual approach to cryptocurrency, providing resources to help you make informed investment decisions.

If you’re ready to invest in any one of these cryptocurrencies, working with a crypto broker is one of the easiest and safest ways to start investing. Caleb & Brown specialises in delivering a personalised experience for every investor, ensuring you can make an informed decision on every trade. Not to mention key features such as:

- unlimited pairing with no limits on trading volume

- free custody on all stored assets

- no deposit or withdrawal fees.

Trusted by thousands of clients worldwide since 2016, Caleb & Brown has the experience needed to help you execute your first crypto investment.

Sign up for your free consultation and start investing today.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.