Bitcoin

Bitcoin started December ranging between $56,000 and $59,000 after correction from all-time highs in November. Following some sharp selloffs in traditional markets in early December, prices fell over 15% in just 2 days. This was largely driven by fears of the new Omicron COVID variant, in addition to Federal Reserve chairman, Jerome Powell, voicing fears around inflation, signalling that an increase in interest rates may be on the horizon.

Typically, a low interest environment is beneficial for investors as loans and debt servicing are cheaper. Due to the encouraging investment environment lower interest rates create, this tends to see cash flow into assets such as equities and cryptocurrencies. Increasing interest rates could pressure some investors into de-risking their portfolios as bond yields grow more attractive and loans more expensive.

While the selloff was motivated by the above factors, it was exacerbated by the cascading liquidations of long positions. Despite funding rates (periodic payments made either to traders that are long or short, based on the difference between futures and spot market prices) remaining relatively low over the past few months (below 10%, compared to 30% in March which was a much more volatile period), open interest (the total number of outstanding derivative contracts) increased significantly while funding rates were positive. This indicates that there were more leveraged long positions opened compared to leveraged short positions during the period shown below. There was a short:long ratio of 1:5.78 with longs accounting for 85.26% of total open positions and shorts accounting for 14.74%. In essence, there was a greater amount of money invested on the long side compared to the short.

Consequently, when Bitcoin fell below $50,000, a resistance that had been held for over two months, many traders with leveraged longs were stopped out or liquidated. When traders are liquidated or have their stop losses triggered, they are forced to market sell their positions, causing significant sell pressure in an already weak market. Data from Coinglass shows that there were $2.09 billion in liquidations in a single day. This is what caused Bitcoin to fall almost 20% from $52,000 to $42,000 in a single four-hour period.

As investors reflect on major price movements, the market tends to consolidate for prolonged periods of time. This can be observed in the major cryptocurrency pairs and within the top 20 tokens ranked by market capitalisation, which have recently been trading in a tight range with low volatility. Based on historical price action, Bitcoin will tend to continue within a tight range for the coming weeks ($47,000 and $52,000).

Ethereum

Ethereum followed Bitcoin's price action and sold off this month along with the rest of the market. Normally, Ethereum is deemed to have higher risk and volatility than Bitcoin. This means that we generally expect higher returns in Ethereum during market rallies and larger corrections during the dips.

This was, however, not the case as during this time the ETH/BTC pair hit a local high of 0.0885, the highest price the pair has traded since May 2018, possibly indicating a shift in sentiment towards Ethereum. As the network continues to grow and support more markets such as NFTs, altcoins, DApps, and other chains, it will only cement Ethereum's status as the leading smart contract platform. During Bitcoin's recent consolidation, this pair has since retraced 10% and should be closely watched in the coming weeks.

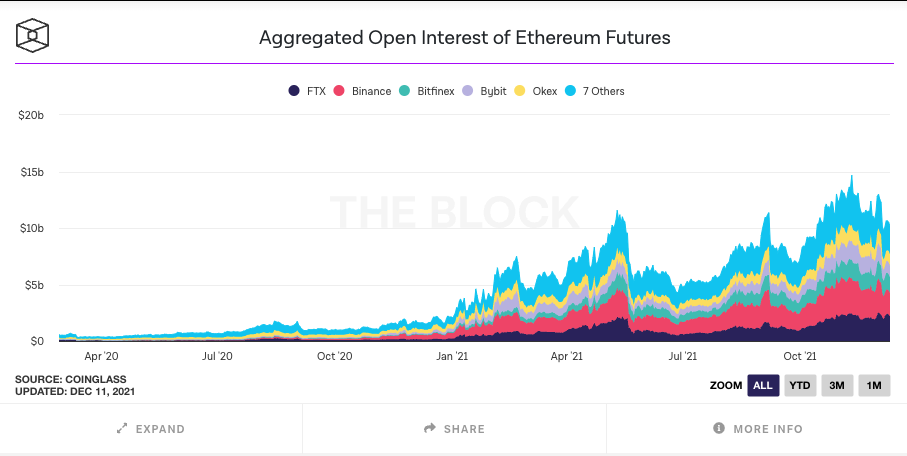

Derivatives data for Ethereum is similar to Bitcoin, with open interest staying low since the selloff at the start of the month and futures premiums remaining close to neutral. In other words, futures prices are remaining close to spot prices, suggesting that traders are currently expressing a neutral sentiment towards the market as a whole. The only divergence in derivatives data between these two assets would be the significantly higher reduction in open interest in Bitcoin compared to Ethereum.

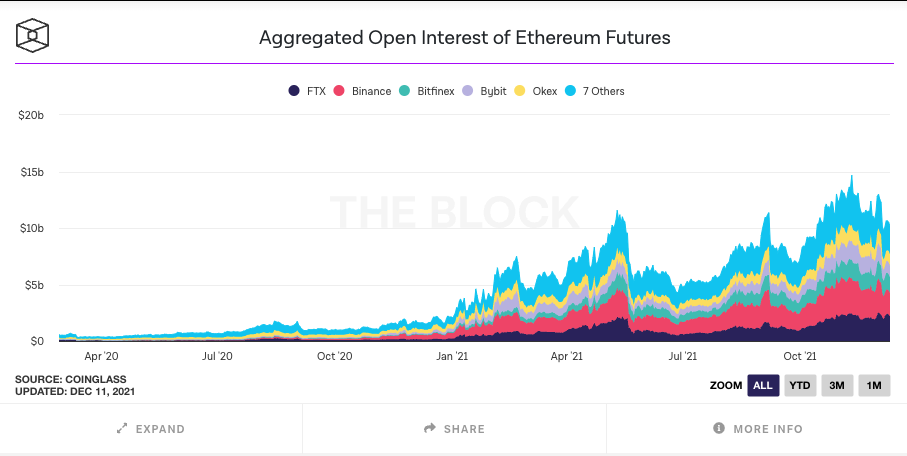

Last week, the Ethereum network's gas fees dropped marginally and, consequently, the Ethereum net issuance rate also fell from nearly 100% in the week prior to 58.97%. This has made the network much more usable for all individuals, with transactions costing as little as $3. This is in contrast to previous average gas prices which have been as high as 300 gwei, costing users $1,000 or more per transaction during the peak of network activity. These spikes in network activity can usually be attributed to major anticipated events such as NFT mints or releases, or even simply a hyped-up coin. This is reflected by more ETH being burned than issued per block, resulting in a net reduction in ETH supply. The current top burn contributors are OpenSea, native transfers, and Uniswap V2, which account for 30% of all ETH burned. In the past 7 days, the top 3 have burned more than 4,000 ETH, with the next runner up, USDT, burning just 2,000 ETH. While cheap transactions are an overall positive for Ethereum and its users, this can also imply less network activity as the market is consolidating.

Altcoins

Over the past week, most altcoins suffered a correction and have been consolidating since. However, close to 20% of the top 100 altcoins still outperformed Bitcoin during the consolidation period.

Looking back over the last 3 months, clear narratives have emerged amongst altcoins with specific sectors outperforming the market significantly. Most recently, it was the Metaverse, with tokens such as Sandbox (SAND) and Decentraland (MANA) performing extraordinarily well, with 800% and 700% gains at the peak of the hype. Before the Metaverse narrative, Layer 1 protocols such as Avalanche (AVAX) and Solana (SOL) had their run to all-time highs.

In this current market, there is no clear outlier, however as the market adapts to concerns of inflation and the potential rising interest rates, it would not be surprising to see investors consolidate back into Bitcoin and Ethereum.

Regulatory Updates

In terms of Australian regulatory updates, last week, Treasurer Josh Frydenberg announced the federal government's endorsement of many key recommendations proposed as part of the Select Committee on Australia as a Technology and Financial Centre's Final Report.

The Australian government expects to begin forming specific policies around crypto regulation in 2022, aiming to complete consultation on both a licensing framework for Digital Currency Exchanges and on the custody of crypto assets by mid-2022. By the end of 2022, the government hopes to finalise policy work around one-size-fits-all payment licensing as well as beginning a crypto token mapping exercise. The government’s planned policy ideation and implementation will, crucially, depend on the outcome of the upcoming Australian federal election.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)