On September 15, 2022, Ethereum’s long-awaited Merge was executed, marking the network’s transition from a Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism. As this content was written pre-Merge, any mentions of Ethereum using PoW are in reference to the network’s previous consensus mechanism, not its current one.

As the world’s second most popular blockchain platform next to Bitcoin, Ethereum is trying to overcome many of the perceived limitations of its predecessor. However, some of its technical constraints are holding it back, such as its proof of work (PoW) consensus algorithm and lack of scalability. In order to grow the network, Ethereum is in the process of completing an upgrade coined “the merge”. The merge is the most significant Ethereum upgrade and one of the most talked about events in the crypto space, as it will completely reshape how Ethereum functions going forward. It will achieve this by changing its consensus mechanism from proof of work (PoW) to proof of stake (PoS). This article analyses these two mechanisms for achieving consensus, as well as looking at how this will affect Ethereum’s environmental impact, issuance, degree of centralisation and scaling.

What is Proof of Work?

PoW is the consensus mechanism currently used by Ethereum, to validate transactions and secure the network. In PoW, miners lend their computer power to solve complex algorithms and validate blocks. Blocks hold a certain amount of transactions within a blockchain network. Miners are rewarded for adding a block to the Ethereum blockchain with a block reward. Blocks are created every fifteen seconds, and the miner that creates the block is currently rewarded with 2 Ether.

What is Proof of Stake?

PoS is an alternative consensus mechanism, already used by blockchains like Solana, Cardano and Avalanche. In a PoS system, network participants must stake their cryptocurrency to validate the network. After transitioning to PoS, users will will need to stake 32 Ether to become a validator of the Ethereum network. Validators are randomly chosen to create blocks, as well as checking and confirming blocks they don’t create. Validators that provide incorrect information can be penalised through losing 10-100% of their staked Ether. The risk of penalties discourages misbehaviour for validators.

Further reading: What is proof of stake in crypto?

Proof of Work vs Proof of Stake

While PoW is an effective system for verifying transactions, it requires miners to use a significant amount of energy to secure the network. Annually, Ethereum’s energy consumption is quite similar to the entire nation of Finland, according to Ethereum.org. If the energy required to run mining operations stems from non-renewable sources (38% of miners use some coal according to Cambridge), this can be detrimental to the environment. PoW systems allow for trapped energy (energy that couldn’t be productively used elsewhere) to be utilised. They encourage investment in renewable energy sources because they can be cheaper to run. However, it is estimated that the transition to PoS will use 99.95% less energy than the current PoW model.

Moreover, PoW mining tends to be an arbitrage of sorts; miners are incentivised to run their machines so long as the money they spend to fuel operations is less than the rewards they receive. As these margins tend to be quite thin, miners can be forced to sell most of their rewards in order to continue to fund their operations. This adds sell pressure to the market. In contrast, running a validator in a PoS network isn’t as costly as one merely has to stake their crypto which requires zero upfront costs. These low costs ensure that validators will not need to sell in order to fund their operations. This makes validators more likely to hold and compound their rewards instead of selling.

Both consensus mechanisms have trade-offs when it comes to decentralisation and security. PoW requires expensive mining hardware, pricing out most retail miners. However, the high cost of miners does make it almost impossible to secure enough hash power to perform a 51% attack. At current prices, this would cost more than $10 billion and would be a logistical nightmare. On the other hand, the large expense necessary to acquire specialised mining equipment also ensures that mining is mainly controlled by large specialised mining companies that can leverage their economies of scale. PoS systems allow anyone to stake their ETH with no upfront costs (investors with less than 32 Ether can pool their Ether to run a validator through a staking provider like Lido). In theory providing greater access to validate the network, should make it more decentralised. However, power laws have seen a select number of staking providers attract most of the assets. Therefore, staking providers such as Lido have gained a monopoly in the liquid staking sector, with 90% of Ether liquid staking taking place through their service, which has created a centralised attack vector.

The Beacon Chain

As part of the planned transition to PoS, Ethereum developers built the Beacon chain in late 2020 in order to merge the network. The Beacon chain currently exists separately to the Ethereum mainnet and runs on PoS. All that users can currently do on the Beacon chain is stake Ether. These users will likely be able to withdraw Ether a few months after the merge, or alternatively through a dedicated service like Lido that offers a token representing staked ETH (sETH). When ready, all records that are currently on the Ethereum network will be moved across to the Beacon chain, merging the two chains together. The merge is currently being tested, most recently through a shadow fork which involved merging a copy of the Ethereum blockchain onto a testnet.

Further reading: Shadowforks

Delays/Difficulty Bomb

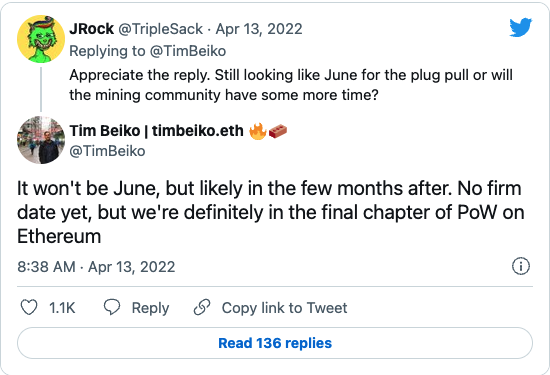

The merge was initially supposed to take place in June 2022, but senior Ethereum developer Tim Beiko confirmed that the merge will be delayed until late Q3/ early Q4.

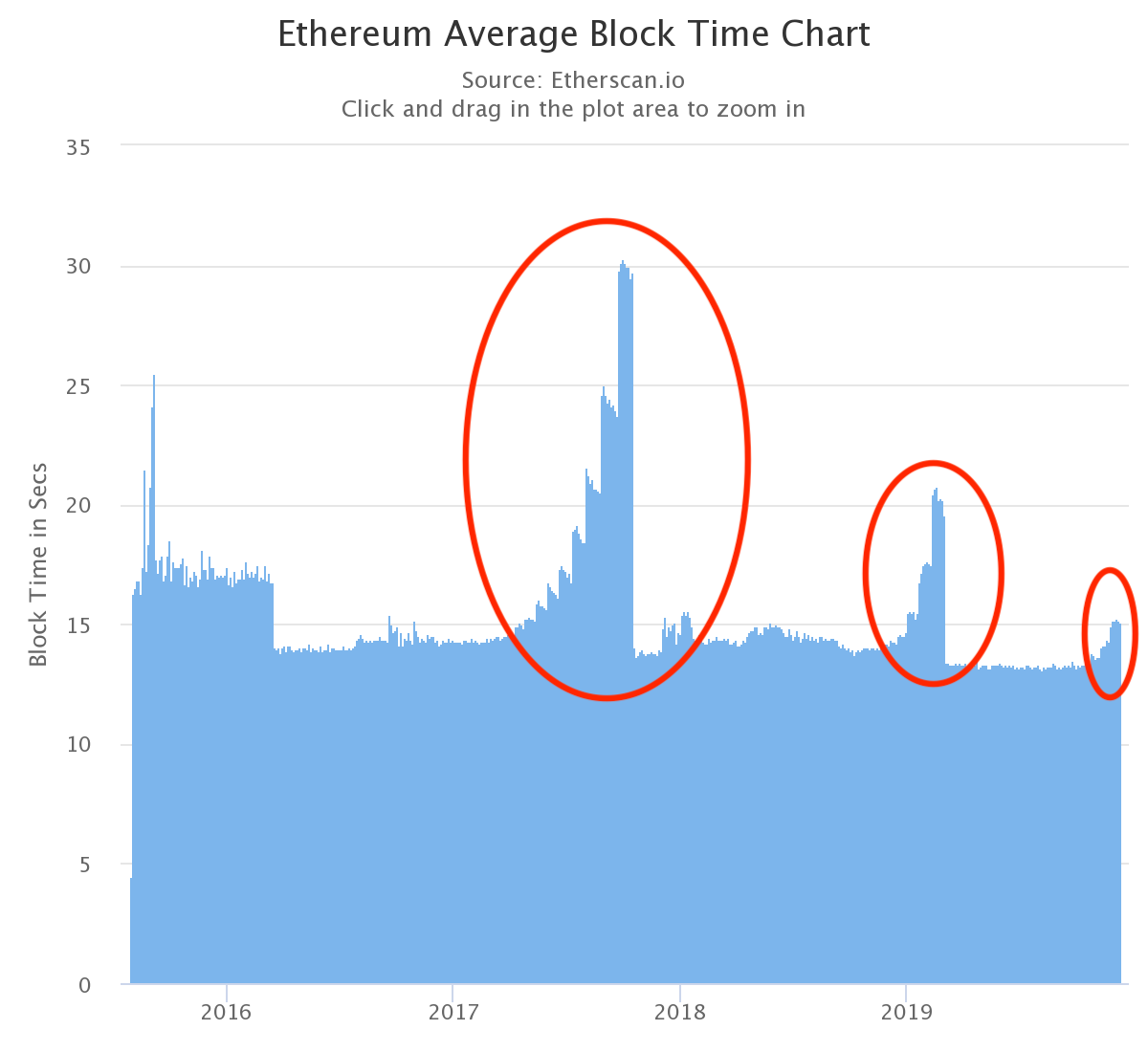

In order to ensure miners stop using the old network after the Ethereum mainnet merges with the Beacon chain, a “difficulty bomb” has been programmed into the Ethereum network. This involves a sudden, intentional increase in mining difficulty that will significantly increase the time needed to mine each block. This aims to deter miners from continuing to use PoW and creating a hardfork. A hardfork occurs when a protocol upgrade takes place and miners choose to either support the upgrade by validating the new protocol or continue to validate transactions on the ‘old’ protocol, forking the chain into two separate chains.

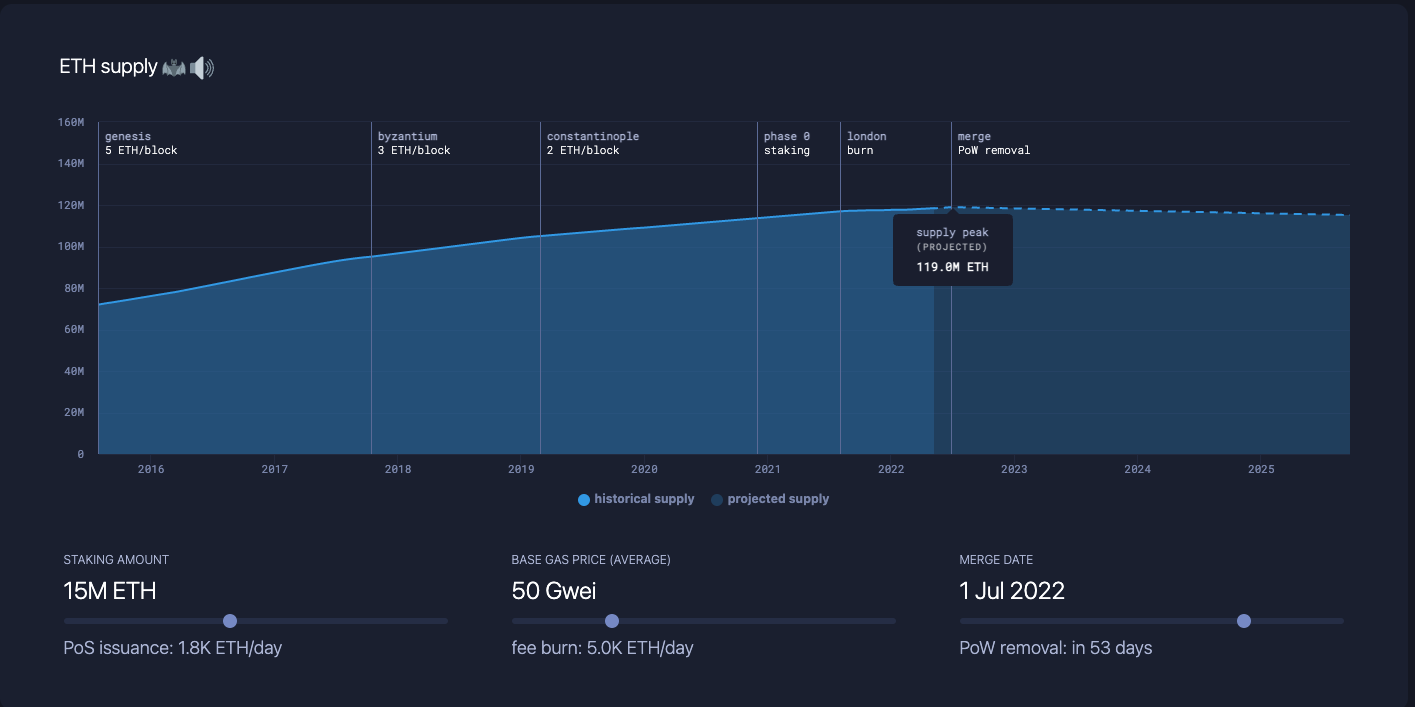

Changes in Net Issuance

The net issuance for Ether is expected to be significantly lower once the network has migrated to the Beacon chain. The issuance of new Ether will drop by 90%, and could even become deflationary. The block reward on Ethereum will decrease from 2 Eth per block (formed every 15 seconds) to a fraction of that (one cannot know the exact block reward as it depends on the amount of Ether staked). Yields for stakers are projected to be around 7-12%.

If we assume an average gas price of 50 Gwei (Ether transfers costing) Ethereum would actually become deflationary after the merge, as the Ether burnt exceeds the Ether rewarded to validators. The chart below shows that Ether will transition from an inflationary to deflationary asset, which should result in less sell pressure for this asset.

Conclusion

Ultimately, the merge is a huge step for Ethereum and will fundamentally improve the protocol. PoS is expected to reduce the environmental impact of Ethereum by 99% and it will reduce the net issuance of Ether to become a deflationary asset. While the merge itself won’t solve scaling on Ethereum, it lays the groundwork for future scaling solutions (like sharding) that will help to increase the speed of the Ethereum network while keeping fees low and maintaining maximum decentralisation.

Recommended reading: What is a Layer 1 Blockchain?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.