Bitcoin

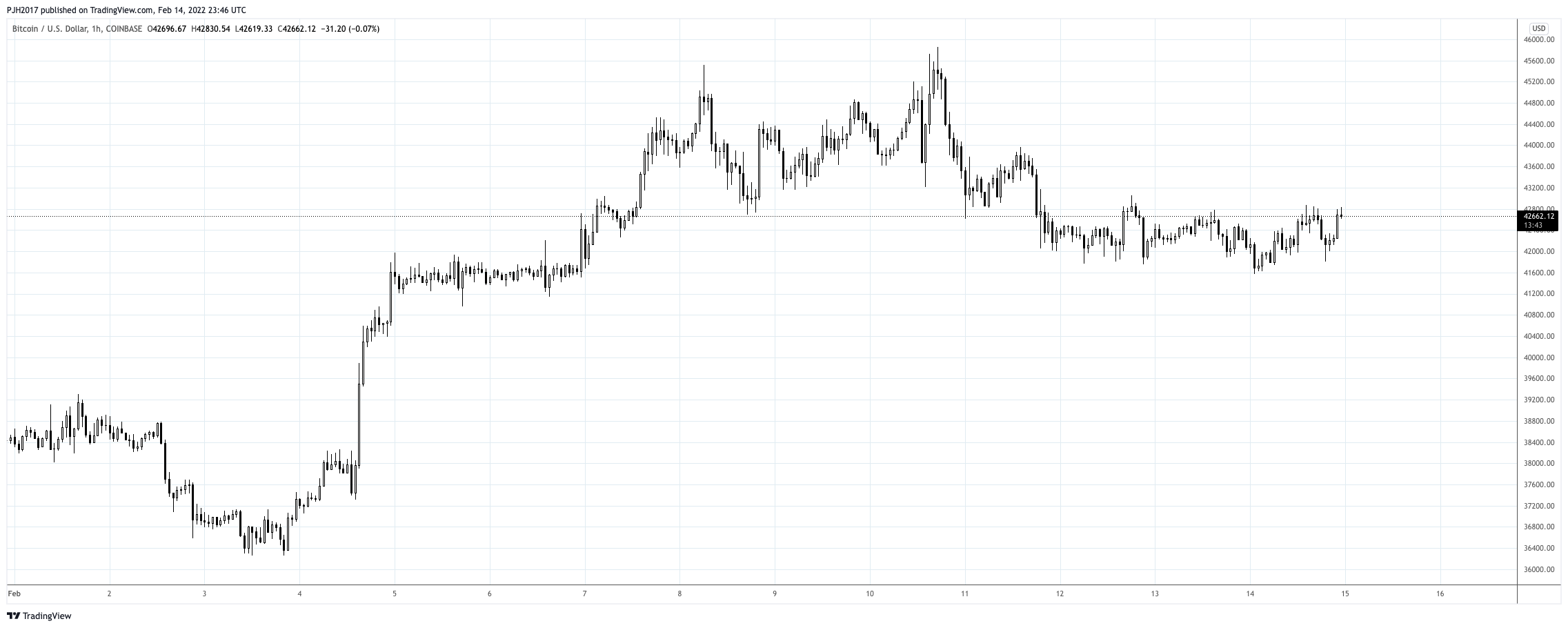

February has been a great month for cryptocurrency markets, with Bitcoin rising dramatically from last month's lows of $33,500 to beyond $45,000 on the 11th. During this rally, KPMG's Canadian arm joined the likes of MicroStrategy, Square, and Tesla in adding Bitcoin and Ethereum to their balance sheet, stating their "belief that institutional adoption of crypto assets and blockchain technology will continue to grow and become a regular part of the asset mix." Despite the SEC rejecting all Bitcoin spot ETF applications so far, KPMG has remained steadfast in their decision and plans to expand its expertise into Decentralised Finance (DeFi), Non-Fungible Tokens (NFTs), and the Metaverse.

Recommended Reading: Institutional Adoption of Cryptocurrencies: the who, what, when, where and why

In the same week, the U.S. Justice Department reported the seizure of approximately 94,000 Bitcoins from a New York-based couple. The Bitcoins were stolen from the centralised exchange Bitfinex in 2016, making it the largest breach of all time, valued at over $4 billion. While the funds are still in the hands of the U.S. government, a judgement must be made as to whether the 'victims' of the hack should have the funds returned to them. Arguments against the release of the funds centre on the grounds that the money is itself the proceeds of crime, necessitating further investigation.

Bitcoin has since corrected by roughly 9% from geopolitical pressures due to Russia's stark statement of a potential Ukraine invasion. The resulting implications of flows into safe-haven assets rippled across the market, with investors de-risking and seizing profits. Despite the downturn, Bitcoin’s volatility was surprisingly low. The ongoing flows into the space and on-chain data seem to support bullish sentiment, cushioning the downside - albeit the market is yet to be certain on the narrative.

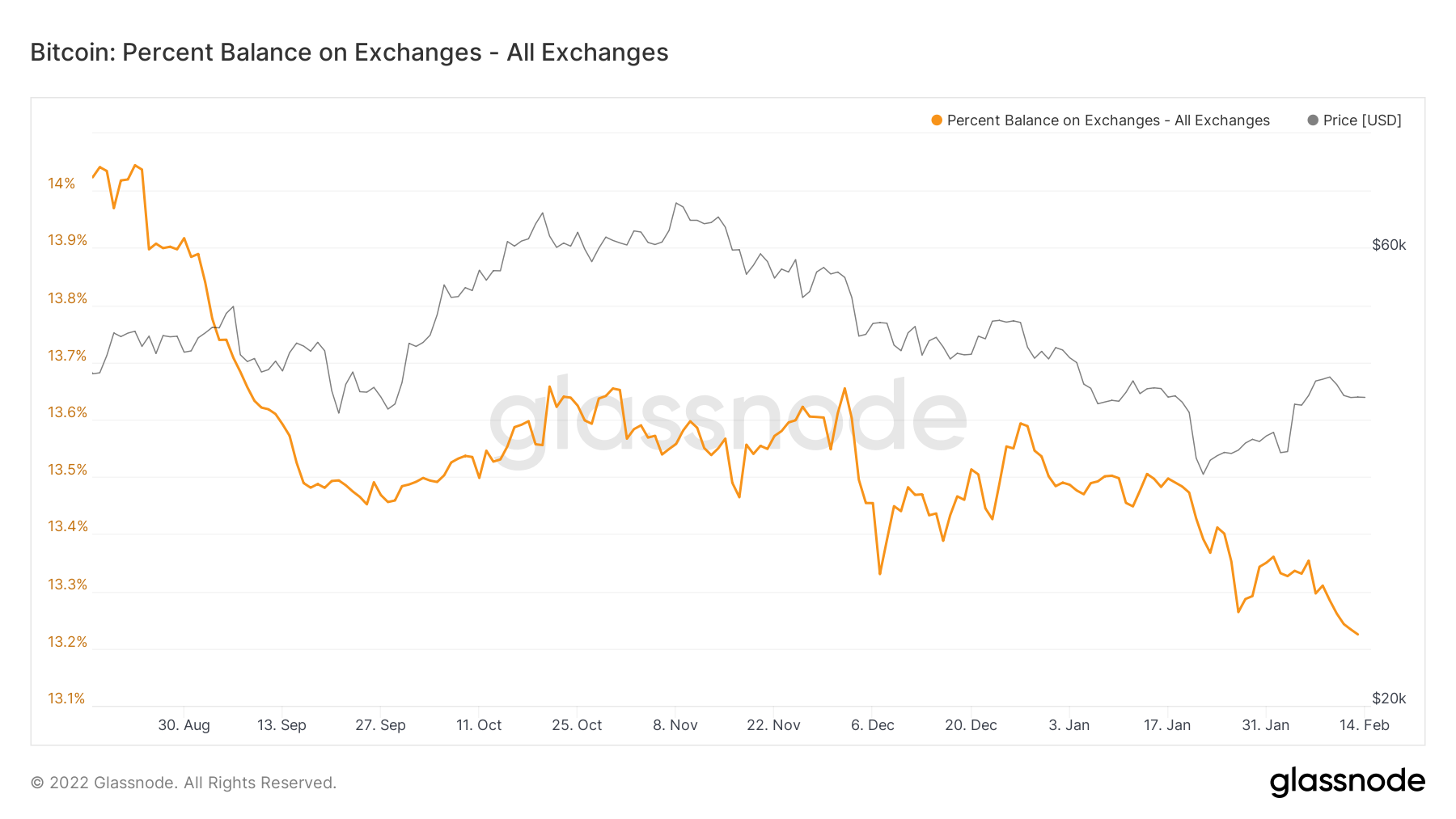

On-chain data supports a bullish long-term, with exchange reserves continually dropping and long-term holders (HODLers) beginning to liquidate into strength. Both are generally indicative of long-term momentum building. Having said that, macro and geopolitical risks will be the determining factor in the short-term.

Ethereum

Ethereum had an even stronger start to February, surging to a high of $3,255, up more than 40% from last month’s lows of $2,200. As expected, Ethereum reacted favourably to Bitcoin's gain, with investors and DeFi users driving up price and Total Value Locked (TVL) during the first 14 days of the month. On the ETH/BTC price chart, Ethereum increased by 4% against the price of Bitcoin, reaching a local high of 0.075. This has now corrected by 6% and is now trading at 0.068, down 21% from all-time highs in December.

While this suggests that Bitcoin will reclaim its dominance in the first quarter of 2022, Ethereum has stayed active due to its use in DeFi Apps (DApp and NFT markets). While DeFi was the weakest performing sector at the beginning of February, prominent Ethereum DApps such as Aave (AAVE) and Curve Finance (CRV) both returned 20 percent or more gains and kept the network active. NFTs have also remained important this month, with OpenSea setting a new monthly volume record in January and on track to reach $3 billion in volume.

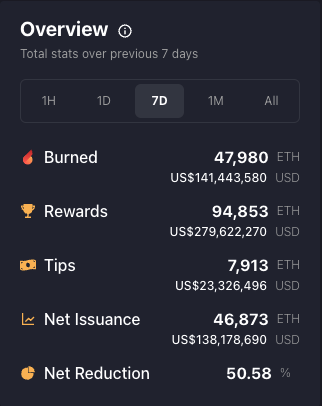

The network is handling all this volume without any congestion difficulties or gas spikes, thus demand for NFTs is beginning to establish a more organic growth trajectory. Base fees have been trending downward, with only 53,280 ETH burned in the last week, cutting net Ethereum issuance by 50.58%, down from a 90% net weekly decrease rate recorded in January. This could imply that total network traffic is decreasing, benefiting individuals who are currently transacting on Ethereum with lower fees and faster transactions.

Since the implementation of EIP-1559 in August, almost 1.8 million ETH has been burned, accounting for 64% of total issuance. OpenSea, ETH transfers, and Uniswap V2 continue to be the top three burners, accounting for about 30% of all ETH burned thus far.

Sector Analysis

Following Bitcoin and Ethereum’s sharp recovery, the majority of sectors have finished with positive returns over the 14-day period. Sectors such as Gaming, Smart Contract Platforms, Web 3, DeFi, Currencies, and Top Assets have all generated double digit positive returns in the past week.

Top Assets, one of the best performing sectors of the week, has Ripple (XRP) leading the group, finishing the period with a 35% gain. The massive outperformance can be attributed to positive sentiment extracted from the firm’s recent court case news.

In terms of Smart Contract Platform assets, Avalanche (AVAX) has showcased resilience while others have had a sideways fortnight, AVAX has continued its upwards trajectory with a 14% gain on the fortnightly while the next best performer, Ethereum (ETH) had a 10% return.

This massive outperformance was outdone by Smooth Love Potion (SLP) with the highest return for the fortnight of 190.2%. This significant move was on the back of multiple Sky Mavis announcements for future plans and upcoming features developments. Axie Infinity will be adding free in-game “starter monsters” so that new users can get a taste of the game without buying the NFTs - although they will not have the ability to earn SLP reward tokens. Note that the free monsters will not be NFTs that can be sold or transferred. This will be rolled out with a new battle system too. On top of this, Sky Mavis plans to overhaul the token rewards model, in hopes of halting SLP inflation.

NFTs

It has also been a very eventful few weeks on the NFT front. Last week, a Buzzfeed investigation revealed and unmasked two of the four anonymous creators of the massively successful and loved NFT collection, Bored Ape Yacht Club (BAYC). Soon after, the remaining two members stepped out and doxxed themselves voluntarily. Was it ethical for Buzzfeed to uncover the creators' identities? Many crypto natives lashed out at Buzzfeed, saying that they were “doxxing people for clicks and ad revenue.”

In other news, over the most recent weekend, a CryptoPunks NFT sold for 8,000 ETH, or about $23.7 million worth at the time of sale. The Punk was purchased by Deepak Thapliyal, CEO of cloud blockchain infrastructure firm Chain. This is amongst his many popular purchases, such as his golden BAYC for 420.69 ETH or when he swept the BAYC floor with 640 ETH or the Mega Mutant Serum #69 for 1542.069 Ethereum — which is roughly $5.7 million.

Regulatory Updates

As for key regulatory updates, President Biden's office announced late in January that the administration plans on issuing an executive order relating to digital assets. The executive order is anticipated to be focused on national security, potentially indicating the administration's focus on approaching digital assets from a perspective of AML/CTF regulation. The executive order is expected to assign different government and administrative agencies to study digital assets, focusing on stablecoins and NFTs. Aside from the fact that digital assets are being approached from a national security perspective, these developments have not boded well amongst crypto natives. The reason is that many anticipate that any Biden crypto regulation could hand the reigns to the traditional finance sector—namely, banks, who have been actively lobbying the federal government into 2022.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)