Introduction

The cryptocurrency ecosystem has faced a large increase in volatility over the last few weeks. Many Altcoin holders saw their coins achieve new all-time highs, only to fall 40%, 50% or even 70% from these levels a week later. Now is a perfect time more than ever to discuss how important it is to manage one’s risk as an investor. Whether you are a seasoned cryptocurrency fanatic or just starting your cryptocurrency journey, instilling these strategies into how you manage your portfolio are better learned now, as large swings in the market can put your portfolio goals at risk.

Managing Losses in your Portfolio

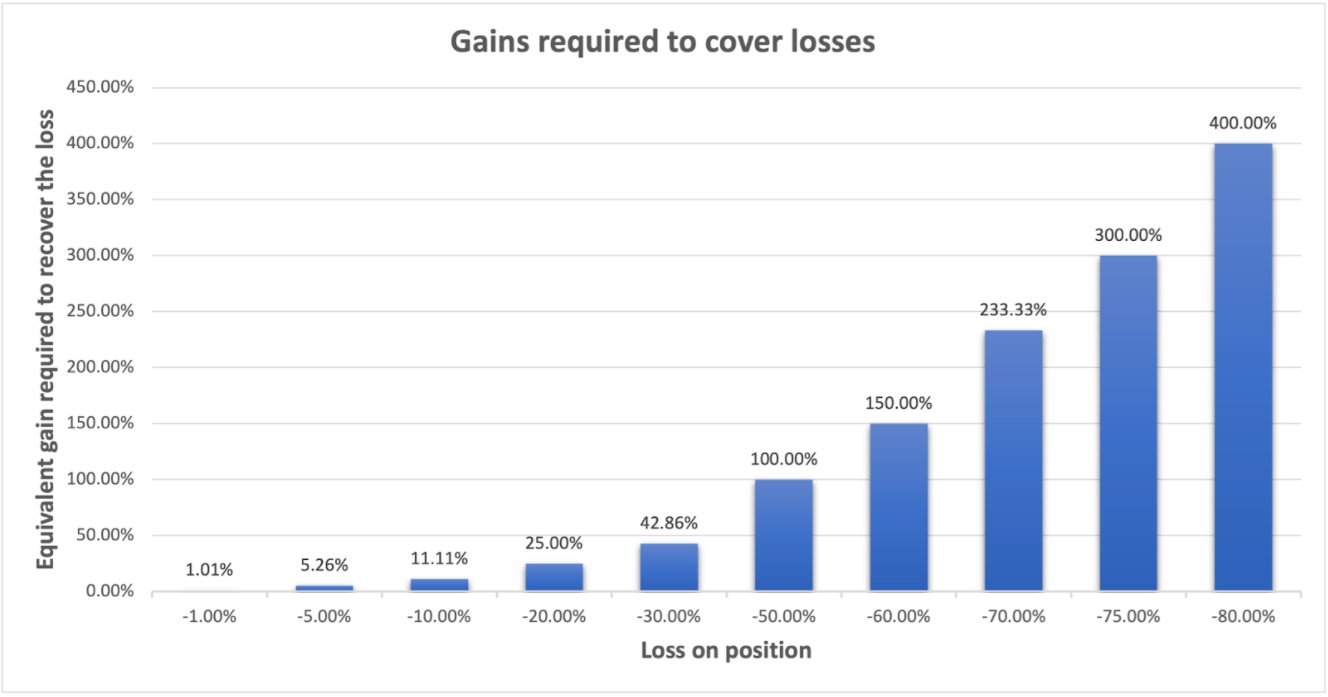

Swings in the market can happen almost instantly, and oftentimes the price can fall violently over the space of just a few minutes, causing some of your positions (especially newly entered ones) to be sitting at a loss. It is important to have an exit plan in mind in such situations, as further losses will mean that the asset price will need to rise even more significantly to recover your original position.

This point is very important to remember, as the graph below illustrates. For instance, a 20% loss requires a 25% gain to recover the original position, which is indeed achievable. However, in instances where the price falls similar to the movements seen recently, a drop of 50% requires a 100% gain to recover the original position, which is a devastating outcome for any investor. As such, it is worth having a defined holding period in mind, so that you can structure out a target price that you are comfortable to take profits when the time comes.

Portfolio management

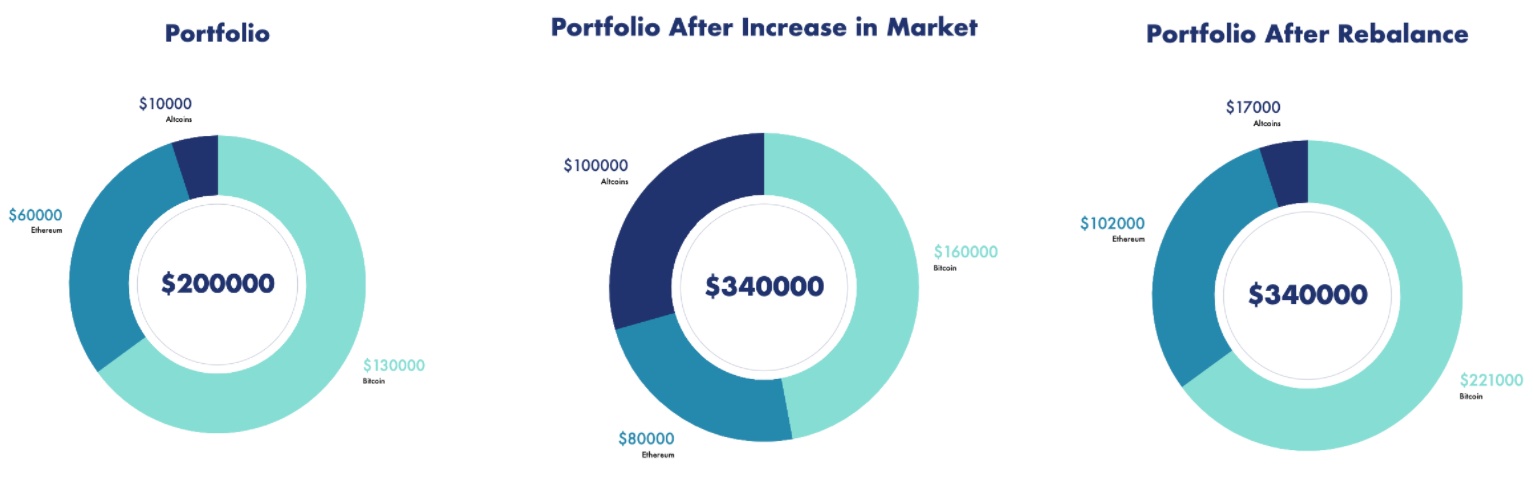

Portfolio weights are a great way to track how your portfolio is performing and rebalancing after a specific amount of time accordingly (this could be monthly, quarterly, or whatever suits you the best). The idea is to have a set allocation to specific assets contained within your portfolio, and as price movements happen in the market, you are able to rebalance and capitalise on gains while still maintaining the overall goal of your portfolio. An example of this is illustrated below.

In this example, Altcoins have increased significantly more than Bitcoin and Ethereum, making it now nearly 30% of the entire portfolio when the previous set allocation was only 5%. This would be a perfect time to rebalance back into Ethereum and Bitcoin, taking the extra gains earnt from Altcoins that are much riskier to hold long-term, and placing them back into Bitcoin and Ethereum, restoring the original portfolio weights. This allows you to capture gains made without selling them for fiat currency, but also gives you the flexibility to reconsider your portfolio weights and make adjustments according to your risk preferences (this could mean a 10% Altcoin allocation instead of the original 5%)

Dollar-cost averaging (DCA)

Dollar-cost averaging (DCA) is a simple investment strategy that aims to reduce the impact of short-term market volatility on an investment. It involves buying equal amounts of an asset at regular intervals (e.g. weekly, fortnightly, monthly).

The theory is that by entering the market incrementally, the investment may not be as subject to volatility as if it were a lump sum. Buying at regular intervals can smooth out the average price of acquisition, reducing the negative impact that a bad entry may have over your investment. In the long term, DCA will be able to save you the effort of trying to time the market as the famous saying goes, “The reality is, it's time in the market, not timing the market.”

Similarly, this can be applied to an exit plan, that is, a trading strategy for getting out of the position. After determining a target price, you would divide your investment into equal chunks and begin selling them once the market is closing on the target. This strategy would help mitigate the risk of not getting out at the right time.

Exit Strategies

Having an exit strategy is one of the key factors that distinguishes profitable cryptocurrency investments from unprofitable ones. A take-profit strategy must be approached in a highly objective manner, free of emotional bias. For example, the habit of waiting for more gains after hitting your profit targets can be a costly one. It’s important not to be overly attached to your assets, as no matter how large one’s profits are, they will not be realised until a sale or rebalancing is made. Below you will find examples of the most commonly used exit strategies.

Strategy 1: Exit entire position simultaneously

This strategy is for investors who are cashing out their entire holdings and are exiting from the market as a whole, either temporarily or indefinitely. If you are exiting from a small position, it makes no sense to break a small trade into even smaller parts, so it is more effective to look for the most opportune time to sell the entire stake. However, larger positions benefit from Strategy 2, a scaled exit strategy.

Strategy 2: Step-ladder exit strategy

This method allows you to take profits of a predetermined percentage of your holdings at certain price points. This strategy can prevent becoming too greedy, or selling too late, while still cashing in your profits from time to time. Many investors will keep 5-10% of their holdings for a longer period of time, just in case of a larger up-cycle or because they firmly believe in the longevity of the project. Nonetheless, it is always smart to take profits at a predetermined price range.

Strategy 3: Initial investment return

Another option is to take profits similar to the initial invested amount. For example, if you have invested 1000 dollars into X, taking profits equal to that amount after a huge up-cycle could be a great way to liquidate the risk of selling too late. This strategy makes sure that no matter what happens, you can never lose more money than what you initially invested. This is considered breaking even on your initial investment.

Conclusion

Many investors design strong and complicated exit strategies, but don’t follow through when the time comes to take action, allowing emotions to take over which can leave devastating results. When making your plan of attack, start by calculating reward and risk ranges, then use those levels as a blueprint during times of uncertainty, whether you're profiting or taking a loss.

In any bull market or price rally, it can often seem as if the sky's the limit, especially in such a rapidly moving market as cryptocurrency. It is, however, always important to remember that what goes up can also go down. Having backup strategies in place for a rainy day can help one realise profits when profits are due, and reduce the risk of losing out on months, or even years, of accumulated positions on your holdings. As such, take the time to consider when profits ought to be taken for your hard-earned assets, and how you can minimise your losses for when uncertainty hits.