Bitcoin

Bitcoin has followed February’s price action as it continued to trade within the price channel of $37,000 and $45,000, slowly tightening its range as investors speculate on rising geopolitical tension and regulatory actions. Following last month’s dip in price due to Russia’s invasion of Ukraine, Bitcoin began March on a high note, gaining about 20% before reverting back to its pre-rally price of $39,000.

Following Joe Biden's Executive Order on 'Ensuring Responsible Development of Digital Assets' on March 9th, Bitcoin enjoyed its first price surge of March, closing the day up 8.29%. The US Treasury was given permission to begin researching cryptocurrencies under this directive, allowing for "American leadership in the digital space race." Investors reacted quickly to the news, sending Bitcoin's price up over 7% in less than an hour, before settling back at $39,000 the next day.

On Wednesday March 16th, the U.S. Federal Reserve announced they will be lifting the fed-funds rate by 25 basis points from 0.25% to 0.5%. This is the first time since December 2018 that benchmark interest rates have been raised. The market responded well to the news having expected a 0.5% rate hike , with Bitcoin surging for the second time this month, by 6% in just 15 minutes. However, immediately after the Fed announcement, BTC corrected by 4%. Similar price movements were seen in the S&P500 and across crypto markets. For the third week in a row, markets have continued to see reversals. A trend like this hints at the possibility that we are currently in a consolidation phase.

Both of these price pumps had very comparable on-chain characteristics prior to the price rise. The characteristics include a small sell-off due to a shift to negative funding and increased open interest. Typically, this puts sell pressure on an asset. Instead, a liquidation of shorts (PERP activity) occurred, causing the price to squeeze upwards. As funding rates began to shift positively, long positions (SPOT activity) joined the party. Over the next 24 hours, spot activity decreased as PERP activity increased. While this may not immediately suggest price movement, a solid and long-lasting rise usually necessitates leading and increased SPOT activity. With PERP activity fuelling the current rally and diverging from SPOT activity, how Bitcoin’s price responds in the coming days should be noted.

Ethereum

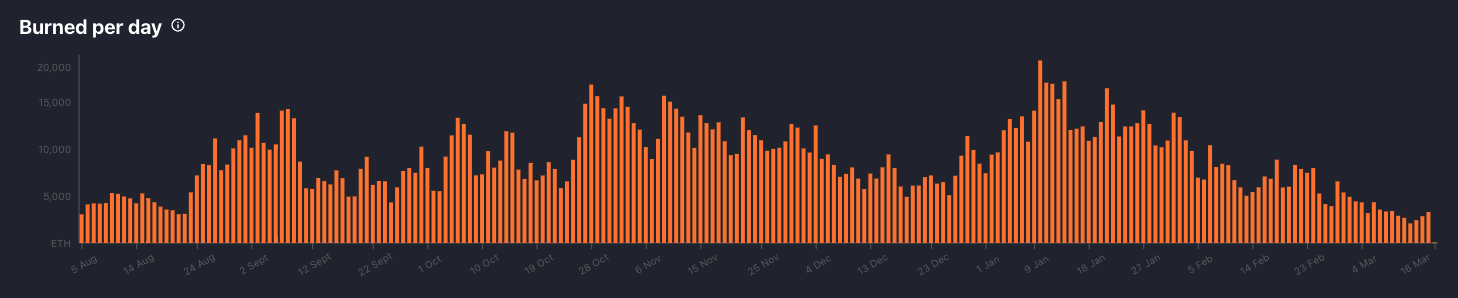

Ethereum has followed Bitcoin's lead this month, falling 10% since the beginning of March. Overall network activity has remained modest (in comparison to late last year), as evidenced by lower base gas fees and burned ether. Just over 150,000 ETH have been burned in the last month, countering net issuance by 37%, down from almost 70% from earlier this year. This means there is less network activity, which correlates with the total value locked (TVL) in DeFi protocols and the volume of OpenSea. OpenSea, on the other hand, is still on top of the burn leaderboard, having burned about 18,000 ETH in the last 30 days.

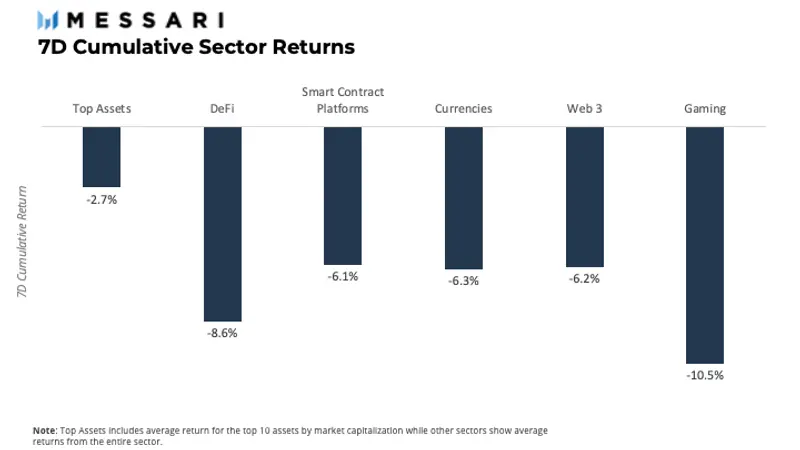

Altcoins

During the first half of March, altcoins underperformed Bitcoin. Altcoins have a tendency to accentuate Bitcoin's swings, and this has been the case in recent weeks. Bitcoin is down roughly 6%, and many major altcoins are down between 8% and 18%.

Terra (LUNA) has managed to stay out of this slump, rising 10% in the last two weeks. To provide more context, both the LUNA token and the decentralised stablecoin TerraUSD (UST) are part of the Terra ecosystem. Because UST is linked to LUNA, anyone who mints UST must also burn LUNA. If the price of UST drops below $1, a user can buy it at a discount and exchange it for $1 of LUNA. This arbitrage aids in keeping the UST pegged at $1. Despite this, algorithmic stablecoins are still criticised since they are vulnerable to market volatility. To combat this, UST recently established a UST forex reserve to aid in the maintenance of the peg. To help stabilise the network during significant sell-offs, the reserve is $1 billion in Bitcoin.

Furthermore, the Terra ecosystem's total value locked (TVL) has continued to rise. Anchor Protocol, Terra’s decentralised lending platform has maintained its position as the protocol with the highest stablecoin yields in DeFi, at roughly 20%. Terra's TVL has increased by almost $2 billion in the previous two weeks as a result of this. Because of these positive fundamental trends, LUNA has been trending higher while the rest of the market has been falling.

Total Value Locked (TVL) on Anchor Protocol

Fantom (FTM), on the other hand, was an outlier on the downside. FTM has plummeted by 38% since the beginning of March, significantly underperforming the market. This is partly owing to well-known developer Andrew Cronje's abrupt departure from DeFi. Cronje was a key figure in FTM and his resignation represents a significant setback for the layer one protocol.

Other altcoins such as Thorchain (RUNE) have also exhibited considerable strength in the recent week, rising by roughly 76%. Waves (WAVES), Basic Attention Token (BAT), and Stacks (STX) have all had gains of 15-20%.

NFTs

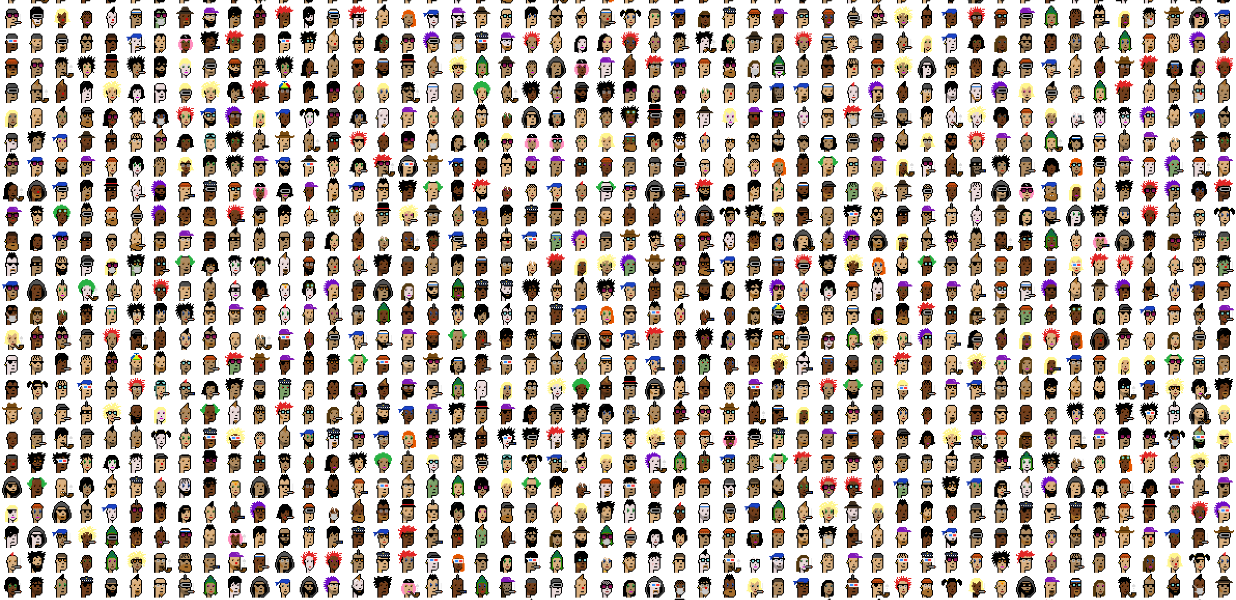

On the NFT front, Yuga Labs, the company behind Bored Ape Yacht Club, announced that they have acquired the rights to CryptoPunks and Meebits, two of the most valuable NFT collections. The market responded positively to this announcement, with the floor prices (cheapest price an item from the collection can be purchased for) of both collections appreciating after the announcement. Bored Apes increased from a 72 ETH floor to 92.5 ETH. The positive sentiment from the news can also be attributed to the first planned actionable for Yuga Labs, which is to grant full commercial license to CryptoPunks and Meebits holders.

Regulatory

Jumping back to President Biden’s Executive Order regarding crypto regulation, which can be referenced using this Fact Sheet. The Executive Order is described as addressing the implications of a crypto market on “consumer protection, financial stability, national security, and climate risk.”

While promising, this Executive Order is only a very early and preliminary step in the overall regulatory project in the U.S. While the Biden Administration is able to direct government departments and agencies to engage in the research outlined in the Fact Sheet, the Administration has not signalled that a particularly heavy-handed approach is required. Rather, the overall sentiment is that any research and resulting policy development must prioritise consumer protection alongside a competing interest of financial and technological innovation.

Further reading: Crypto Security Part 1: Best Practices

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)