In this Week's Market Rollup

They say there’s never a dull moment in crypto, and the past seven days has been no exception. Just as the cold of crypto winter looked to be potentially thawing, the industry bore witness to one of the most dramatic collapses in its history. The sudden fall of FTX, one of the world’s largest crypto exchanges, sent shockwaves across the market with prices spiralling down across the board over the past week. Both Bitcoin (BTC) and Ethereum (ETH) lost over 20% of their value, while most other assets were hit even harder.

Market Highlights

- FTX, a major centralised exchange, declares Chapter 11 bankruptcy, triggering a wave of broader market sell-offs. The FTX Token (FTT) is down nearly 95% over the last seven days.

- Caught in the mess, BTC tumbled below US$16,000 for the first time since November 2020.

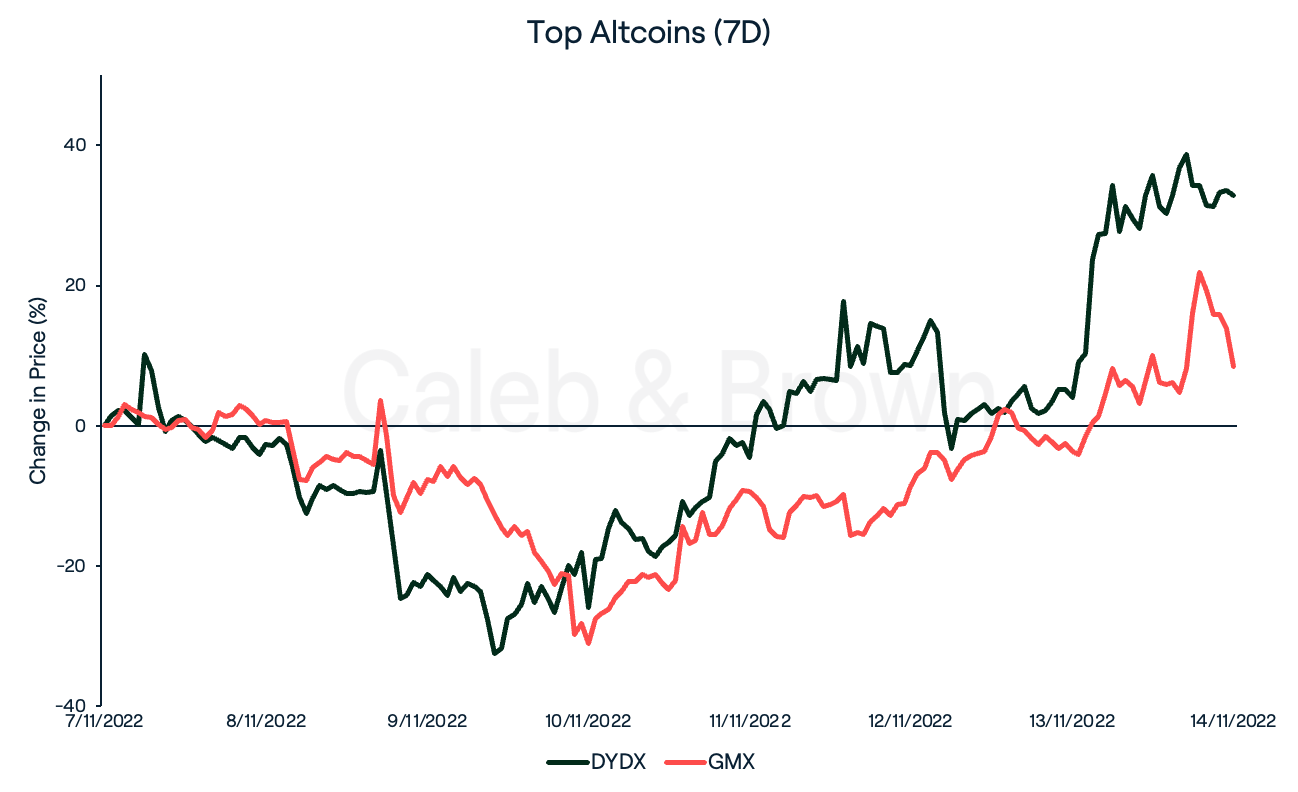

- In the wake of failing centralised platforms, two decentralised perpetual exchanges have absorbed relative volume and market share. dYdX (DYDX) and GMX (GMX) in particular benefited from the recent events, gaining 23.7% and 8.3%, respectively.

What the FTX? The Meltdown Explained

It has been an volatile week to say the least. In less than seven days, FTX has gone from being one of the largest and most reputable brands in the crypto industry to filing for bankruptcy. But how did this unfold?

On November 7, Binance CEO Changpeng “CZ” Zhao declared he would move to liquidate his exchange’s entire FTT holdings (FTT is FTX’s native token) following revelations that FTX’s CEO, Sam “SBF” Bankman-Fried, was allegedly lobbying “against other industry players behind their backs.”

CZ’s tweet caused a bank run as FTX customers began withdrawing funds from the exchange en masse. In less than 72 hours, over $6 billion was withdrawn from the exchange. While SBF claimed all “assets were fine” in a now-deleted tweet, FTX was forced to suspend withdrawals, causing further panic amongst investors.

Insolvent and unable to process withdrawals, CZ announced on Tuesday, November 9, that Binance was looking to bail out FTX in a tentative agreement to acquire the company. However, the following day, CZ announced that “FTX was beyond our ability to help.” In a tweet, Binance attributed its U-turn to the “latest news reports regarding mishandled customer funds and alleged US agency investigations.”

The crisis concluded on November 12 with the news that FTX had filed for Chapter 11 bankruptcy alongside approximately 130 additional affiliated companies. The press release also brought news of SBF’s resignation as CEO and the appointment of veteran bankruptcy lawyer John J. Ray as the new CEO of FTX.

Price Movements

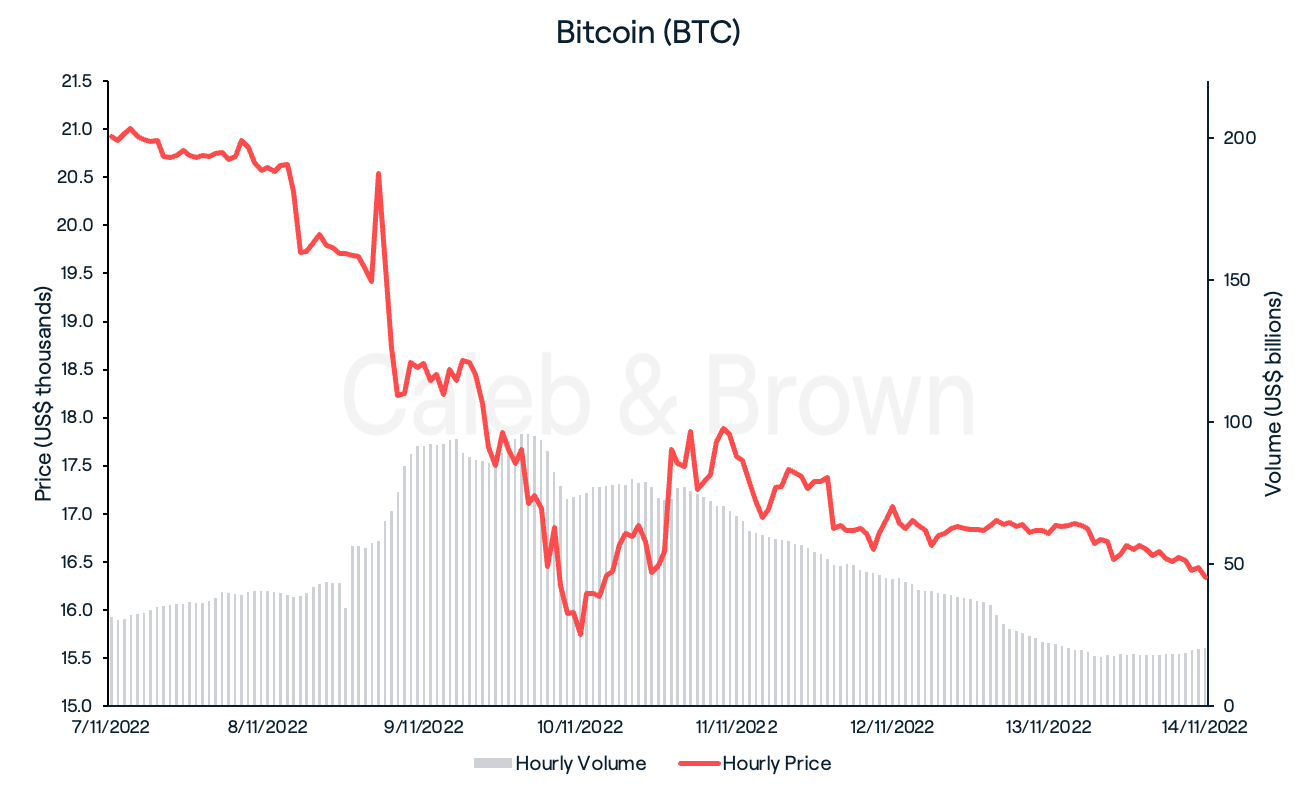

Bitcoin (BTC)

The unexpected collapse of FTX has had a dramatic impact on the world’s largest cryptocurrency over the last seven days, sending the price of BTC crashing. As news of the FTX fiasco unravelled, many investors rushed to sell or withdraw their funds from exchanges. This sell-off saw the price of BTC decline to as low as US$15,558 on November 10, marking a two-year low. While the November consumer price index (CPI) report provided a brief relief rally of 10% on November 11, the impact of the FTX fall-out proved too much, with BTC closing the week at $US16,302, down an eye-watering 21.9%.

The latest report from the Bureau of Labor Statistics revealed that the CPI had risen 0.4% for the month and 7.7% over the last 12 months, both lower than the estimated rates of 0.5% and 7.9%, respectively. While this sits well above the Federal Reserve’s 2.0% to 3.0% annual inflation target, investors responded positively to the news as BTC and the rest of the market rallied over the next 24 hours, allowing for a small but short-lived sense of relief in what had been a bloodbath of a week.

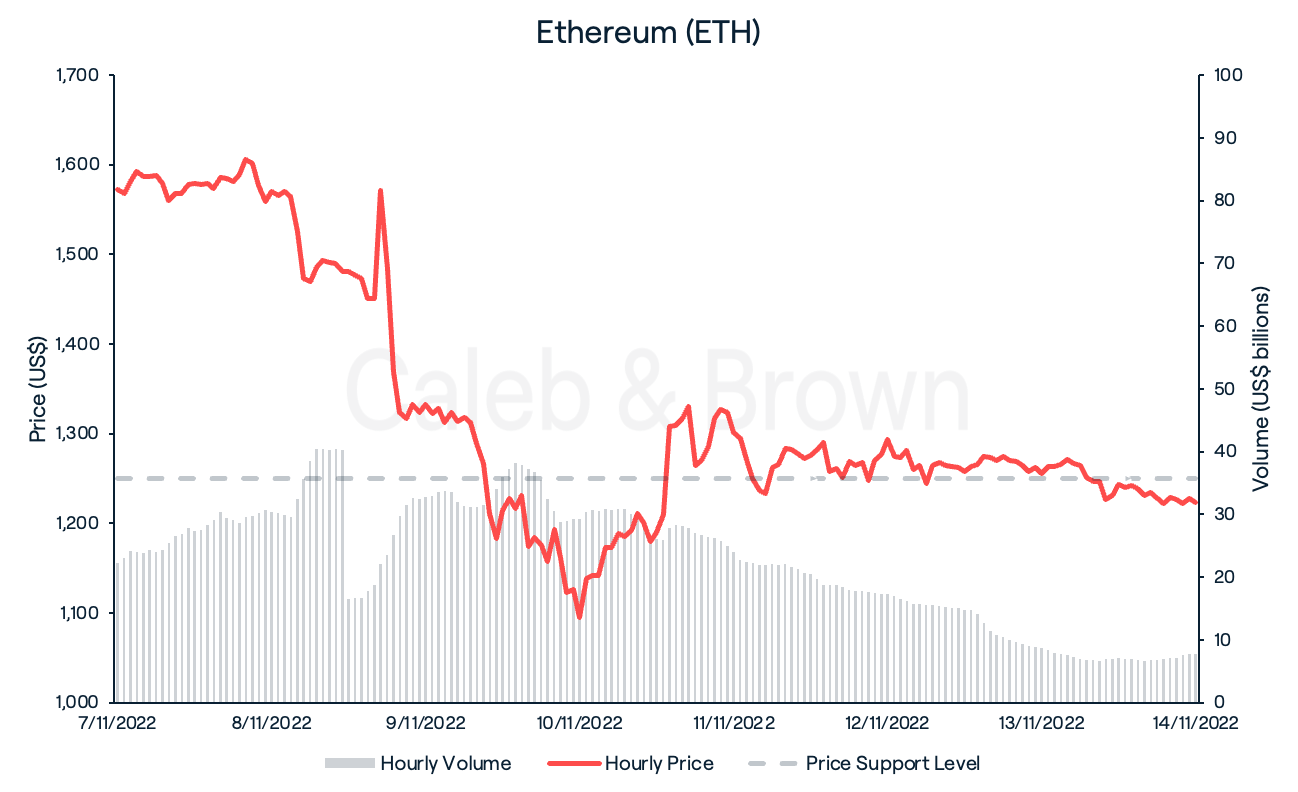

Ethereum (ETH)

The price of ETH fared no better than BTC as investors reacted aggressively to the events surrounding FTX. Ethereum’s price crashed in sync with BTC over the course of the week, reaching a local bottom on November 10, marking a four-month low of US$1,073. Positive CPI news again provided some relief to the market on November 11, with ETH rebounding 14.3% to trade as high as US$1,350. However, the price steadily declined into the weekend, with ETH closing the week down 24.1%.

Altcoins

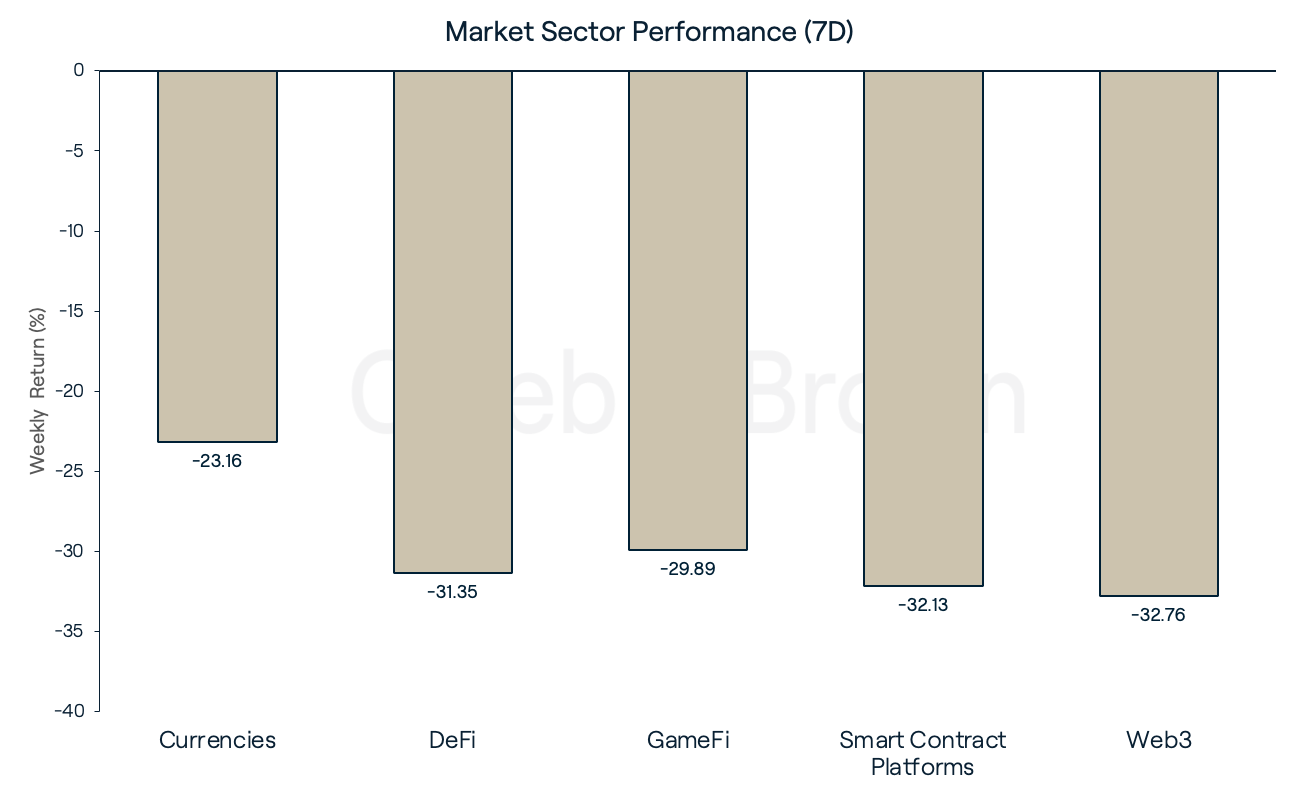

With both BTC and ETH tumbling this week, it is no surprise that market sectors have diminished across the board. Web3 was the hardest hit sector, losing 32.76%, followed by Smart Contract Platforms, DeFi, and GameFi, which lost 32.13%, 31.35%, and 29.89% respectively. Currencies saw the smallest decline but still fell by 23.16% week-on-week.

Most of the worst-hit assets this week were either directly or indirectly linked to FTX. FTX’s native token, FTT, has been hit the hardest, losing nearly 95.0% of its value over the last seven days. The most significant loss in the top fifty cryptocurrencies was felt by Solana (SOL) holders, who saw their holdings fall by 47.0%. Sam Bankman-Fried (SBF), the ex-CEO of FTX, was one of Solana's first investors. SOL was the second largest holding of SBF’s now-collapsed hedge fund, Alameda Research.

However, some have benefited from this week’s mayhem. In the wake of the chaos, decentralised exchanges have captured some of the volume of their centralised counterparts. Traders appear to have rotated their capital in anticipation of a narrative push around decentralisation, with dYdX (DYDX) and GMX (GMX) rallying 23.7% and 8.3%, respectively.

Recommended reading: Caleb & Brown's Approach to Risk Management and Client Protection

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)