In this Week's Market Rollup

Both Bitcoin (BTC) and Ethereum (ETH) traded lower over the past seven days following higher-than-expected U.S. Consumer Price Index (CPI) inflation data, with core inflation reaching a 40-year high. This negative price action carried across the market, with most leading assets and sectors shedding value, reversing last week’s gains. News of two major institutional players moving into crypto did little to move prices, as negative sentiment prevailed.

Market Highlights

- BTC and ETH finished lower after a period of high volatility immediately following the latest U.S. CPI inflation figures.

- The Bitcoin network continues to grow from strength-to-strength, with mining difficulty hitting a new all-time high on October 10.

- Ethereum (ETH) supply turned deflationary for the first time since The Merge, with over 4000 ETH tokens burned.

Price Movements

Bitcoin (BTC)

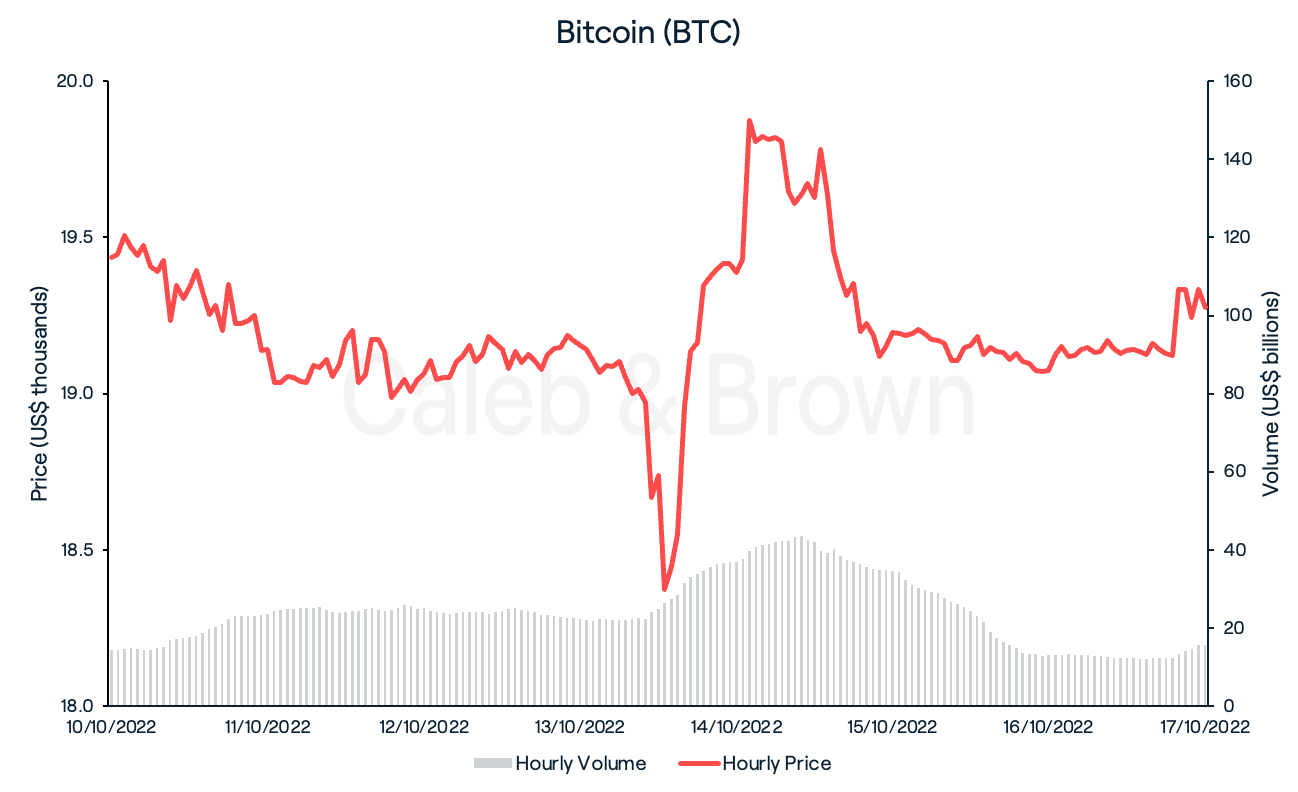

BTC witnessed volatile price action over the past seven days following higher-than-forecasted inflation figures in the U.S. The price of BTC started the week in a gradual negative downtrend, before whipsawing dramatically mid-week leading up to the release of the U.S. Bureau of Labor of Statistics’ CPI data on October 14.

This report revealed that U.S. consumer prices have increased 8.2% year-on-year. Meanwhile, core inflation came in at 6.6% year-on-year — the biggest increase since 1982. This data may suggest the Federal Reserve will not curb its interest rate hikes anytime soon, with the market now pricing in further increases at their next meeting in November. BTC subsequently closed the week at US$19,293, down 1.35%.

In other news, Bitcoin’s mining difficulty hit a new all-time high after spiking 14% on October 10. This marks the second largest adjustment in mining difficulty since May this year, when mining difficulty increased 22%. While increases in mining difficulty indicate a strong and growing network, they could potentially signal slimmer profit margins for miners if Bitcoin’s price remains unchanged, as more computational power is needed to mine BTC. The challenging market conditions faced by miners is highlighted by the 53% fall in mining revenue since the start of the year.

Ethereum (ETH)

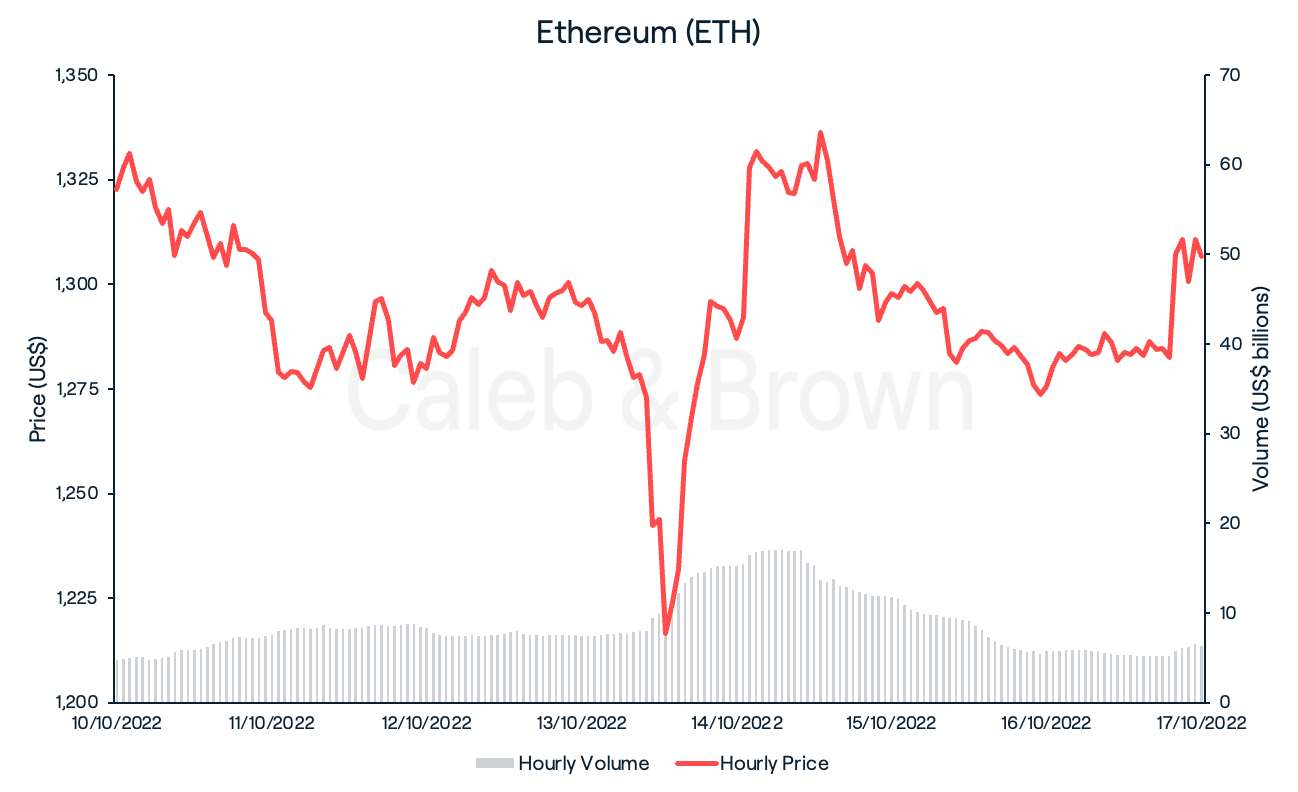

Ethereum’s (ETH) price mirrored that of BTC over the past seven days, with almost identical price volatility mid-week, before consolidating over the weekend. ETH closed the week at US$1,310, shedding 1.93% in value.

Ethereum’s supply turned deflationary over the past week for the first time since The Merge, meaning that more ETH was burned (and removed from circulation) than created. ETH supply issuance hit a yearly rate of -0.16% over the last seven days, equating to over 4,000 ETH (approx. US$5.2 million) tokens being burned.

Altcoins

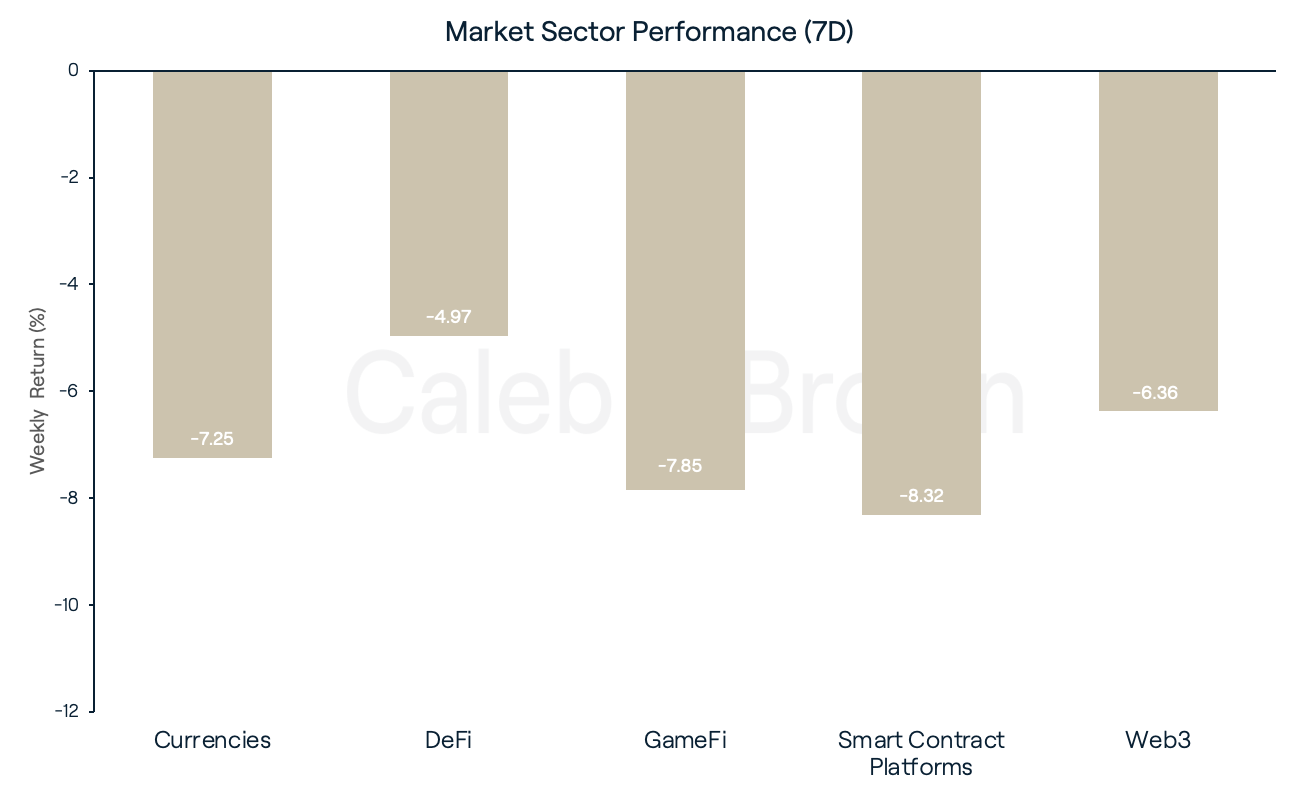

The broader crypto market fell alongside the two major assets this week, with each market sector shedding nearly 5% or more in value over the last seven days. Indeed, almost all of last week’s gains have been negated. The DeFi sector suffered the least this week, losing 4.97% in value while Web3, Currencies, and GameFi fell 6.36%, 7.25%, and 7.85% respectively. Smart Contract Platforms was the hardest hit sector this week, decreasing 8.32% in value.

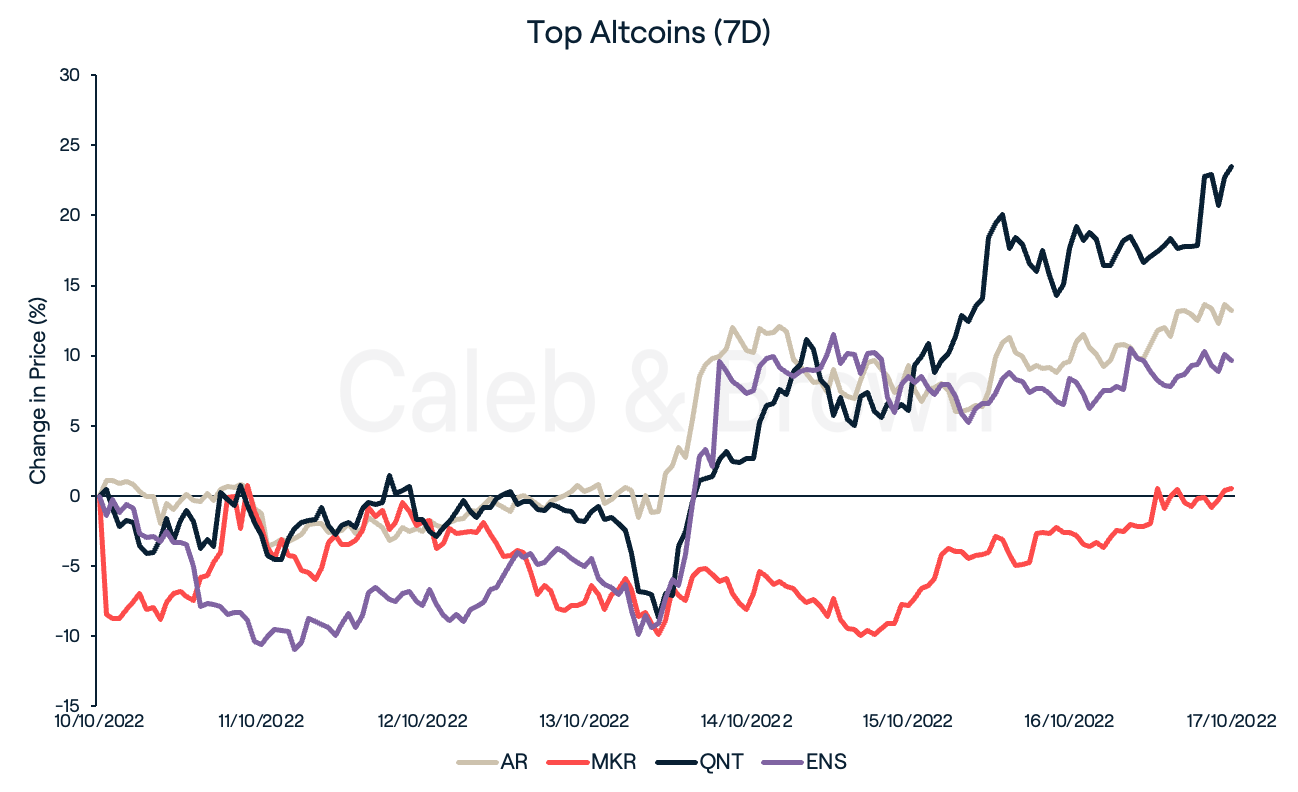

Despite bearish performance across market sectors this week, a few individuals assets were able to break the trend. Coming out on top of the DeFi sector for the third consecutive week was Maker (MKR). MKR continues to top the DeFi leaderboard with US$7.76 billion total value locked (TVL) in the protocol. MKR scraped by with a 0.7% gain this week while the rest of the sector fell. Arweave (AR) and Ethereum Name Service (ENS) also posted gains this week, increasing by 12.7% and 8.3%, respectively.

Meanwhile, Quant (QNT) has continued its move from last week, rallying a further 24%, making it the best performing asset this week, and is up 78% over the last 30 days. Quant is seen as the gateway to interoperability between blockchains and currently has ties to a network of over 570 banks. Given its connections and ability to join the world’s private and public blockchains together, Quant is uniquely positioned to be utilised in the design of central bank digital currencies (CBDC). As such, investors continue to speculate on a Quant-backed CBDC, pushing the price to a 10-month high this week.

Web3 News

At the midway point of the month, October has already seen the highest volume of crypto hacks for the year, according to Chainalysis. Over US$718 million in assets have been stolen from DeFi protocols in 11 different incidents.

The latest hack occurred on October 12, when Solana-based DeFi trading platform, Mango Markets, was fleeced of US$100 million. In an interesting turn of events, the hacker submitted a proposal to the Mango Markets DAO to return the funds for a bug-bounty fee and in exchange for receiving no criminal prosecution. Following tense negotiations, both parties were able to come to an agreement to return US$67 million back to the treasury, allowing for bad debt to be cleared and depositors of the protocol to be repaid. Additionally, the hacker was allowed to keep a US$47 million bug-bounty fee for themselves and avoid further legal investigation.

Two major institutional players announced they were entering the crypto market this week. Google’s cloud division publicised plans to use Coinbase to accept crypto payments for cloud services from early 2023. In addition, investment banking titan BNY Mellon, one of the oldest U.S. banks, launched a custody service for BTC and ETH on behalf of select investment firms. The bank developed the software alongside crypto custody provider, Fireblocks.

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)