In this Week's Market Rollup

It’s been a rather stable week across the crypto market, with both Bitcoin (BTC) and Ethereum (ETH) range-bound. The largest cryptocurrencies by market value remain glued to the $19,000 and $1,300 price levels, respectively. Amongst the crypto market sectors, DeFi has stole the show, with many leading assets securing double-digit gains.

Market Highlights

- BTC has shown signs that it may be decoupling from the stock market, with data indicating it has been less volatile than both the Nasdaq and S&P500 for the first time in two years.

- The Ethereum foundation has launched a new testnet for the next planned upgrade, Shanghai. This marks the first major update since The Merge.

- Aptos (APT), a recently launched Smart Contract Platform, felt the heat during launch, plummeting by more than 40% on its first day of trading.

Price Movements

Bitcoin (BTC)

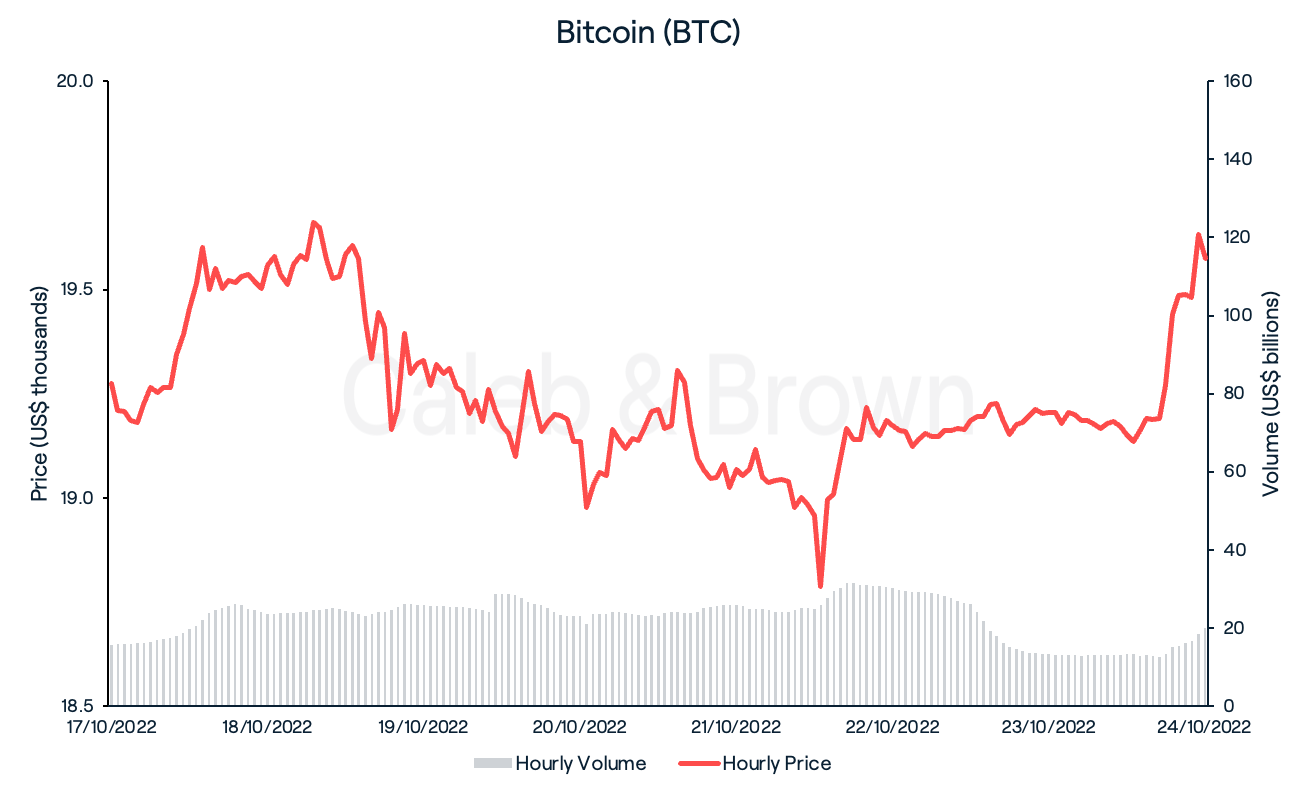

The BTC price remained range-bound, making small moves between US$18,500 and US$20,500, the range in which it has bounced since late June. It touched a mid-week low of US$18,650 before recovering to US$19,100, where it spent most of the week, prior to closing higher at US$19,550, up 1.90% week-on-week.

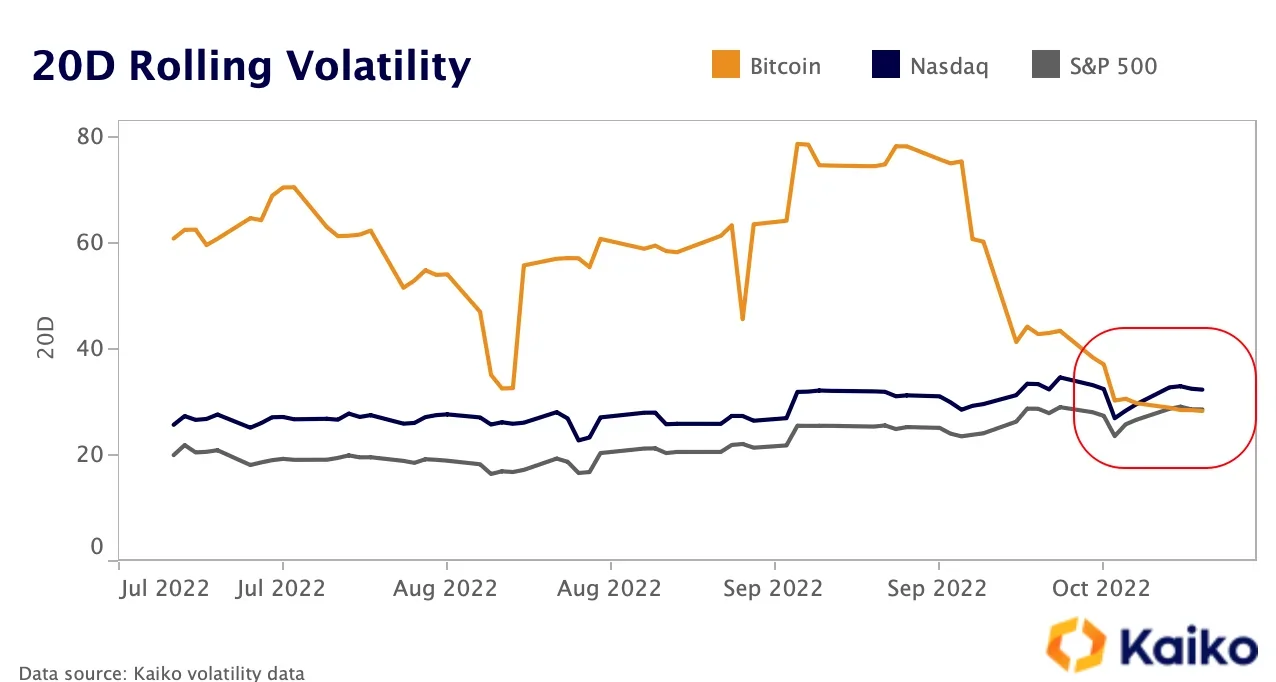

An interesting trend for Bitcoin this year has been the reduced volatility in the overall BTC daily price movement. Recent data released by Kaiko highlighted that BTC has become less volatile than both the Nasdaq and S&P500 for the first time in two years. The 20-day rolling volatility graph below, depicting the daily change in price of BTC, indicates that BTC has dipped lower than the two major indices over the past week.

This decrease in BTC volatility has also coincided with a breakdown of the previously close relationship of Bitcoins price movements with the Nasdaq and S&P500. With the correlation coefficient trending down (from 0.9 to 0.3), the price of BTC is showing resilience in the face of volatile equity markets.

Ethereum (ETH)

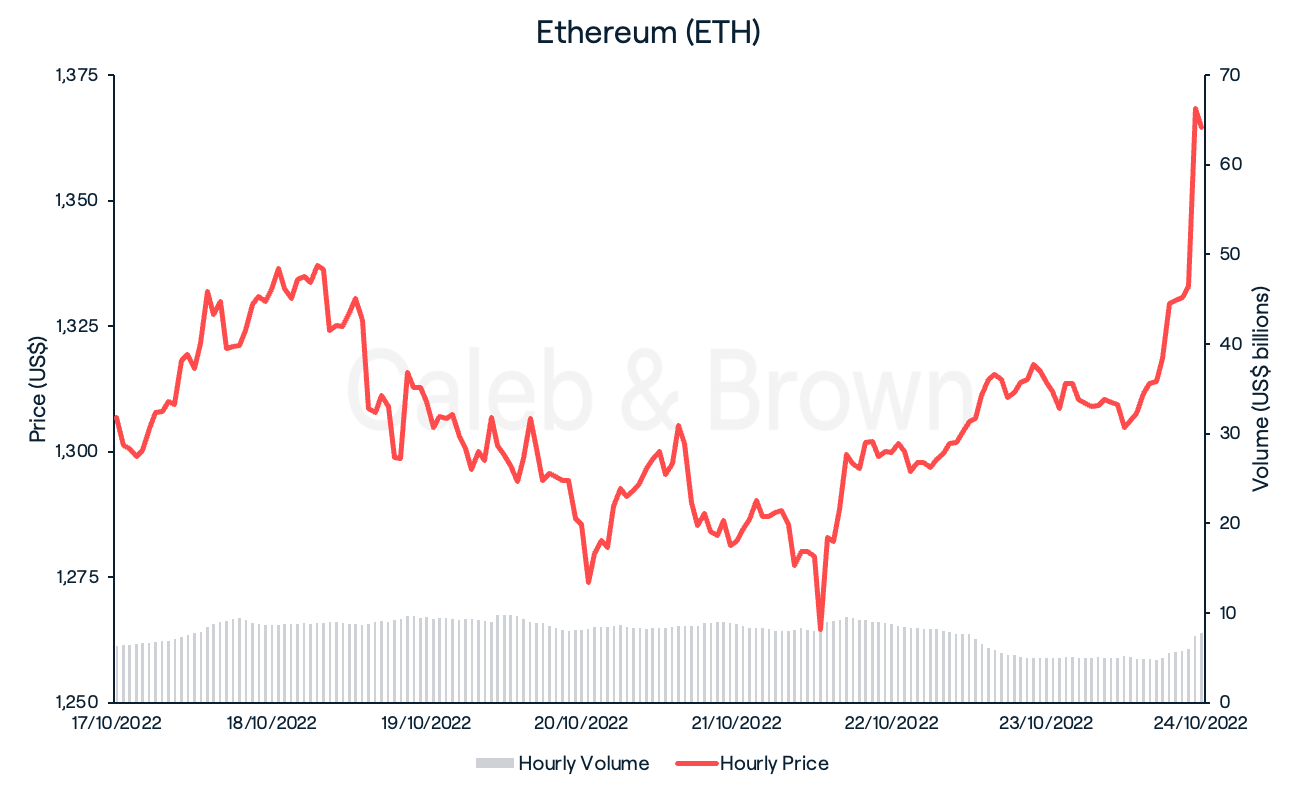

ETH traded in a tight range between US$1,250 to US$1,350 for most of the past seven days, in similar fashion to BTC. However, a late weekend surge pushed ETH’s price past US$1,365, helping it close the week up 4.93%, recapturing 3.11% of relative market share against BTC.

A month after the successful implementation of The Merge, the Ethereum community has already started on the next steps of its roadmap. Last week, Ethereum launched a new testnet known as Shandong in preparation for the Shanghai upgrade. The Shandong testnet will be used by developers to test staked ETH (stETH) withdrawals and implement new Ethereum Improvement Proposals (EIP) that aim to reduce gas fees. The testnest will run until September 2023, when the official launch of the Shanghai upgrade is scheduled to take place.

Altcoins

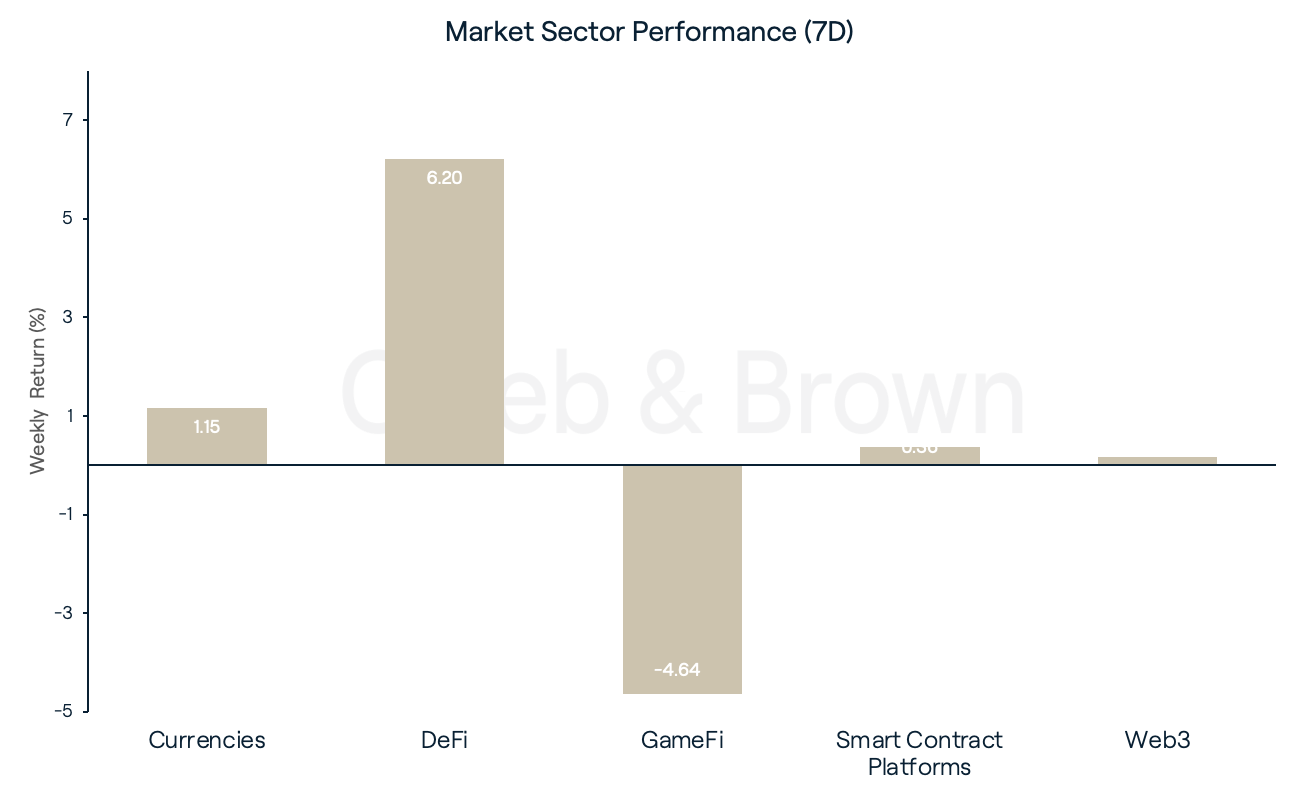

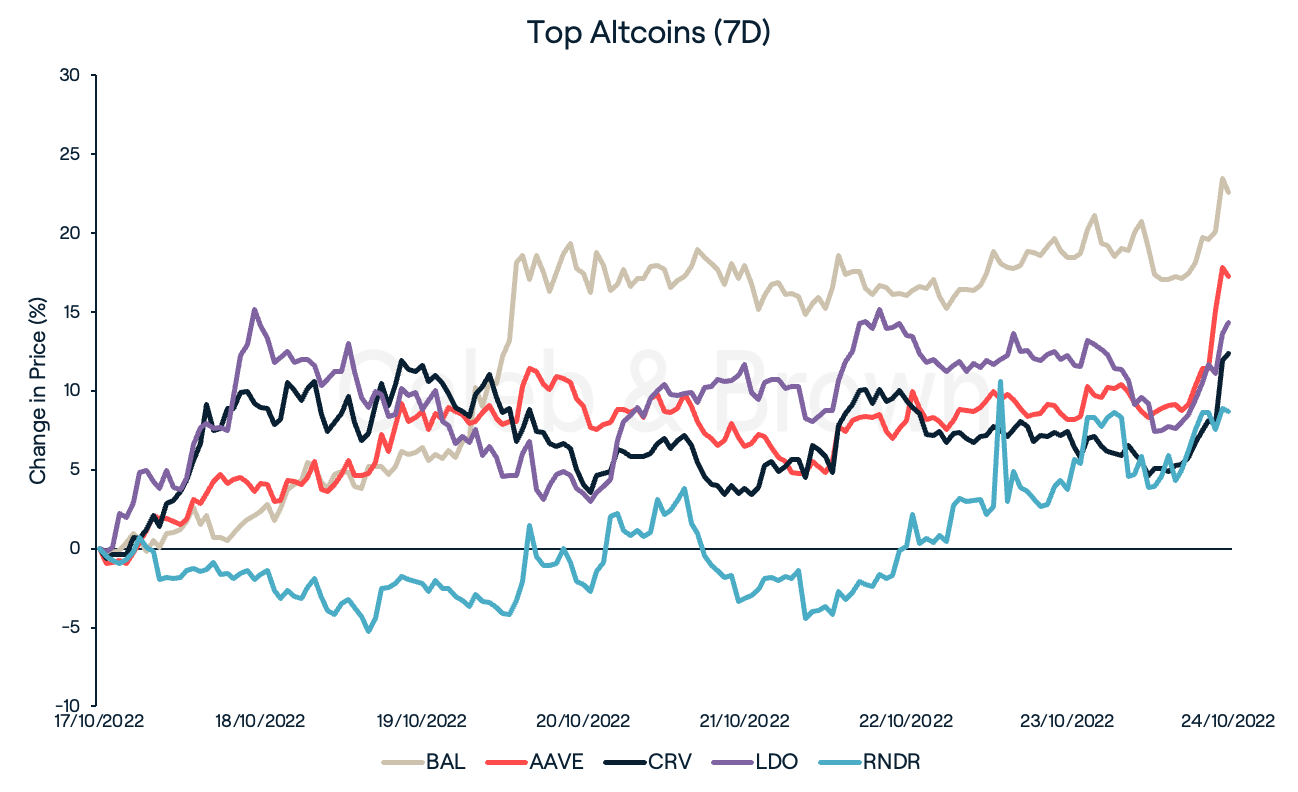

It’s been a tale of two outliers across the crypto market sectors this week where DeFi has led the charge, rallying 6.20%. By contrast, the worst performing market sector has been GameFi, which fell 4.64%. Other market sectors remained relatively flat, with Currencies, Smart Contract Platforms and Web3 returning 1.15%, 0.36%, and 0.16%, respectively.

Leading the DeFi sector was Balancer (BAL), which gained nearly 25.0% in value, followed closely by AAVE (AAVE), which increased by 20.4%. Curve DAO (CRV) also managed to secure a double-digit gain, rallying 10%. Despite the sector’s performance, total value locked (TVL) across DeFi protocols currently sits just under US$53 billion, the lowest it’s been since March 2021.

Other notable mentions include Lido DAO (LDO) and Render (RNDR), which convincingly outpaced their sectors, gaining 13.4% and 12.6% respectively.

Web3 News

Aptos (APT), a recently launched Smart Contract Platform, dubbed to be the next “Solana killer”, went live on October 17. Instead, the protocol was plagued with issues from the very beginning. Opaque tokenomics, unclear communication, and lower-than-expected transaction throughput led investors to sell the token on launch, shedding over 40% in value on its first day of trading.

One of the world’s largest asset managers, Fidelity, has revealed plans to offer its clients both custodial and trading services for ETH. In an email sent to its clients this week, Fidelity announced that by the end of October institutional investors will be able to “buy, sell, and trade ETH using the same model provided for bitcoin investments today.”

In other news, Ripple General Counsel, Stuart Alderoty, announced the acquisition of the “Hinman documents” on October 21, claiming “it was well worth the fight to get them.” The documents contain former SEC director William Hinman’s 2018 speech, in which he declared Ethereum to be outside of and not subject to federal securities regulation. Whether the acquisition of these documents proves dispositive is yet to be seen.

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)