In this week's Market Rollup

Is the bear market over already? Ethereum (ETH) leads the market in the first substantial rally in months, as anticipation for the Merge grows. Altcoins have also enjoyed a sea of green for the second successive week, as investors and traders alike continue to speculate that crypto prices may have reached a bottom following months of negative price action.

Market Highlights

- ETH continues its price rally, peaking this week at US$1,664, its highest price since mid-June.

- Exchange reserves of ETH hit a four-year low, falling below 22 million ETH (approx. US$3.43 billion), as investors prepare for the upcoming Merge.

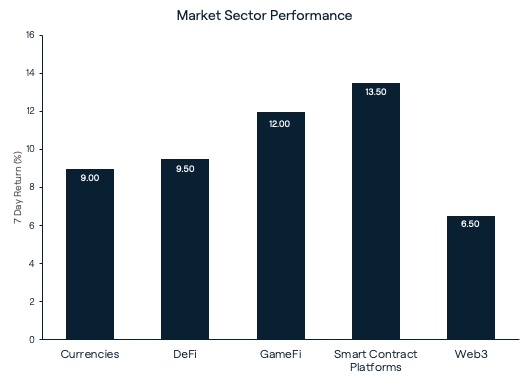

- Markets enjoy a week of green, with all major sectors posting positive returns. Smart contract platforms led the pack with a 13.5% gain.

Price Movements

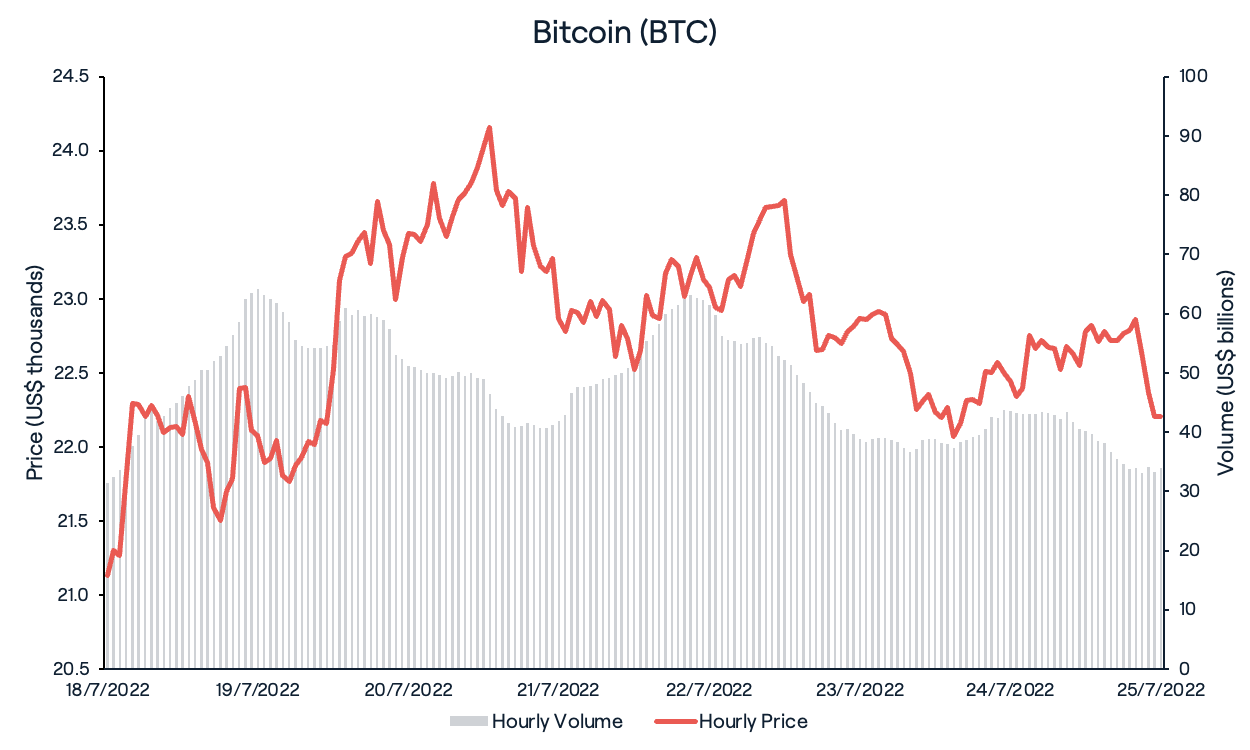

Bitcoin (BTC)

Bitcoin (BTC) enjoyed one of its strongest weeks in recent times, gaining 5% over the last 7 days. BTC started the week at roughly US$21,000, and reached a high of US$24,270 mid-week, but it was unable to break resistance and finished the week at US$22,420.

The difficulty in mining a block of Bitcoin (BTC) was reduced by a further 5.4%. The reduction comes as network difficulty continues its three-month-long downward streak since reaching an all-time high back in May 2022. Network difficulty is a means to ensure the legitimacy of all transactions using raw computing power. The reduced difficulty allows Bitcoin miners to confirm transactions using fewer resources.

This negative adjustment suggests a drop in the number of global miners competing to discover new blocks. This trend may be due to current global market conditions and rising energy costs, resulting in miners exiting their Bitcoin positions or shutting down operations entirely due to a lack of profitability.

Ethereum (ETH)

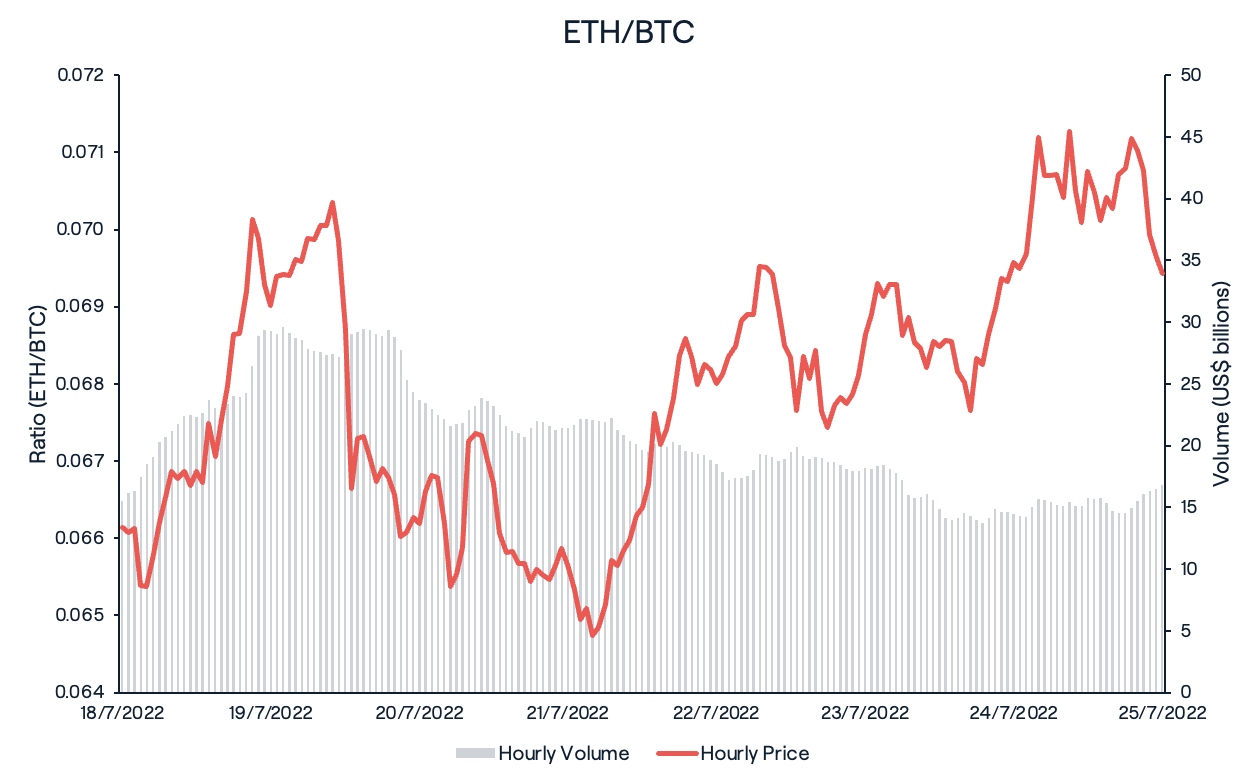

Ethereum (ETH) has led the market in its first considerable rally since its peak of US$4,868 in November 2021. The price of ETH rose 15.3% this week, successfully holding above US$1,250 after breaking through the key level of resistance on July 16 and outperforming BTC by 10.1%, recovering 3.44% of its relative market share.

Ethereum co-founder, Vitalik Buterin, spoke at the annual Ethereum Community Conference (EthCC) in Paris on July 21. Vitalik’s speech focused on the longer-term future of Ethereum, claiming that Ethereum has reached its inflection point and that overall network development will be “55% complete once we finish the Merge.”

For the first time since July 2018, the total amount of ETH held by exchanges fell to a four-year low of less than 22 million ETH (approx. US$3.43 billion). These exchange outflows, however, were met with increased inflows into Ethereum’s staking contract as investors seek to earn yield on their ETH ahead of the Merge. The Merge will transition Ethereum to a proof-of-stake (PoS) protocol and is scheduled to take place on September 19, 2022.

Altcoins

This week saw altcoins continue to follow this month’s uptrend. All sectors saw positive returns over the last seven days, with smart contract platforms posting the highest average return (13.5%) in this period. GameFi also had a strong week, increasing by 12% on average. DeFi, Currencies, and Web3 returned 9.5%, 9.0%, and 6.5% respectively.

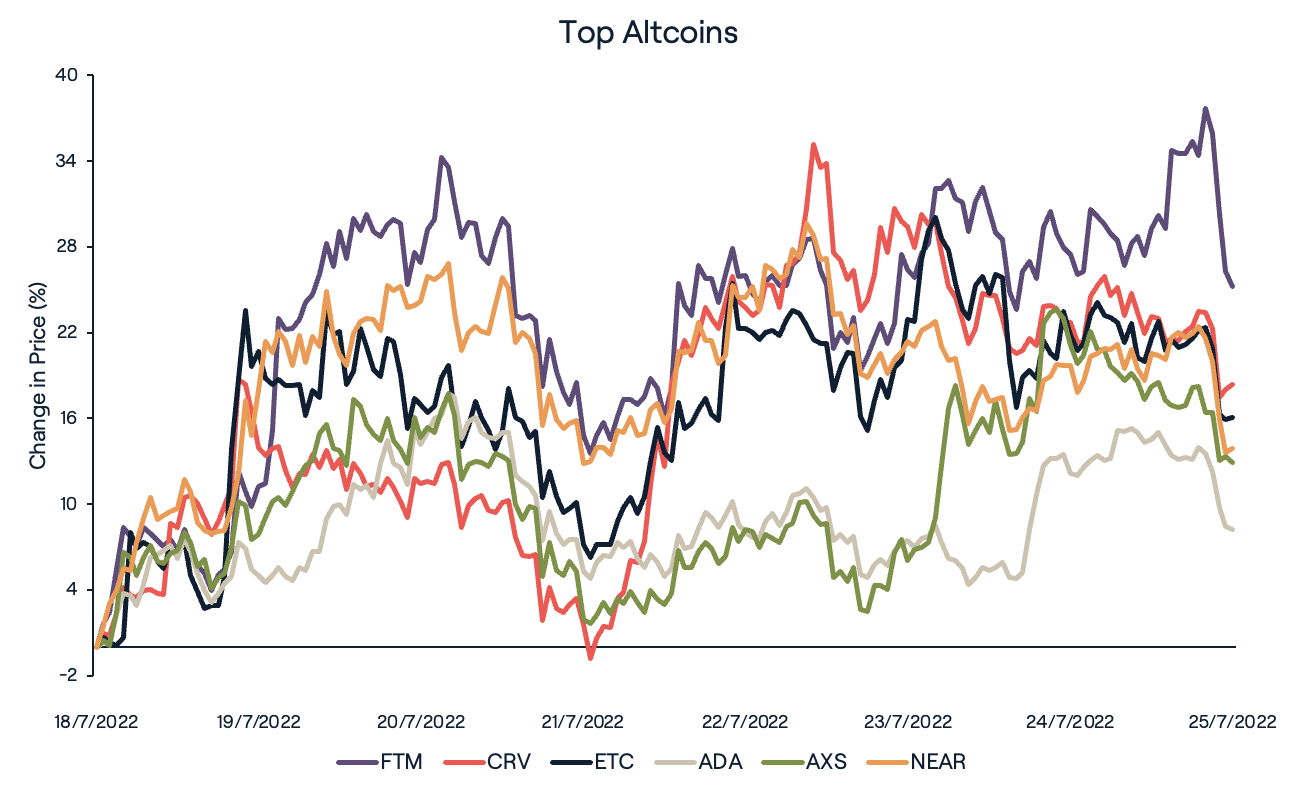

Fantom (FTM) was the strongest performing large cap coin this week, trading 32% higher. The total value locked (TVL) on the smart contract platform increased by 13% in this period. Curve (CRV) increased by 28% this week, largely driven by the founder of Curve Finance, Michael Egorov, announcing Curve’s intention to build a decentralised over-collateralised stablecoin to rival Compound’s DAI, which has a marketcap of US$6.9 billion. DeFi protocols have seemingly learnt from the collapse of the Terra (LUNA) ecosystem and are only launching over-collateralised stablecoins instead of unbacked algorithmic stablecoins like UST, which has lost over 95% of its value.

After surging by 49.6% last week, Ethereum Classic (ETC) continued its strong uptrend, increasing by 26% this week. While Ethereum Classic’s hashrate (the computational power per second used when mining) has increased by 20% over the last month, the Merge won’t necessary cause this trend to continue. After suffering several 51% attacks within a single month in 2020, Ethereum Classic changed its mining algorithm from Ethash to Etchash in the Thanos hard fork of November 2020. This change made Ethereum ASIC (application specific integrated circuit) miners incompatible with Ethereum Classic, ensuring that Ethereum ASIC miners can’t be repurposed to mine ETC.

Near (NEAR), Ethereum (ETH), and Cardano (ADA) were the strongest of the Layer 1 protocols, returning 24%, 15.3%, and 15% respectively. The GameFi sector is trading higher this week, total average return is up 12%, with Axie Infinity (AXS) up 19%, Enjincoin (ENJ) up 18%, and Sandbox (SAND) up 14.5%.

Regulation

The SEC has launched an insider trading case against former Coinbase product manager Ishan Wahi, his brother Nikhil Wahi, and Sameer Ramani. In this case, the SEC alleges that 9 of the 25 different cryptocurrencies purchased by the defendants are unregistered securities.

While the case, SEC v. Wahi, is not centrally concerned with determining whether the relevant cryptocurrencies in question were or are indeed securities subject to regulatory requirements in the US, the case nonetheless demonstrates a growing trend whereby the SEC seeks to regulate through enforcement.

Recommended reading: Ethereum: What is The Merge?

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)