Market Highlights

- Markets sent into turmoil after Silicon Valley Bank (SVB) and Signature Bank shut down operations, making them the largest U.S.-based banking crashes since 2008 financial crisis. Bitcoin (BTC) and Ethereum (ETH) fall ~7.5% in response.

- USD Coin issuer, Circle announced that roughly 8.2% of its cash reserves were stuck on SVB causing USDC to depeg to as low as US$0.87.

- Biden administration steps in to assure all depositors of both SVB and Signature Bank will be able to withdraw funds on Monday, sending BTC and ETH to new weekly highs.

Price Movements

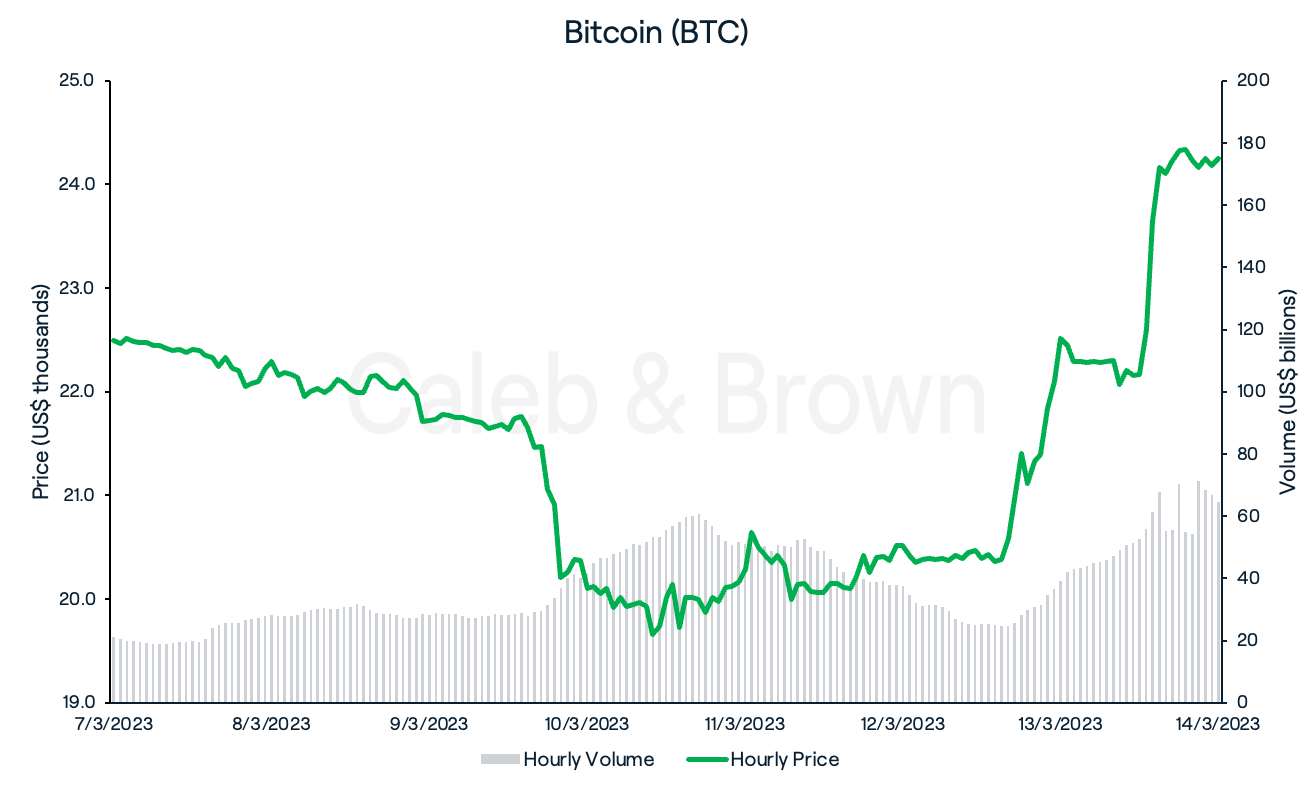

Bitcoin

It was a rollercoaster week for the crypto space, with Bitcoin (BTC) swinging drastically in both directions over the past seven days. What started out as a rather lacklustre week quickly turned south as news of Silvergate Bank winding down operations and voluntarily liquidating its bank was released Wednesday. In a panic, investors were quick to sell risk-on assets such as BTC, sending its price down 7.5% in only a few hours and bringing the total crypto market cap below US$1 trillion.

The shaky sentiment was further perpetuated after the Federal Deposit Insurance Corporation (FDIC) announced the closing of Silicon Valley Bank only a couple of days later. As a result, BTC spent most of the weekend teetering around US$20,000.

Following a joint announcement by the Federal Reserve, U.S. Treasury, and FDIC stating that all customers of the now-defunct Silicon Valley Bank and Signature Bank would be able to withdraw their funds on Monday, the struggling cryptocurrency market saw a positive shift.

Fueled with confidence, investors rushed back into BTC, causing it to spike over 16.0% the same day. BTC closed the week at US$24,428, up 9.1% over the last seven days.

What is going on with US banks?

Caleb & Brown CEO Jackson Zeng and Director of Risk Management Daniel Caruso caught up to discuss the US banking crisis, whether we've reached the end of quantitative tightening, and what this all means for crypto markets.

See the video below:

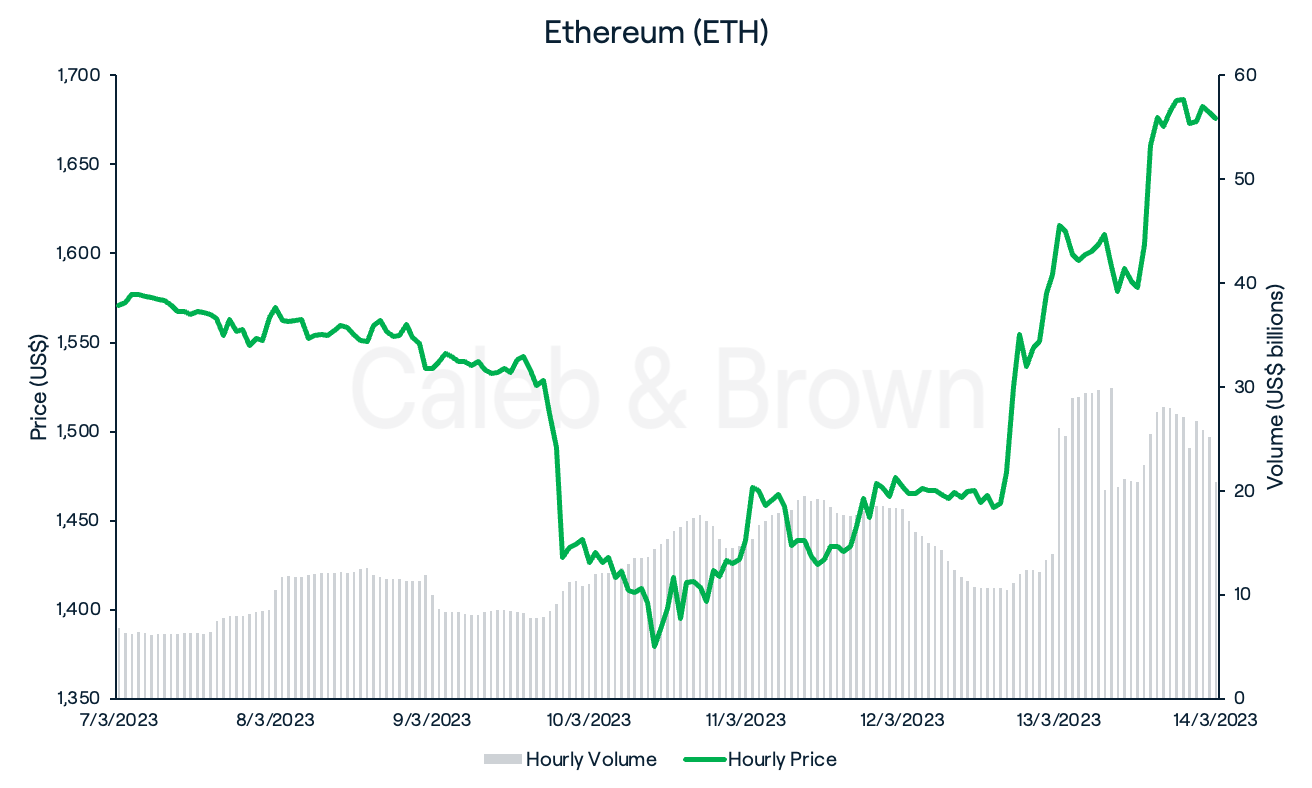

Ethereum

Ethereum (ETH) had a similar trajectory to BTC this week, and fell sharply in response to Silvergate Bank’s shutdown. ETH reached a low of US$1,368 on Friday before quickly recovering to weekly highs Monday.

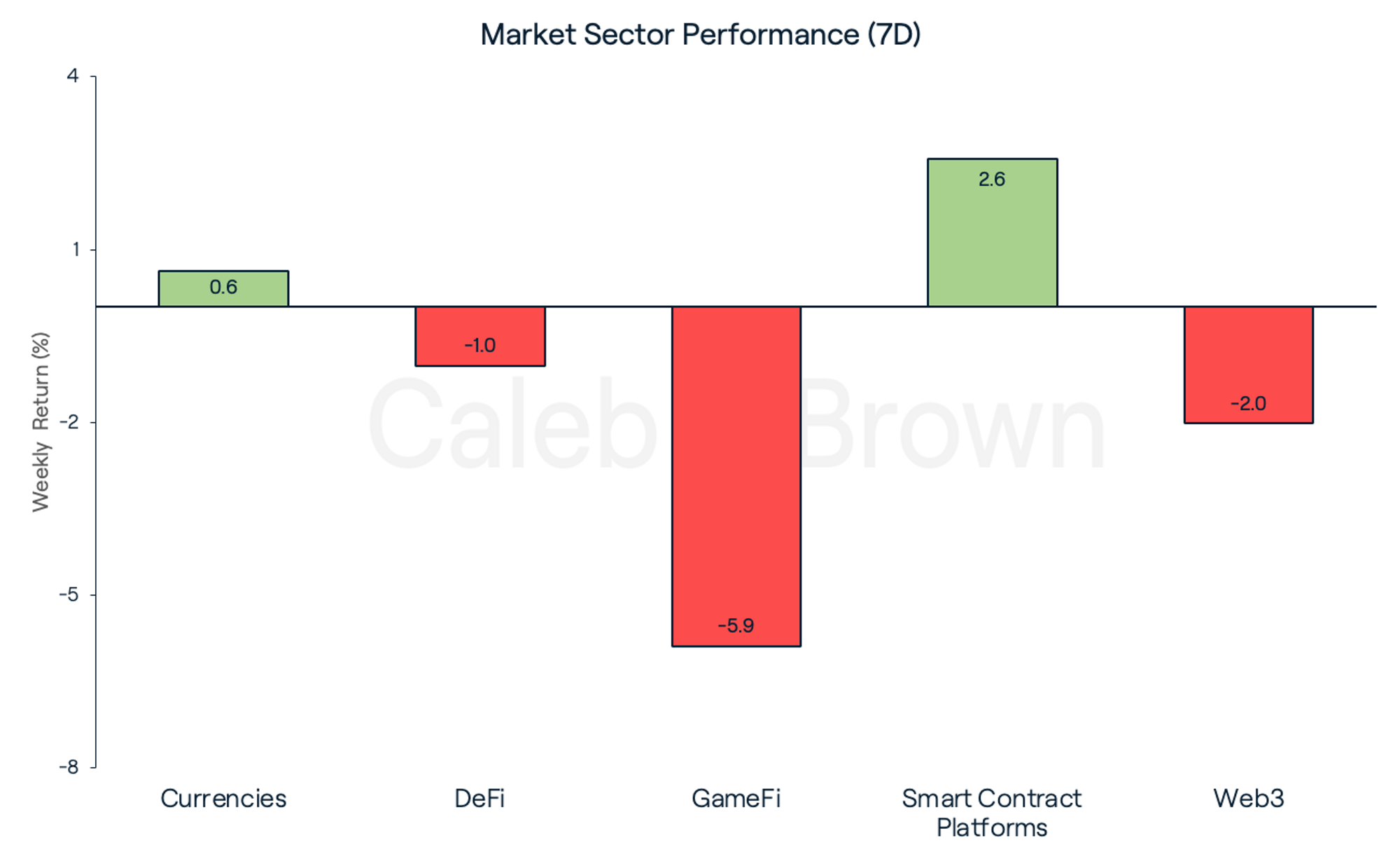

Altcoins

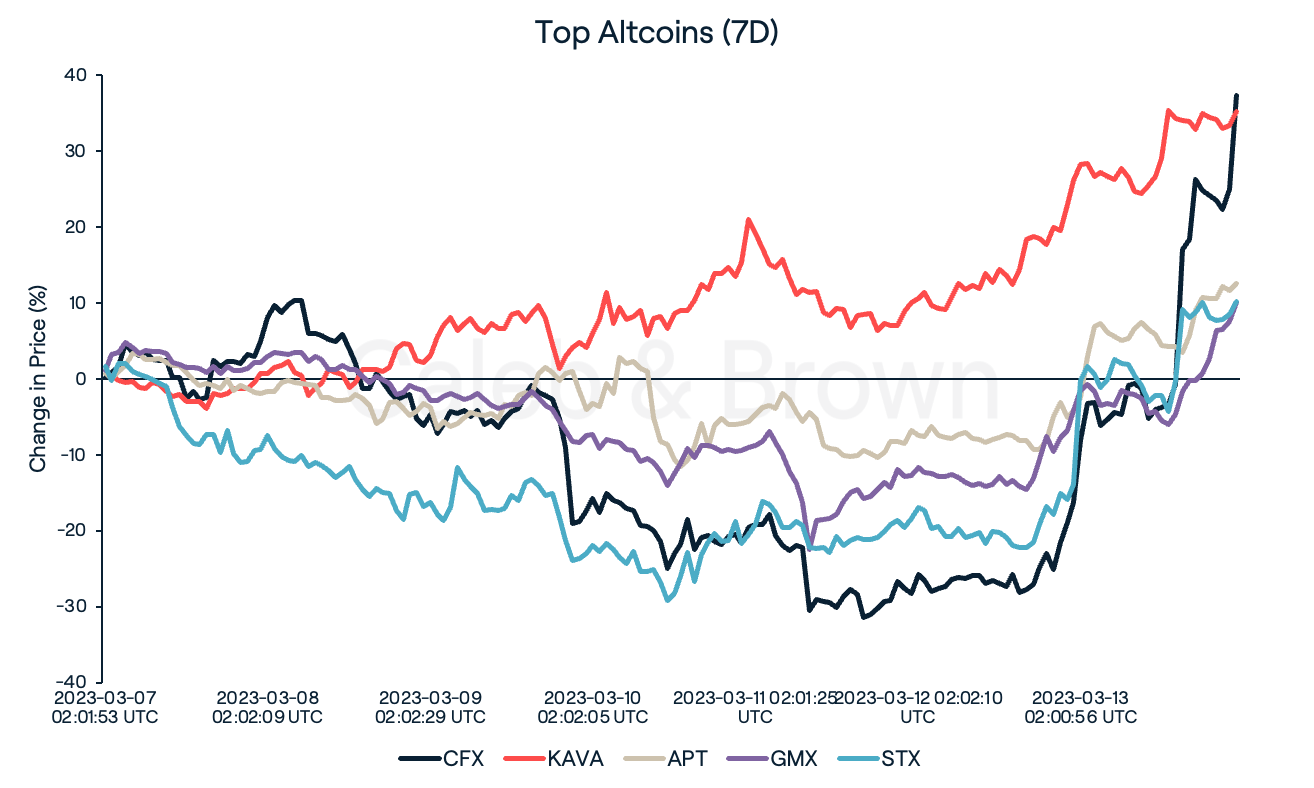

While BTC and ETH made strong recoveries on Monday, altcoin prices remained all over the place. Market sector performance was also quite varied, with sectors like GameFi and Web3 losing 5.9% and 2.0%, respectively. Smart Contract Platforms was the best performing sector this week with a 2.6% increase. Despite the mixed bag of results, a few tokens emerged with double-digit gains.

Among the Smart Contract Platforms, Conflux (CFX), Kava (KAVA), and Aptos (APT) were this week’s winners, each returning 33.8%, 35.2%, and 13.1%, respectively. Each platform is a layer-1 protocol focusing on either fast single-chain transactions, or multichain interoperability, and aims to compete with Ethereum. APT was recently included as the blockchain with the fastest time-to-finality in a Messari report while Binance listed more CFX pairs on its platform. CFX has performed consistently well the past month and is up 348.3% over the last 30 days.

Notable performances this week also included GMX (GMX) and Stacks (STX), which both recovered aggressively on Monday. The decentralised perpetual exchange GMX gained 10.3% week-on-week as it continues to gain traction in the DeFi space. The blockchain analytics tool Token Terminal shows GMX’s revenue to now be the second highest among DeFi apps. STX climbed 18.9% with the help of Binance listing another trading pair.

In Other News

De-banked and De-pegged

The crypto market was in a total state of disorder following a series of bank crashes last week. The first to fall was crypto bank Silvergate, after it disclosed the voluntary winding down of operations on Wednesday.

On Friday, fintech-focused Silicon Valley Bank (SVB) was ordered to cease operations by California state banking regulators after it suffered a US$42 billion bank run the previous day. Finally, on Sunday, New York State financial regulators shut down crypto-friendly Signature Bank, citing systemic risk.

Many crypto companies admitted their exposure to SVB in particular, causing the prices of almost all tokens to plummet. Circle, the issuer of stablecoin USD Coin (USDC), disclosed that it had US$3.3 billion, or 8.2% of its ~US$40 billion in reserves, stuck in SVB, causing USDC to lose its peg to the dollar and fall as low as US$0.87 at one point.

Then, on Sunday night, the Federal Reserve, U.S. Treasury, and FDIC announced that depositors of both SVB and Signature Bank would be able to withdraw their funds on Monday. The Biden Administration also assured that taxpayers would not bear the losses of these banks. By Monday, USDC had regained its peg, generating optimism among investors and a surge in asset prices throughout the market.

DeFi Trading Volumes Soar Amid USDC Depeg

Amidst the recent market chaos, DeFi players have reported significant trading figures. On Saturday, 24-hour trading volume on Curve Finance (CRV), a decentralised stablecoin exchange, reached US$7 billion, an all-time high due to the panic caused by Circle's USDC stablecoin depeg. The platform's stablecoin pool, which includes USDC, USDT, and DAI, accounted for nearly 80% of the total trading volume, with liquidity providers making US$4.9 million in fees over the past week.

Additionally, volumes on Uniswap (UNI) surged, with the WETH-USDC pool hitting US$8.8 billion in trading volume over the last week from almost 100,000 traders. For comparison, these values were nearly triple the volume of non-USDC pools, once again highlighting DeFi’s ability to handle stress and volatility, even in the face of fallen centralised players.

Recommended Reading: What Is Bitcoin Halving?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FfTwBe6qmt1ZS75a8gJQLr%2F6422ef9f6b0d13d779743ca8f0395820%2FMarch_15__2023__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-03-15T02%3A34%3A57.018Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)