Market Highlights

- A wave of events this week led to an 11.1% correction in total crypto market cap.

- Chainlink (LINK) launches Transporter, enabling the cross-chain transfer of crypto across multiple networks.

- Uniswap (UNI) receives Wells Notice from U.S Securities and Exchange Commission on Wednesday.

Bitcoin (BTC)

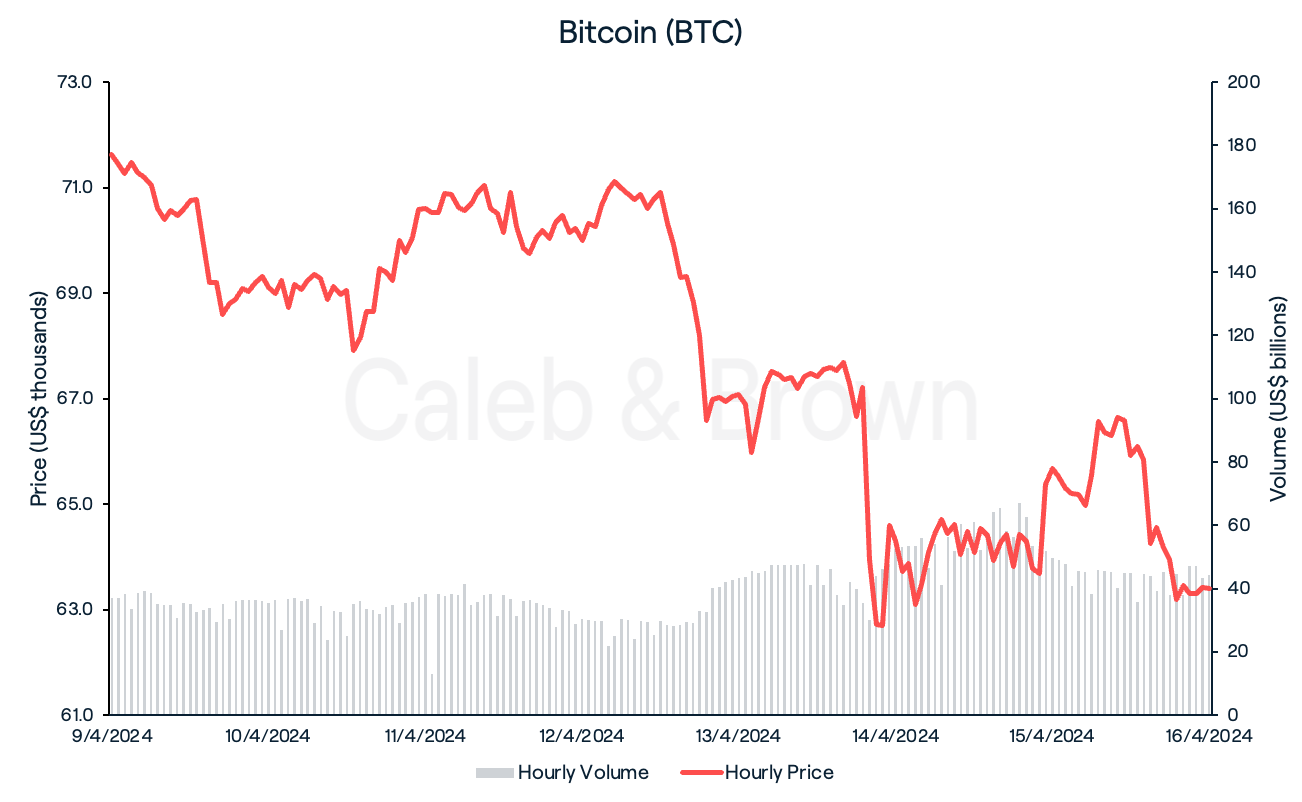

What an eventful week its been for crypto as geopolitical tensions rose, inflation data staggered, and token prices plunged.

The U.S. Bureau of Labor Statistics’ CPI (Consumer Price Index) report revealed on Wednesday that CPI had increased 0.4% throughout March, pushing the 12-month inflation rate to 3.5%, dampening hopes of a timely interest rate cut, and sending Bitcoin (BTC) price down 3.0%.

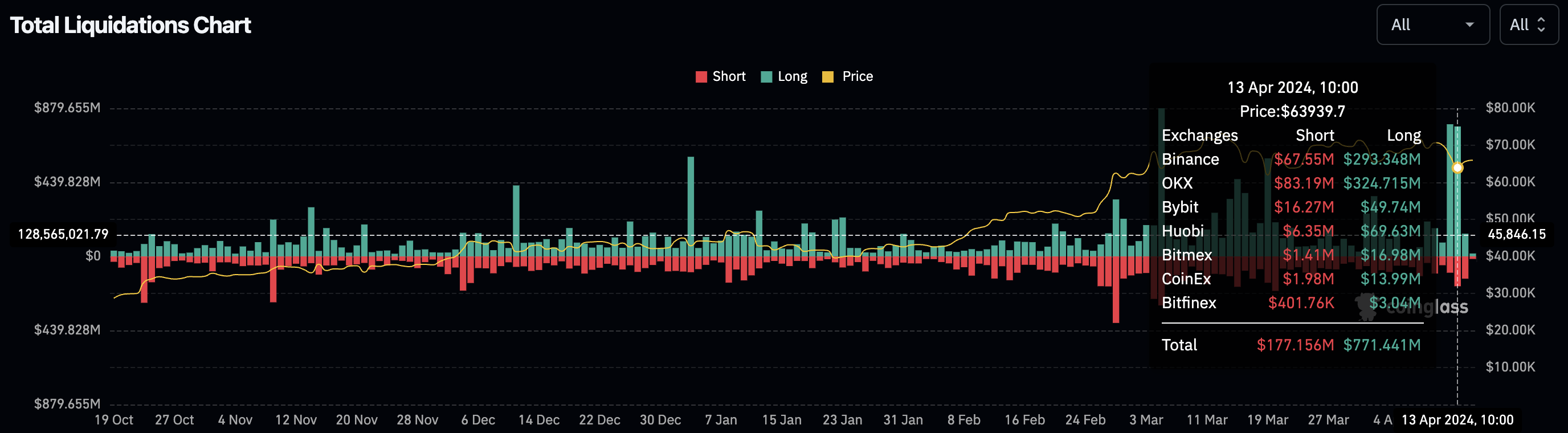

Then on Saturday BTC price plummeted even further after Iran retaliated to an attack by Israel, escalating geopolitical conflicts in the Middle East. This saw BTC drop from US$67,000 to US$60,660 and over US$770m in leveraged long positions liquidated that same day.

As we near the Bitcoin halving event, understanding its implications is crucial. This significant event halves the reward for mining new blocks, reducing the rate at which new bitcoins are created. The upcoming halving will decrease the block reward from 6.25 to 3.125 bitcoins, aiming to control inflation and slow the growth of the circulating supply. Historically, halvings have profoundly impacted Bitcoin's price and the broader crypto market, often leading to price increases due to the reduced new supply and increased scarcity. Learn more about the halving process and its potential effects in our blog post: "What is Bitcoin Halving?".

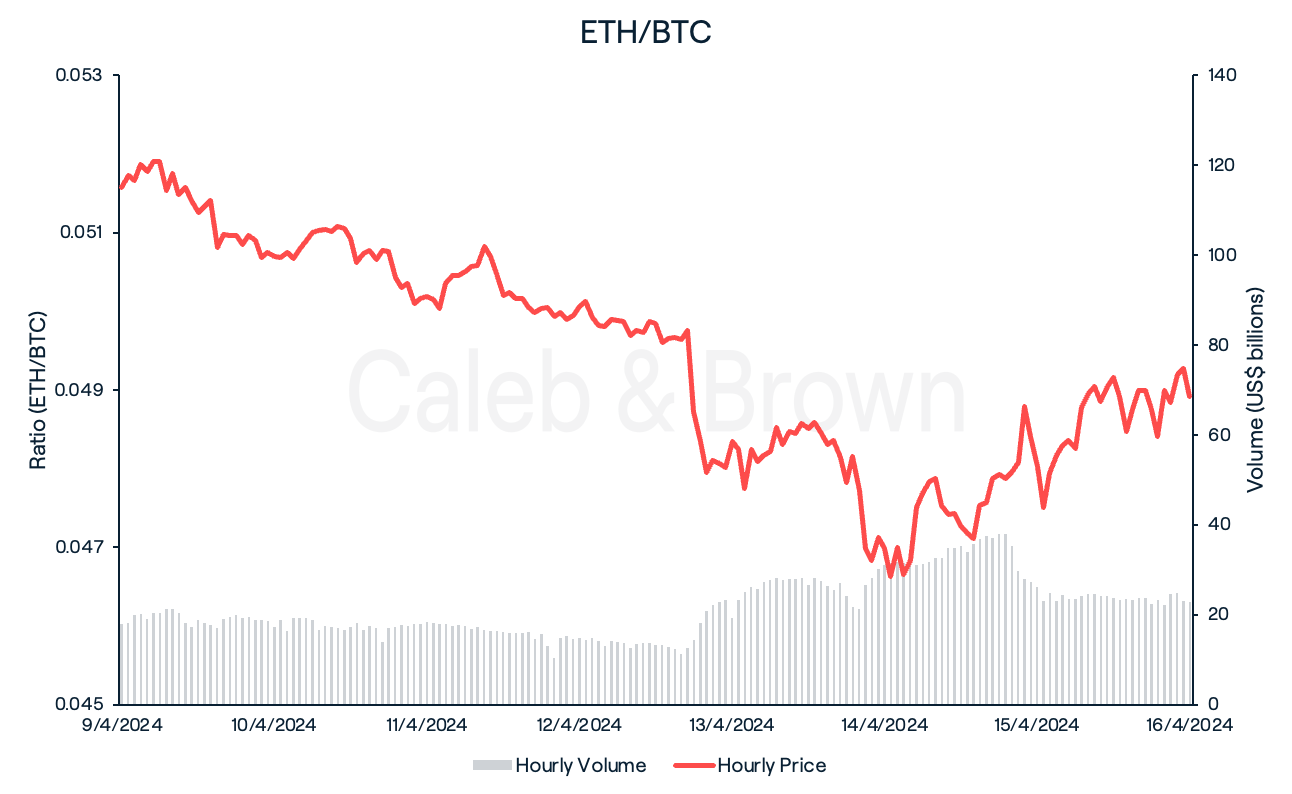

Ethereum (ETH)

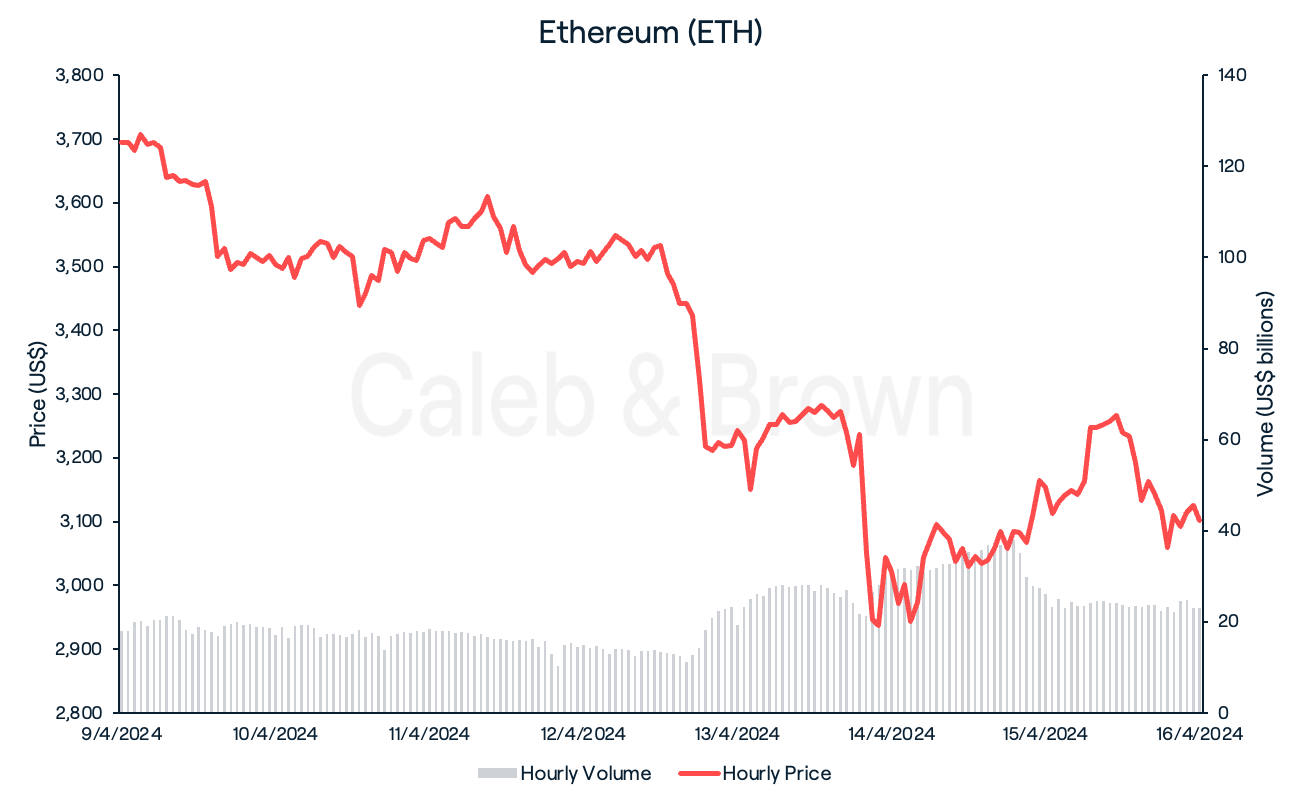

To no surprise, Ethereum (ETH) also struggled this week, falling below US$3,000 for the first time since February. Market sentiment towards a spot Ethereum ETF approval by May has also fallen, with ETF analysts from JP Morgan and Bloomberg Intelligence rating the likelihood of an approval at just 50%.

ETH partially recovered over the weekend to close the week at US$3,101, down 16.1%.

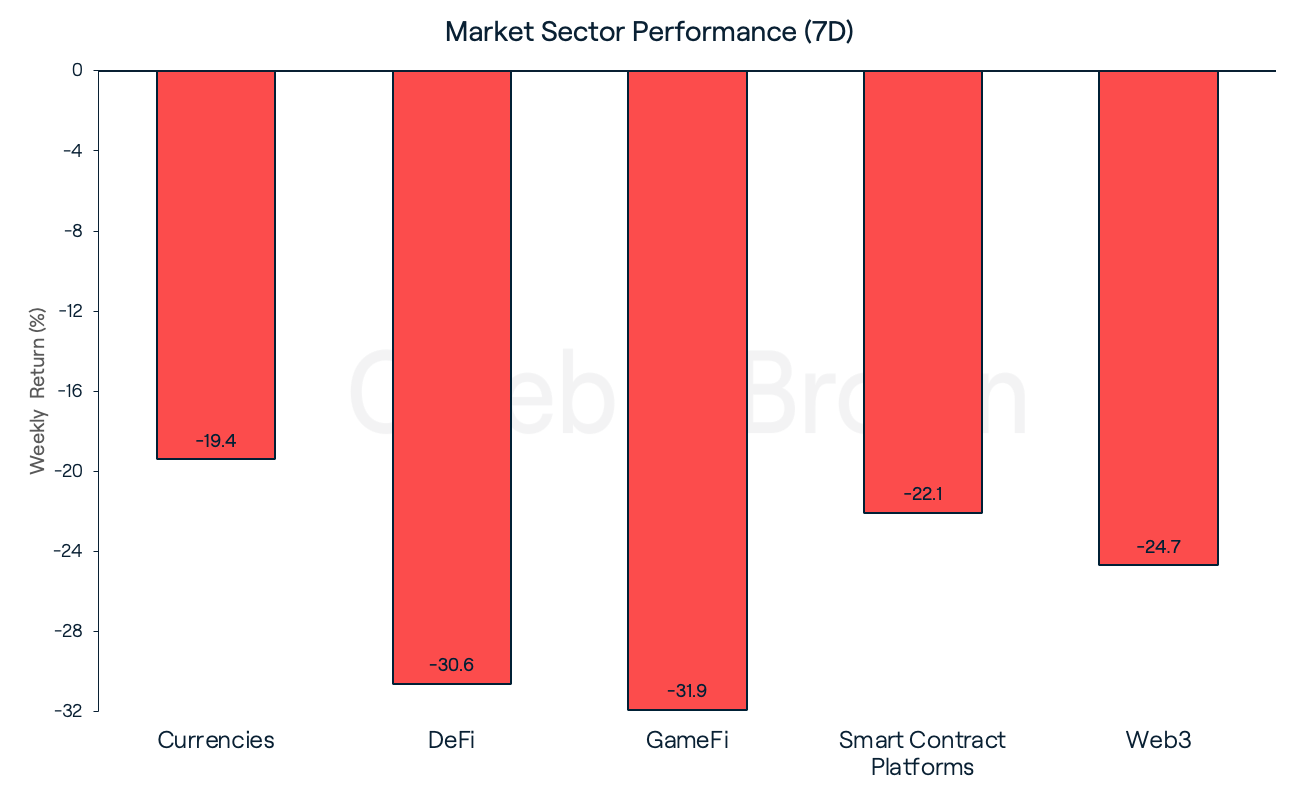

Altcoins

Market sector performance saw a sea of red with all sectors down double-digits. GameFi was hardest hit, shedding 31.9% over the past seven days, followed closely by DeFi and Web3 which lost 30.6% and 24.7%, respectively.

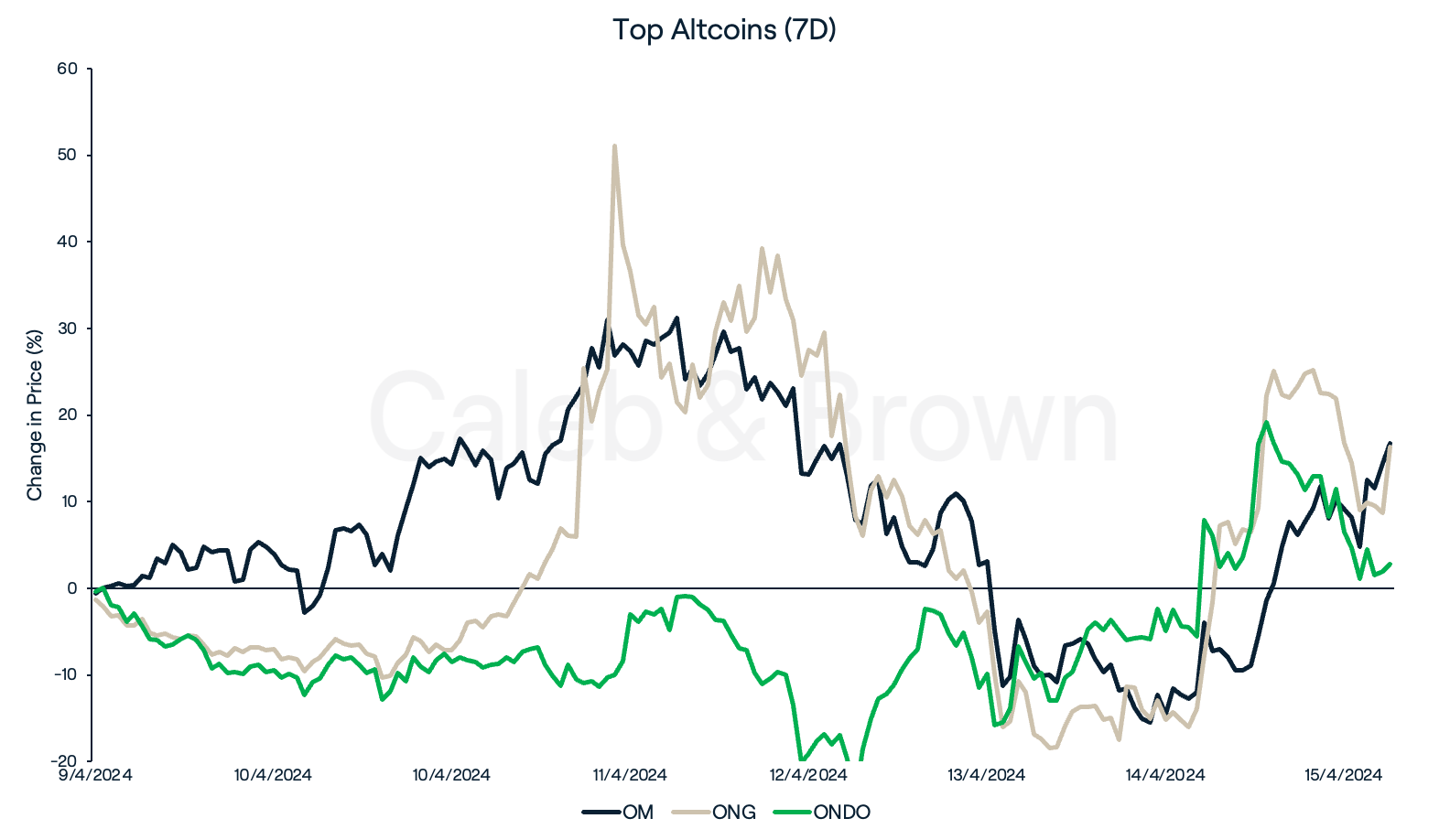

DeFi protocol, Ondo (ONDO) also secured a gain, adding on 2.8%. Ondo spiked this week after releasing a new feature that lets users quickly convert stablecoins, like USD Coin (USDC), into other digital assets, testing a 250,000 USDC trade directly into Blackrock’s new token, BUIDL.

In Other News

- On Thursday, dominant decentralised oracle provider, Chainlink (LINK) launched an app that enables the cross-chain transfer of crypto. Transporter will allow the transfer of tokens across the Arbitrum (ARB), Avalanche (AVAX), Base (BASE), BNB Chain (BNB), Ethereum, Optimism (OP), Polygon (MATIC), and WEMIX (WEMIX) networks.

- March saw Polkadot (DOT) hit a new all-time high in active addresses on its network, with over 605,000 active addresses on-chain by the end of the month, with the majority of those addresses tied to cross-chain smart contract platform, Moonbeam (GLMR).

- BlackRock’s IBIT spot Bitcoin ETF crossed US$15 billion in total inflows yesterday — exactly three months after it began trading on Jan. 11.

Regulatory

- Prominent decentralised exchange, Uniswap (UNI) was the latest victim to fall prey to the U.S. Securities and Exchange Commission regulatory onslaught after it received a Wells Notice from the SEC on Wednesday. This saw its native token, UNI decline 20.0% in response.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.