Market Highlights

- Bitcoin (BTC) tumbled after a federal economic report revealed GDP growth to have slowed down significantly in March.

- Ethereum-based software giant, Consensys, filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) on Thursday, alleging the regulator of attempting to arbitrarily designate ETH as a security.

- Hong Kong based, spot Bitcoin and Ethereum ETFs approved earlier this month will begin trading on April 30.

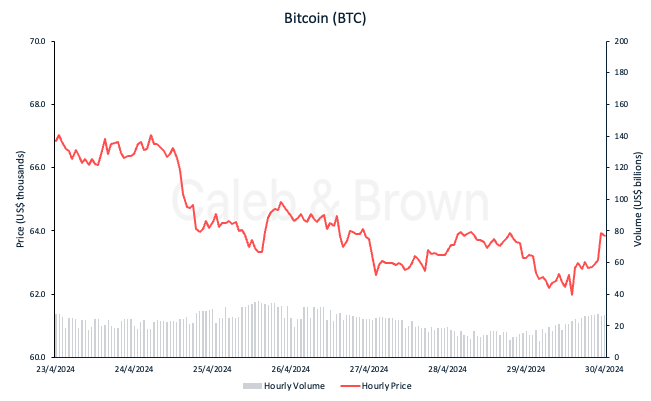

Bitcoin (BTC)

Bitcoin (BTC) experienced a rather unremarkable week, wavering in price just seven days after its long anticipated halving event. The sluggish price action was likely due to a key federal economic report which indicated that the U.S. economy grew slower than expected in the first quarter.

It was reported that GDP (gross domestic product), a broad measure of goods and services, increased at a 1.6% annualised rate, well below the 2.4% estimate.

This news was met with a rush of Bitcoin ETF outflows as nearly US$218 million in funds were pulled out that day, seeing over US$200 million in long positions liquidated.

As a result, BTC closed the week at US$63,827, down 4.5% over the last seven days.

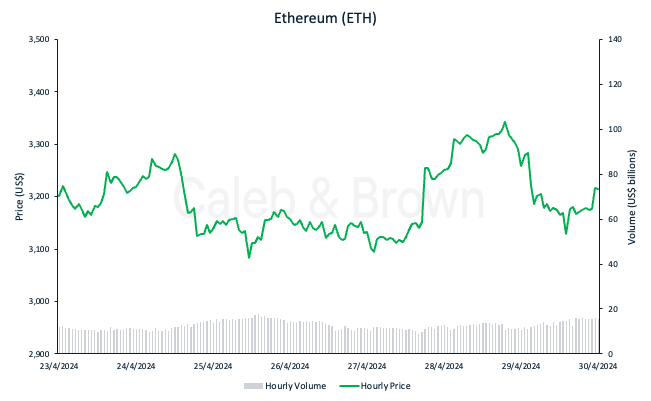

Ethereum (ETH)

In a contrasting tone, Ethereum (ETH) made strides over the weekend to break US$3,300, reaching a high of $3,357 Sunday night. The move was likely spurred on by Ethereum-based software giant, Consensys, filing a lawsuit against the U.S. Securities and Exchange Commission (SEC) on Thursday, alleging the regulator of attempting to arbitrarily designate ETH as a security.

The lawsuit was supported by the crypto community and industry, including Coinbase’s Chief Legal Officer, Paul Grewal, and Uniswap founder, Hayden Adams.

As such, ETH closed the week at US$3,215, up 0.5%.

This saw ETH regain 5.2% relative market share against BTC the past week.

Altcoins

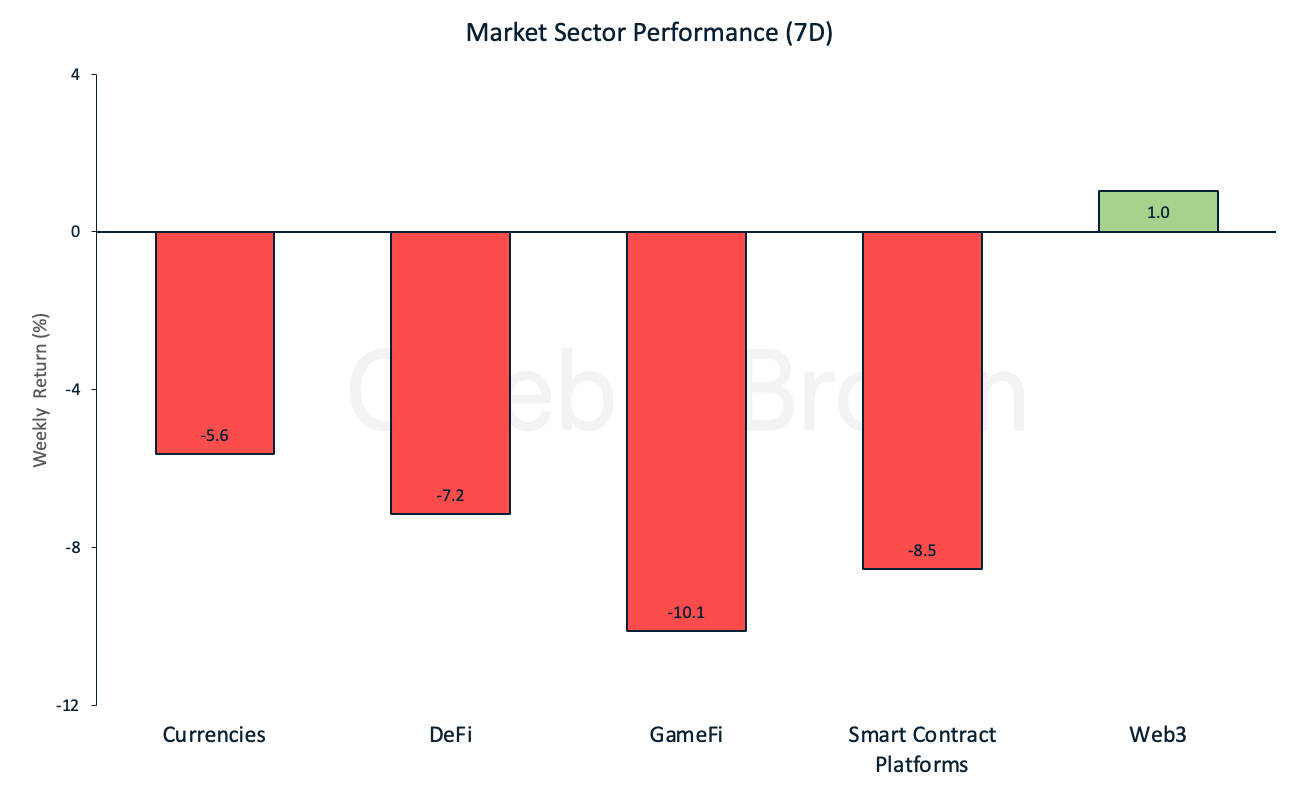

Market sector performance was mostly in the red this week with only Web3 scraping by with a 1.0% gain. GameFi and Smart Contract Platforms were hardest hit, falling 10.1% and 8.5% respectively.

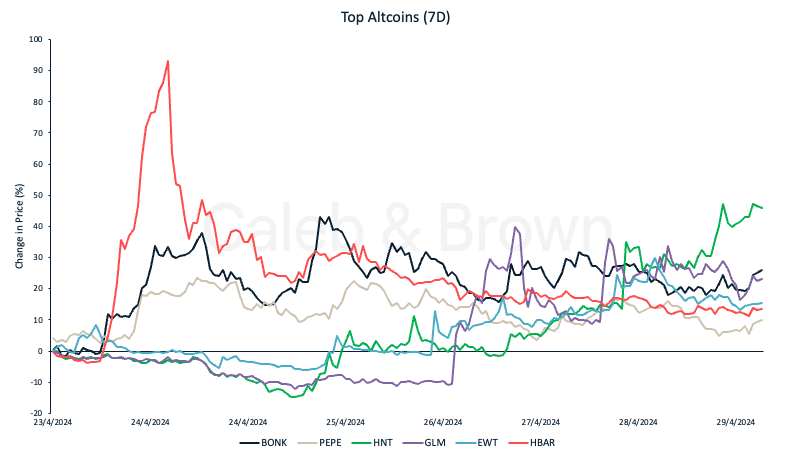

Memecoins found themselves amongst the top performers again this week with Bonk (BONK) and Pepe (PEPE) gaining 26.0% and 10.0%, respectively.

Decentralised wireless computational networks, Helium (HNT) and Golem (GLM) also enjoyed healthy gains, adding on 45.8% and 23.1%, respectively. Golem recently integrated Ray on Golem MVP, allowing for Python code operability.

Energy-focused blockchain, Energy Web Token (EWT) rallied 15.5% after DMG Blockchain Solutions, a publicly traded crypto company, partnered with EWT, and payments giant, Paypal on Wednesday, aiming to explore options to decarbonise the BTC blockchain.

Hedera (HBAR) jumped 100% amidst BlackRock confusion which led investors to believe Hedera was directly involved in the tokenisation of one of its funds. After the euphoria settled HBAR closed the week up 13.6%.

In Other News

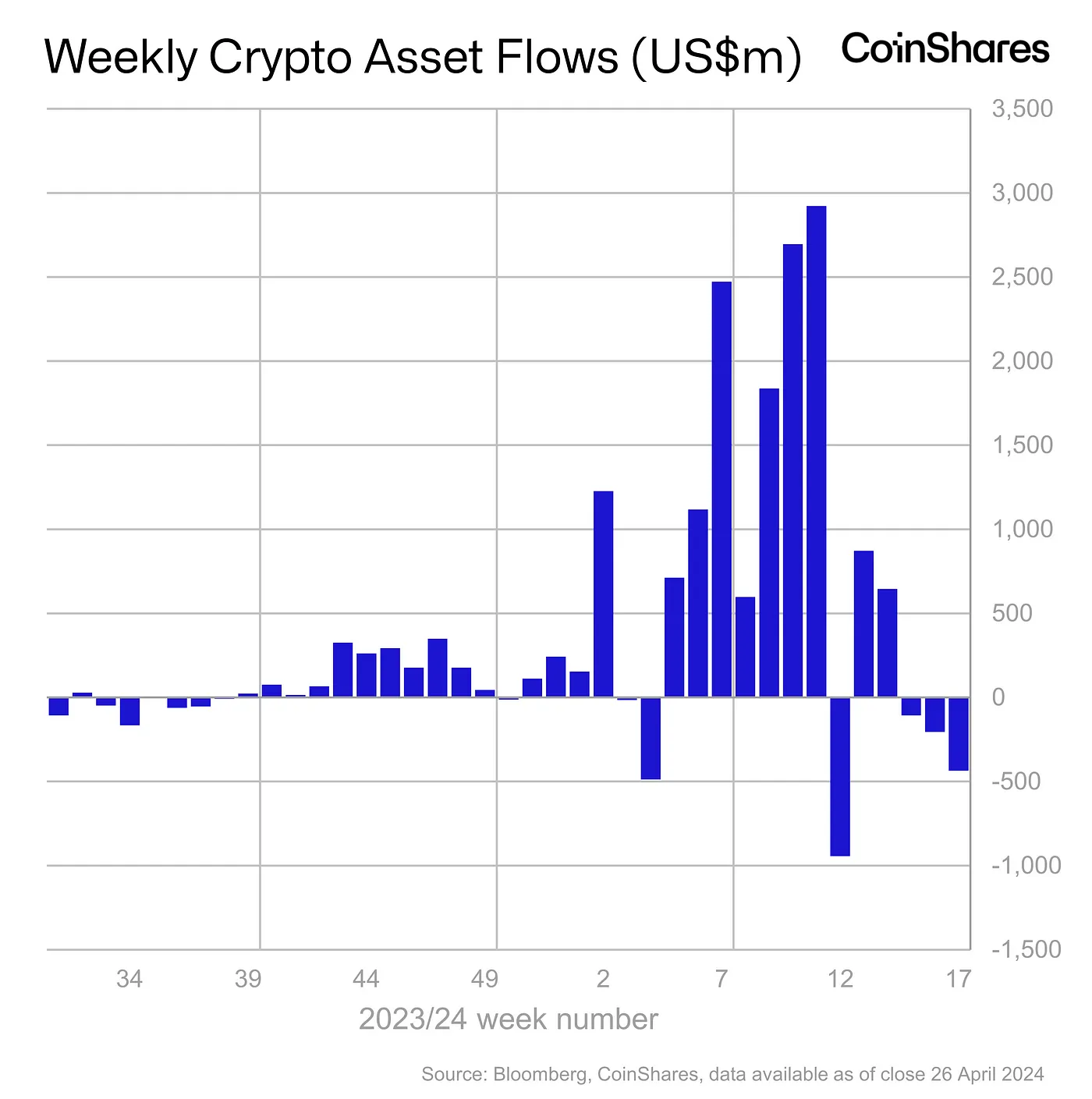

- For the third consecutive week, digital asset investment products experienced outflows totalling US$435 million, marking the largest outflows since March of this year. Simultaneously, inflows from new issuers have also decelerated with only US$216 million moving into ETFs the past week.

-

Following conditional approval from Hong Kong’s Securities and Futures Commission (SFC) earlier this month, the ChinaAMC, Harvest, and Bosera HashKey Bitcoin and Ethereum ETFs are set to commence trading on April 30. This move cements the city’s position as a hub for virtual assets.

-

As Ethereum found itself in the spotlight this week, bullish developments emerged with the staggering multi-million dollar sale of another CryptoPunk NFT. Punk #635, an exceptionally rare Alien Punk, was sold on Thursday for an impressive 4,000 ETH (approx. US$12.38 million) to an undisclosed collector.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.