Market Highlights

- BlackRock’s BTC ETF sees outflows for the first time since launch.

- US Fed Chair, Jerome Powell, states interest rates will remain high for longer, with no progress made towards 2% inflation goal.

- Bitcoin network processed its billionth transaction, highlighting its robust and extensive use.

- Binance CEO Changpeng Zhao was sentenced to four months in prison.

Bitcoin (BTC)

The beginning of last week was rough for Bitcoin and the wider crypto market, but recent trends saw a market recovery.

Bitcoin dropped below US$57,000 earlier in the week. The mid-week plunge may have been caused by record-breaking outflows in spot Bitcoin ETFs. BlackRock's iShares Bitcoin Trust saw outflows for the first time since its January launch, further pressuring Bitcoin's price. This sell-off followed investor concerns about the Federal Reserve's reluctance to cut interest rates. The central bank's chairman confirmed this stance on Wednesday, maintaining the steady key interest rate despite persistent inflation.

The U.S. government’s Nonfarm Payrolls report may have been what lifted BTC back out of its trough. Investors who bet against the top cryptocurrency had their short positions liquidated, resulting in a loss of US$100m, and a steady increase in BTC’s price to a weekly high of US$65,200.

Bitcoin is currently trading at US$62,910, a 4.4% increase on the week.

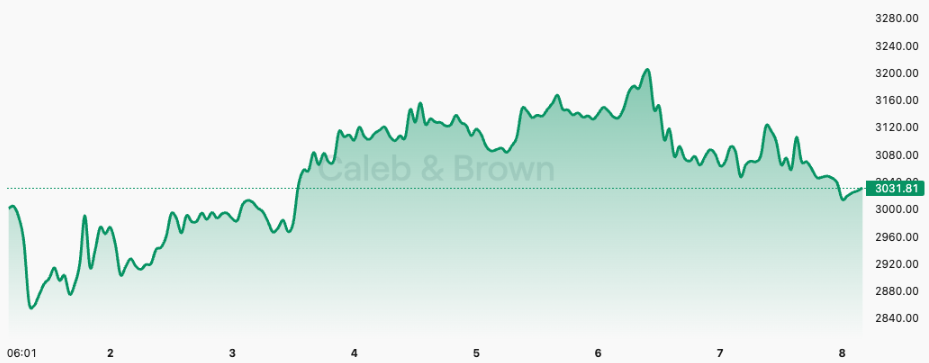

Ethereum (ETH)

Ethereum largely followed Bitcoin’s trajectory, but fared a little worse at the end of the week with a short, sharp dip, trading at US$3,030, for a gain of 1.0% on the week.

Altcoins

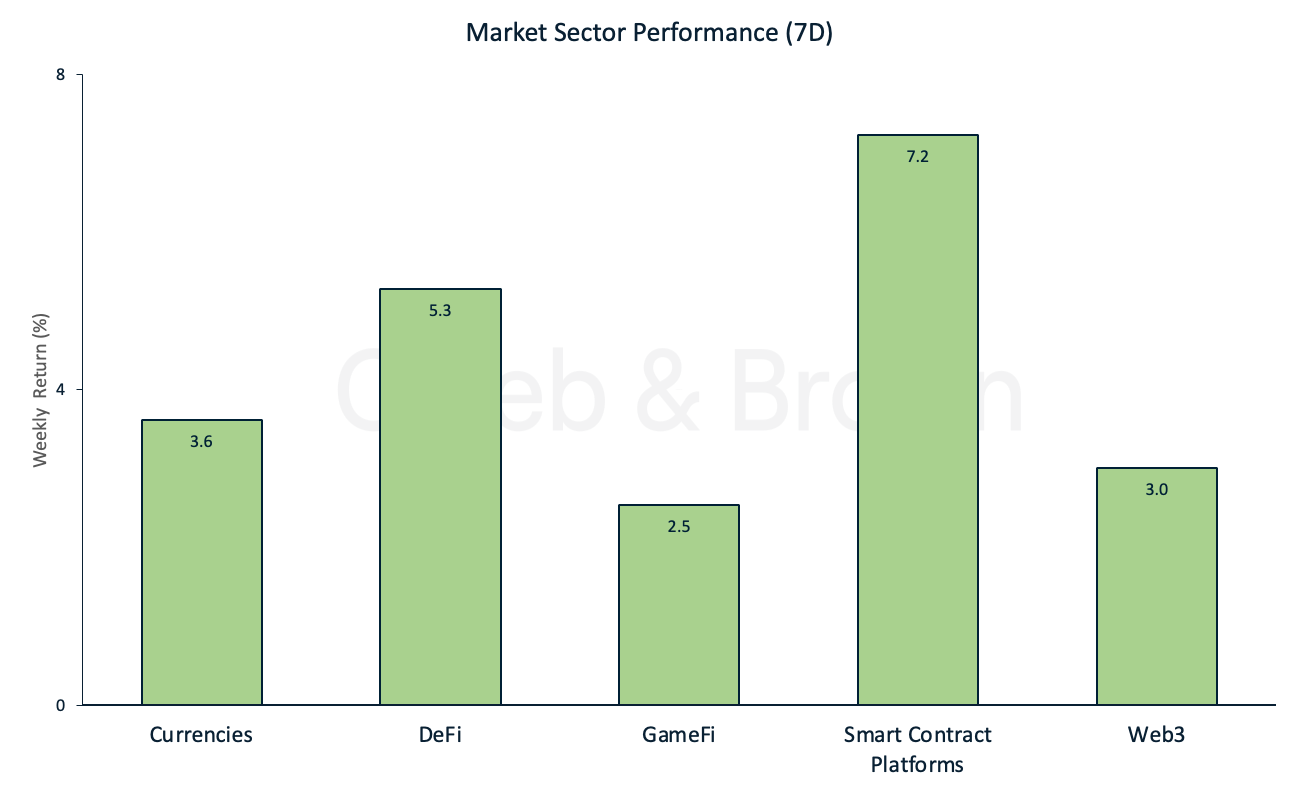

Smart Contract Platforms, led market sector performance this week, rallying 7.2%. This was followed closely by DeFi and Currencies which added 5.3% and 3.6%, respectively.

Decentralized Oracles

- Tellor (TRB) stood out with a dramatic 135% rise in market cap, reaching $247.81 million. This growth was propelled by a significant increase in whale transactions and active addresses, suggesting a robust wave of profit-taking and investor confidence.

- Arweave (AR) also noted a notable increase, with its price appreciating 25%. The platform's role in permanent data storage on the blockchain suggests a bullish sentiment from investors.

AI-Driven Innovation:

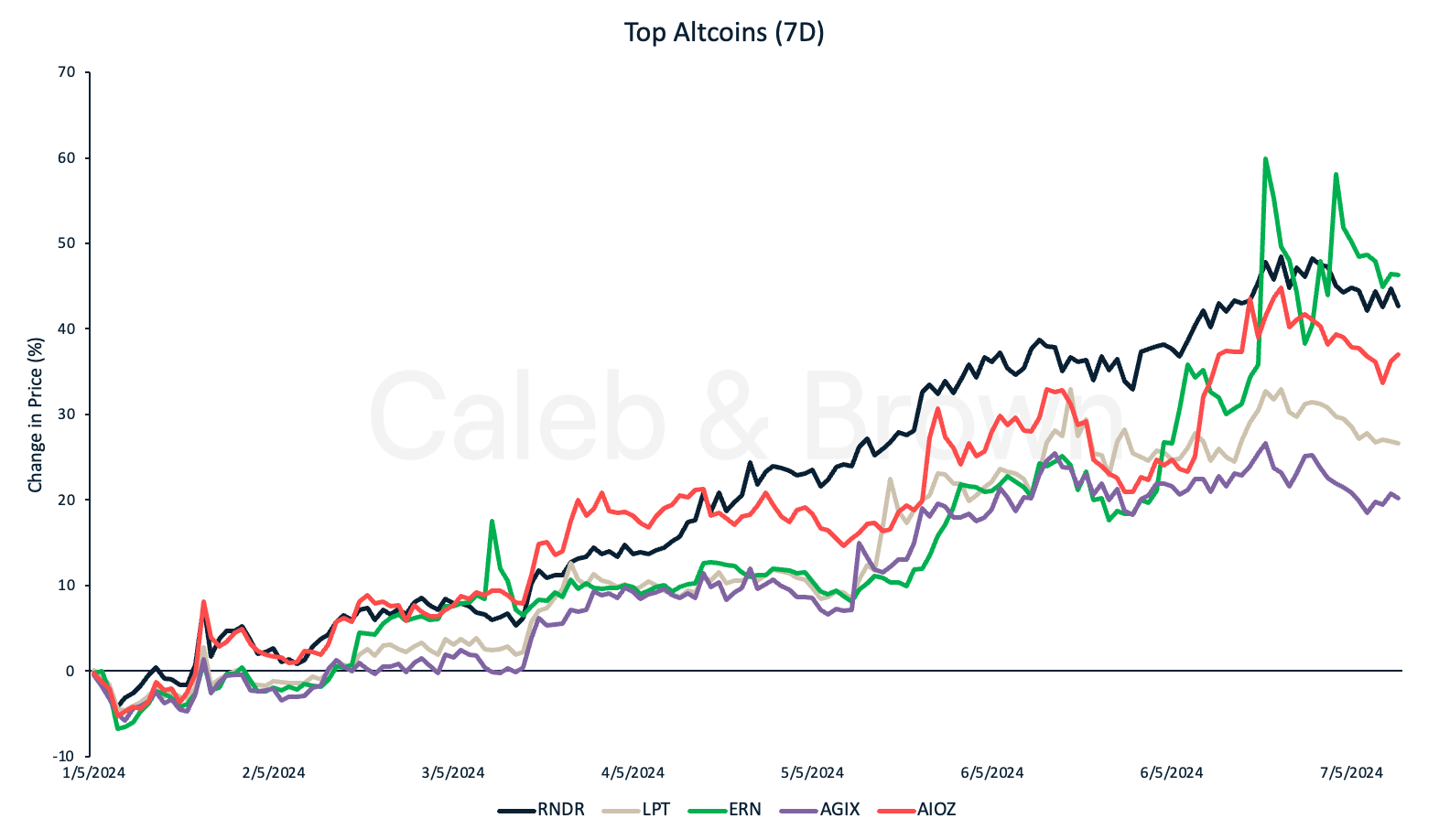

- Render (RNDR) saw a notable 43% increase, demonstrating resilience amid a general market downturn, underscoring its importance in AI and GPU rendering.

- Livepeer (LPT) experienced a significant 27% rise, benefiting from the expanding interest in AI video capabilities following OpenAI's introduction of the Sora model.

- Ethernity (ERN) saw a 50% price increase following the launch of its AI-secured Layer 2 network, emphasising its commitment to eco-friendly and cost-efficient blockchain solutions for global entertainment brands.

- SingularityNET (AGIX) surged 20% and AIOZ Network (AIOZ) experienced a 37% jump, approaching a $1 billion market cap.

In Other News

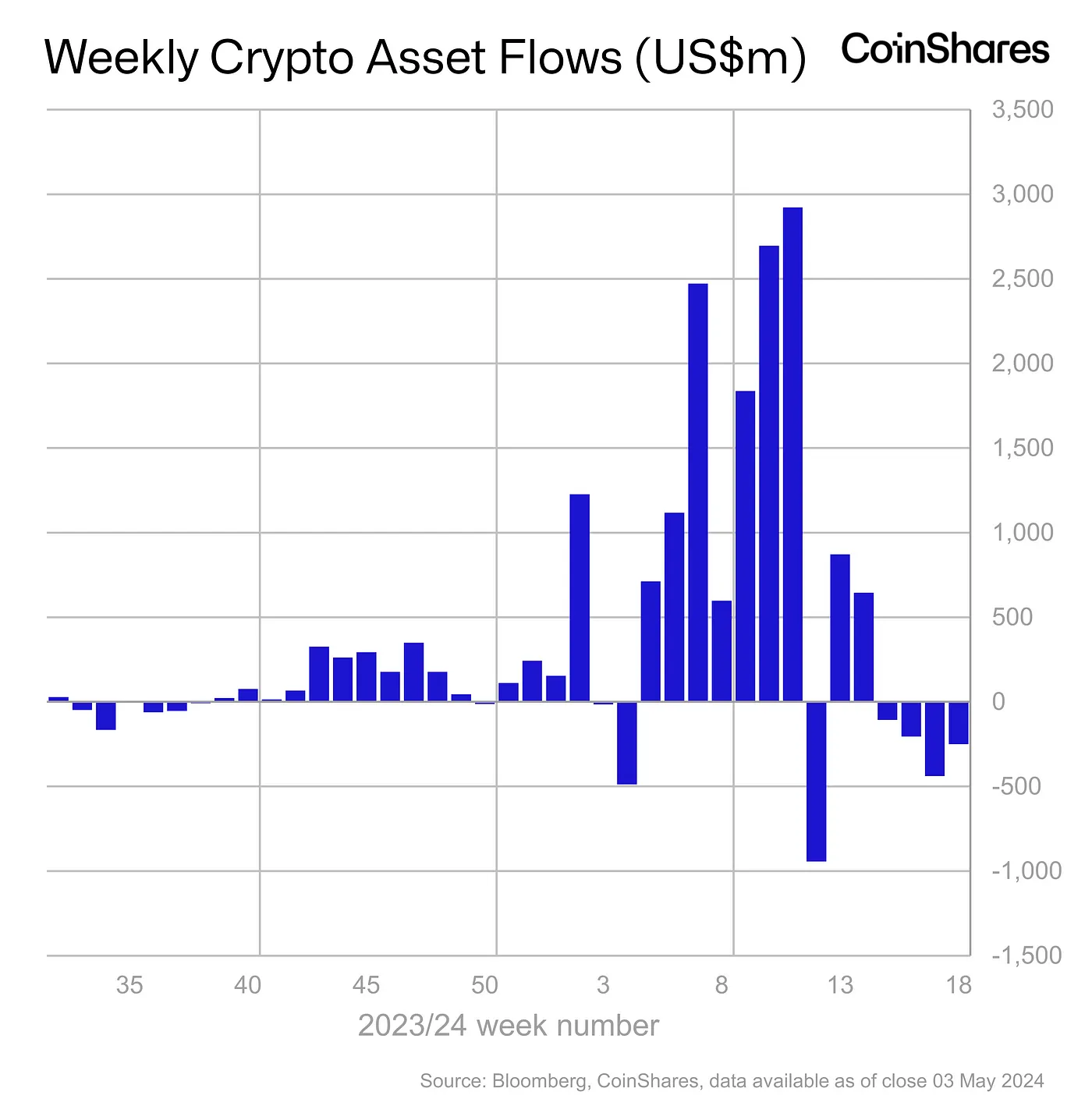

Globally, digital asset investment products saw outflows totalling US$251 million, marking a fourth consecutive week of net withdrawals. Notably, the U.S. registered significant outflows, primarily from newly issued ETFs which experienced US$156 million in outflows. Hong Kong's spot-based Bitcoin and Ethereum ETFs debuted with strong inflows, attracting US$307 million in their first week of trading.

- The anticipation for Bitcoin ETFs in Australia is building, following massive inflows into similar products in the US and Hong Kong. With applications from major players like VanEck Associates and BetaShares, Australia's ASX is expected to greenlight the first spot-Bitcoin ETFs by the end of 2024. These ETFs may play a pivotal role in Australia's robust $2.3 trillion pension market, particularly among self-managed super funds..

- Binance founder Changpeng Zhao, commonly known as "CZ", has been sentenced to four months in prison after pleading guilty to charges related to deficiencies in anti-money laundering measures at Binance. This sentence is part of a larger legal settlement that includes Binance paying $4.3 billion in fines and forfeiture, highlighting stringent regulatory actions in the cryptocurrency domain.

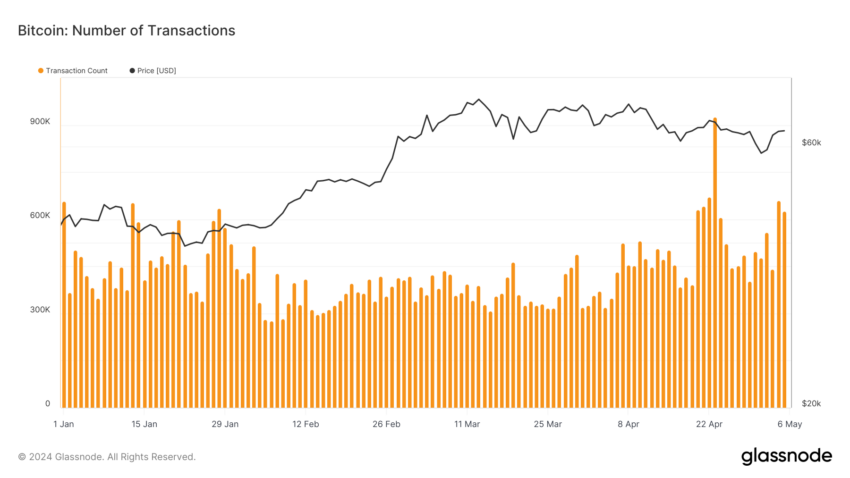

- The Bitcoin network reached a significant milestone, processing its billionth transaction 🎉. This landmark event underscores Bitcoin's widespread use and the robustness of its network over 15 years since its inception.

In case you missed it...

Caleb & Brown Asset Management Pty Ltd, the sister company of Caleb and Brown Pty Ltd, cordially invites you to join our exclusive webinars designed for both Australian and U.S. audiences.

Flagship Fund Quarterly Webinar (USA)

Here's what you can look forward to:

-

Fund Overview: Gain a comprehensive understanding of our investment strategy and objectives.

-

Market Insights: Delve into some of the key topics shaping the crypto landscape.

-

Horizon Outlook: Get valuable sector analysis and expert opinions on what lies ahead in the crypto market.

Save your spot now to secure valuable insights and strategic perspectives for your investment journey with the Caleb & Brown Flagship Funds.

Flagship Fund Quarterly Webinar (AUS)

Here's what you can look forward to:

-

Fund Overview: Gain a comprehensive understanding of our strategy and objectives.

-

Performance Update: Explore our funds' performance metrics for the March quarter, and since inception.

-

Market Insights: Delve into some of the key topics shaping the crypto landscape.

-

Horizon Outlook: Get valuable sector analysis and expert opinions on what lies ahead in the crypto market.

Save your spot now to secure valuable insights and strategic perspectives for your investment journey with the Caleb & Brown Flagship Funds.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.