Market Highlights

- The crypto market recovered last week’s losses after the U.S. Federal Reserve elected to pause interests rate hikes for the first time in 18 months.

- Binance hired George Canellos, a former co-director of the SEC's Division of Enforcement, in order to defend itself against the SEC’s charges.

- Coinbase submitted a formal request to the SEC on Saturday demanding a federal judge to force the SEC to set clearer rules and standards for the digital assets industry.

Price Movements

Bitcoin

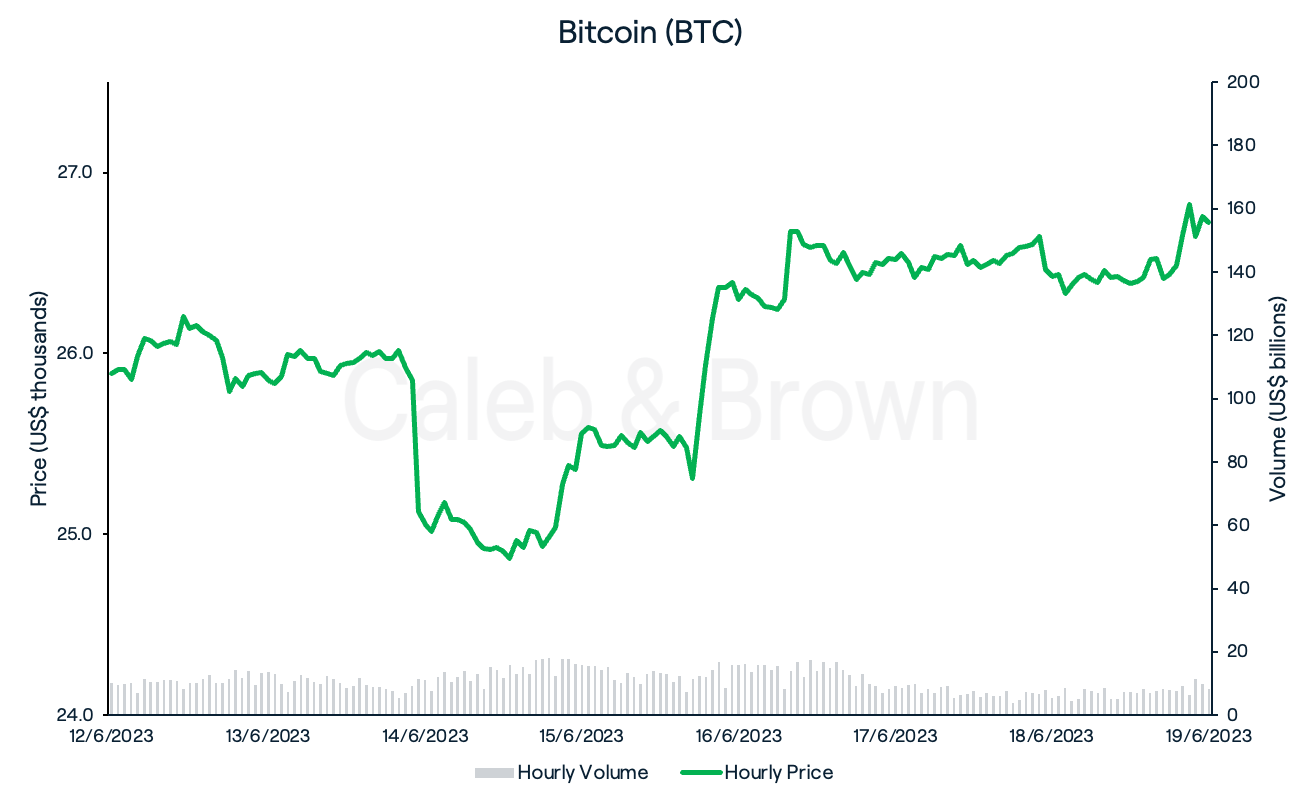

After a bloodbath of a week the crypto market has shown signs of recovery as the total market cap reestablished the US$1.1 trillion mark. The recovery was led by a cooling inflation figure reported by the U.S. Bureau of Labor Statistics (BLS) on Tuesday. According to the report, annual Consumer Price Index (CPI) rose 4.0% in May, falling in line with expectations.

The following day the U.S. Federal Reserve (Fed) elected to to skip a rate hike for the first time in 18 months during its latest Federal Open Market Committee (FOMC) meeting. While a pause in interest rate hikes could indicate a possible pivot in hikes, Fed Chair Jerome Powell said during the meeting “nearly all committee participants view it as likely that some further rate increases will be appropriate this year.”

In response to the FOMC meeting, Bitcoin (BTC) quickly fell 4.0%, pushing it below US$25,000 for the first time in three months. However BTC was able to completely recover by the weekend and closed the week at US$26,724 for a weekly gain of 3.2%.

Ethereum

Ethereum (ETH) followed in BTC’s footsteps for majority of the week, trading relatively flat until Wednesday’s FOMC meeting which saw ETH decline by 5.7% in an hour. ETH was able to partially recover by the weekend where it eventually closed the week at US$1,729, down a slight 0.6% over the last seven days.

This led to a diminishing ETH/BTC ratio for the second consecutive week where it currently sits at ~0.0648, down 3.5%.

Altcoins

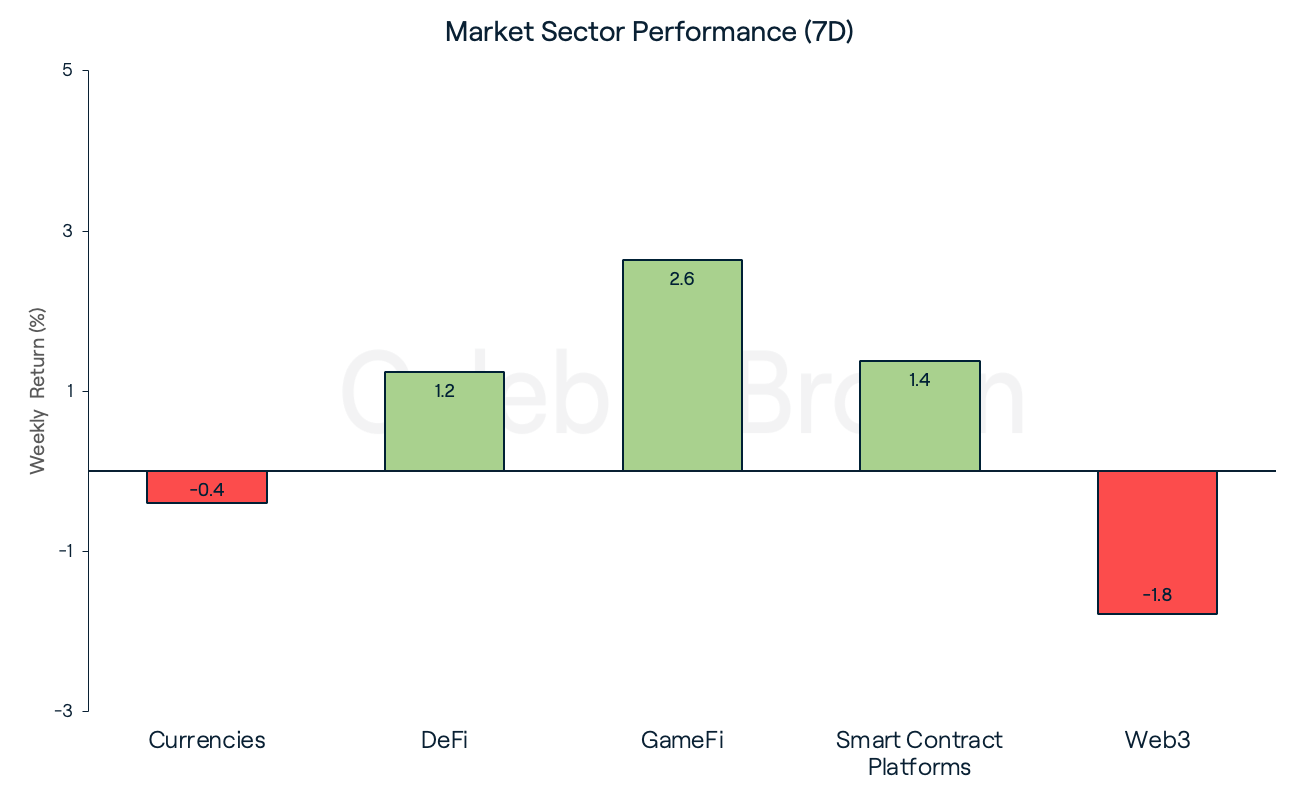

Market sector performance was led by GameFi this week, adding on 2.6% over the last seven days, and was followed by Smart Contract Platforms and DeFi which grew by 1.4% and 1.2%, respectively. Web3 took the largest hit this week, decreasing by 1.8%.

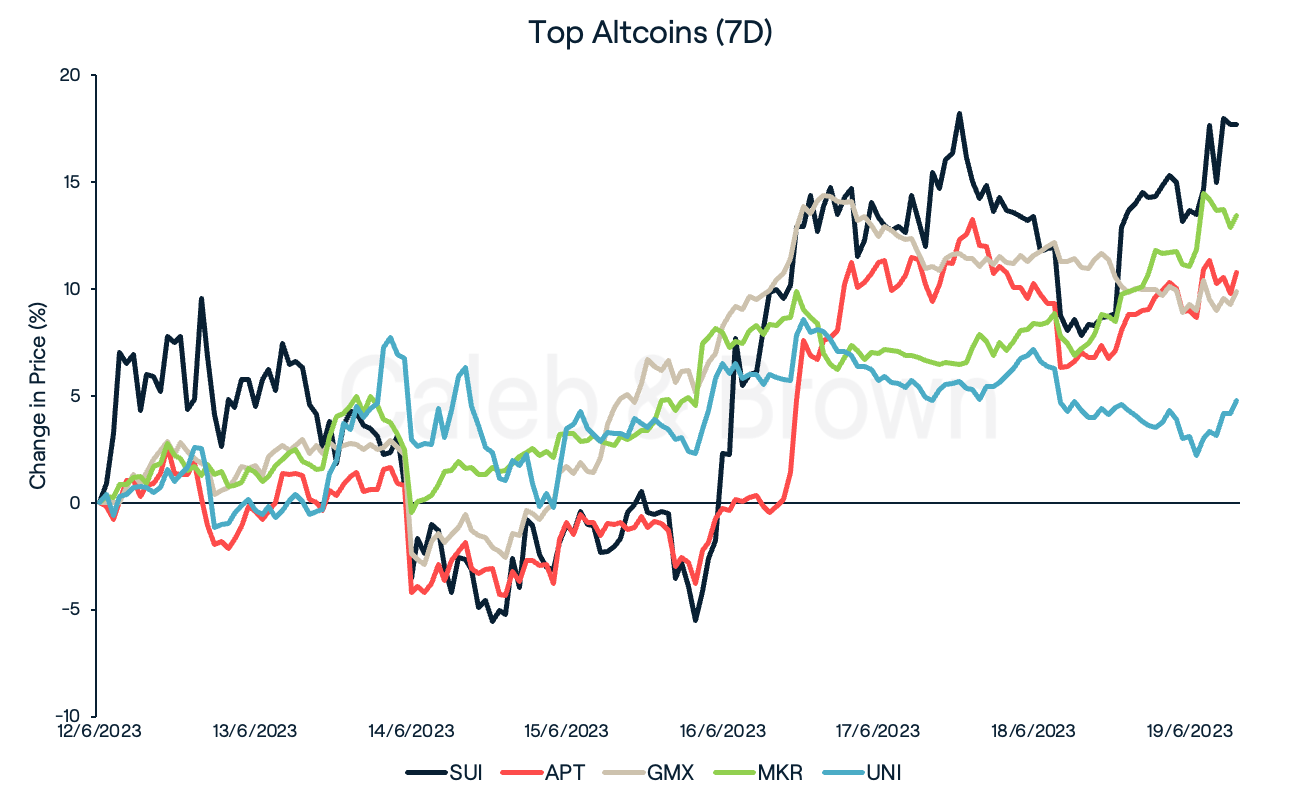

Leading the Smart Contract Platform sector were Sui (SUI) and Aptos (APT) which each rallied 17.7% and 10.8%, respectively. SUI recently partnered with Formula One’s Oracle Red Bull Racing while ATP has enjoyed an increase in daily user transactions, exploding from 75,806 on March 1 to 161,484 on June 18, yesterday.

DeFi players GMX (GMX), Uniswap (UNI), and Maker (MKR) secured double-digit gains after the SEC’s attack on centralised exchanges Binance and Coinbase, last week. The regulatory landscape surrounding these exchanges remains dire with a number of assets being delisted from multiple exchanges after being labelled securities. As such, this has pushed some investors towards decentralised solutions, benefitting DeFi as a whole. GMX rose 9.9% while UNI and MKR increased by 4.8% and 13.4%, respectively.

In Other News

The SEC vs Binance: Week 2

After a harsh week, Binance has taken the steps to defend itself against the SEC’s complaints.

The beginning of the week saw Binance taking legal action by hiring George Canellos, a former co-director of the SEC's Division of Enforcement, in order to defend itself against thirteen civil charges brought by the securities regulator.

On Monday night, Binance submitted over twenty opposing motions in response to the SEC's lawsuit. However, as the week progressed, Binance's presence in Europe diminished significantly. News emerged midweek that Binance was withdrawing from Cyprus and the Netherlands, while facing increased scrutiny from French authorities for suspected "aggravated money laundering."

On Sunday, a judge approved an agreement between Binance and the SEC, regarding the emergency motion to freeze the assets on Binance.US. According to the agreement, Binance has a 45-day deadline to provide the SEC with a comprehensive list of all accounts or wallets it has managed since December 1, 2022, including associated financial institutions and account numbers. Additionally, Binance is required to present records of asset transfers exceeding US$1,000 in value during the same period, providing recipient names and reasons for each transfer.

Meanwhile, following an extended period of silence and ambiguous replies from the U.S. SEC, crypto firm Coinbase took action against the regulator by formally submitting a request to a federal court on Saturday. The letter asks a federal judge to force the SEC to set clearer rules and standards for the digital assets industry– the objective of a petition made by the crypto exchange last year.